Exhibit 10.17

Securities Purchase Agreement

Investor Package

October __, 2012

Ideal Power Converters, Inc.

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

INSTRUCTIONS FOR INVESTING

If you wish to purchase the offered securities of Ideal Power Converters, Inc., please:

|

|

(1)

|

Review this Securities Purchase Agreement, Registration Rights Agreement, Senior Secured Convertible Promissory Note, Warrant, Security Agreement, and Escrow Agreement.

|

|

|

(2)

|

Indicate where appropriate, in Section 6(a) of the Securities Purchase Agreement, your status as an Accredited Investor by initialing the appropriate accreditation categories.

|

|

|

(3)

|

Type or print all information required in the blank sections in Section 6(b) of the Securities Purchase Agreement, including your requested subscription amount and your federal taxpayer identification number.

|

|

|

(4)

|

Execute the signature pages to the Securities Purchase Agreement, Registration Rights Agreement, Security Agreement, and Escrow Agreement.

|

|

|

(5)

|

If you are an individual, complete and execute, or cause to be executed, the enclosed Spousal Consent by either (i) having your spouse execute such consent or (ii) if you are not married, by confirming your status as single on such consent.

|

|

|

(6)

|

Along with the full amount of your investment paid by means of a check made payable to [NAME OF ACCOUNT] or a wire transfer to the following:

|

U.S. Bank, N.A.

ABA# 091000022

FBO: U.S. Bank Trust N.A.

Acct: 180121167365

Ref: Ideal Power Converter/MDB

Attn: Georgina Thomas (213-615-6001)

|

|

You must send the completed and executed signature pages to this Securities Purchase Agreement, the Registration Rights Agreement, the Security Agreement, the Escrow Agreement, the completed Purchaser Information (Section 6 of this Securities Purchase Agreement) and the Spousal Consent to the following escrow holder, preferably by fax or e-mail:

|

Georgina Thomas

Assistant Vice President

U.S. Bank Corporate Trust Services

633 West 5th Street, 24th Floor

Los Angeles, CA 90071

Ph. (213) 615-6001

Fax (213) 615-6199

Georgina.thomas@usabank.com

The Company may choose not to accept all or some of any investor’s subscription for any reason (regardless of whether any check or wire transfer relating to this subscription is deposited in a bank or trust account). The Company will send to you a fully executed copy of the transaction documents if your subscription is accepted. If you have any questions in completing the transaction documents, please contact Christopher Cobb at Christopher.Cobb@idealpowerconverters.com.

IDEAL POWER CONVERTERS, INC.

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (the “Agreement”) is entered into by and between IDEAL POWER CONVERTERS, INC., a Texas corporation (the “Company”), and the undersigned purchasers (each, a “Purchaser”, and collectively, the “Purchasers”) as of the latest date set forth on the signature page hereto.

NOW, THEREFORE, in consideration of the mutual covenants and other agreements contained in this Agreement the Company and the Purchasers hereby agree as follows:

1. Purchase of Securities and Matters Related Thereto. (Capitalized terms used below and not otherwise defined are defined in Section 2 of the Agreement.)

(a) Subject to the terms and conditions of this Agreement, the undersigned Purchaser hereby subscribes for (i) a senior secured convertible promissory note in the form attached as Exhibit C (“Note”), and (ii) a warrant for the purchase of shares of the Company's common stock, $0.001 par value (the "Common Stock") in the form attached as Exhibit D (“Warrant”) (sometimes the Note and the Warrant are collectively referred to as the “Securities”). The total amount to be paid for the Securities shall be the amount (if any) accepted by the Company in connection with this investment, which may be less than or equal to the amount indicated by the undersigned Purchaser on the signature page hereto (the “Subscription Amount”). The offering, purchase and sale of the Securities is referred to herein as the “Offering.”

(b) If, prior to the Calendar Due Date, the Company closes a firm commitment underwritten initial public offering ("IPO") of its Common Stock that raises at least $10 million (the "IPO Financing"), the principal amount of the Note and all accrued but unpaid interest as well as any other amounts payable under the Note will be repaid with shares of the Company's Common Stock in accordance with the terms of the Note. The conversion price will be equal to the lower of 0.70 times the IPO Price or $1.46 per share. Prior to the Calendar Due Date or a conversion in the event of an IPO financing, each Purchaser will also have the right, but not the obligation, in accordance with the terms set forth in the Note, to convert the Note into shares of the Company's Common Stock, including for the purpose of participating in any other financing undertaken by the Company prior to the Calendar Due Date (so long as such financing is for capital-raising purposes) or in the event of a Change of Control, as defined in the Note. In the event of a conversion as a result of a Change of Control, the conversion price will be equal to the lower of 0.70 times the per share consideration paid for the Change of Control transaction or $1.46 per share. In the event of a conversion related to a financing, the Note shall be converted into that number of shares of Common Stock determined by dividing (x) the Principal Amount and all accrued interest by (y) the lower of (i) $1.46 or (ii) 0.70 times the per share consideration paid in the most recent Private Equity Financing to occur prior to the Holder's election (as appropriately adjusted to reflect stock dividends, stock splits, combinations, recapitalizations and the like). With the permission of the Purchaser, the Company may pre-pay the Note prior to an IPO, a Change of Control or the Calendar Due Date with U.S. dollars. In that case, the payment will equal 110% of the principal amount of the Note.

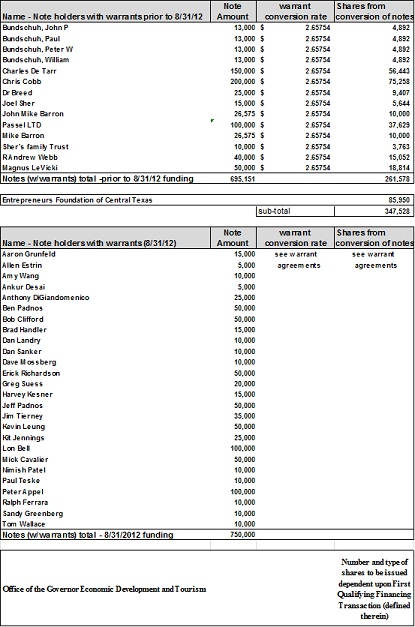

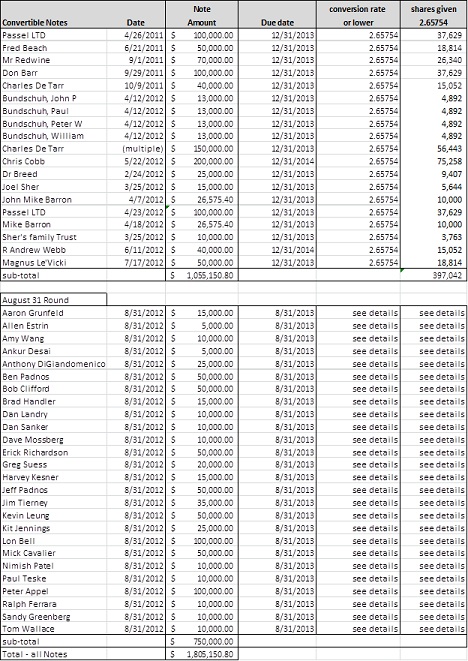

(c) The Purchasers will be granted a first priority senior security interest in and to the assets of the Company, including its intellectual property, pursuant to the terms of a Security Agreement, a form of which is attached hereto as Exhibit E (“Security Agreement”). On August 31, 2012 the Company raised a total of $750,000 through the sale of senior secured promissory notes (the "August 2012 Notes"). The Purchasers will have security interests identical to those of the holders of the August 2012 Notes.

(d) The Texas Emerging Technology Fund, which held a senior security interest in the Company's assets, has subordinated its interest to the interests of the Purchasers in accordance with the Subordination Agreement in the form attached hereto as Exhibit F (“Subordination Agreement”).

(e) The Warrant has a term of seven years. The number of shares of Common Stock issuable upon exercise of the Warrant and the exercise price shall be determined as follows: (i) in the event of an IPO, one-half the principal amount of the Note divided by the lower of 0.70 of the IPO Price or $1.46 will determine the number of shares covered by the Warrant while the per-share exercise price will be equal to the lower of 0.70 times the IPO Price or $1.46; or (ii) in the event that, prior to the Calendar Due Date, the Company does not complete an IPO but, instead, completes a Private Equity Financing, one-half the principal amount of the Note divided by the lower of 0.70 of the Private Equity Financing Price or $1.46 will determine the number of shares covered by the Warrant, with a per-share exercise price equal to the lower of 0.70 times the Private Equity Financing Price or $1.46 provided, however, that (A) if the Company undertakes first, a Private Equity Financing and secondly, an IPO prior to the Calendar Due Date and (B) the Private Equity Financing Price is higher than the IPO Price, then the number of shares of Common Stock covered by the Warrant and the per share exercise price will be adjusted to equal the number of shares of Common Stock and the exercise price calculated in accordance with subsection (i) above. If the Company does not complete either a Private Equity Financing or an IPO prior to the Calendar Due Date, then the number of Shares covered by the Warrant will equal one-half the principal amount of the Note divided by $1.46, and the exercise price will be $1.46 per share. The Warrant also includes a cashless exercise provision.

(f) The Purchasers will have certain registration rights relating to the Common Stock underlying the Securities, which rights are set forth in the Registration Rights Agreement, a form of which is attached hereto as Exhibit G (“Registration Rights Agreement”).

(g) The Purchasers and their permitted transferees and assignees shall be subject to a 180 day lockup following the IPO as set forth in Section 8 of this Agreement. Officers, directors, employees and owners of 5% or more of the Company's Common Stock will be locked up for the greater of 12 months (i) following the IPO and (ii) 12 months after shares of the Company's Common Stock are listed for trading on NASDAQ or a national securities exchange.

(h) This is the second offering of senior secured convertible promissory notes by the Company. By executing this Purchase Agreement and the other Transaction Documents and by accepting the Note, the Holder acknowledges the sale of the August 2012 Notes.

(i) MDB Capital Group, LLC has been retained by the Company as the sole placement agent for the Offering (the “Placement Agent”).

The foregoing description of the Note, the Warrant, the Security Agreement and the Subordination Agreement are qualified in their entirety by the terms of those agreements.

2. Certain Definitions. For purposes of this Agreement and the agreements referenced herein, the following terms shall have the respective definitions set forth below:

(a) “Calendar Due Date” shall be a date that is 12 months from the Closing Date of this Offering.

(b) “Change of Control” means any liquidation, dissolution or winding up of the Company, either voluntary or involuntary, and shall be deemed to be occasioned by, or to include, (i) the acquisition of the Company by another entity by means of any transaction or series of related transactions (including, without limitation, any stock acquisition, reorganization, merger or consolidation) unless the Company’s shareholders of record as constituted immediately prior to such acquisition or sale will, immediately after such acquisition or sale (by virtue of securities issued as consideration for the Company’s acquisition or sale or otherwise) hold at least a majority of the voting power of the surviving or acquiring entity, or its direct or indirect parent entity (except that any bona fide equity or debt financing transaction for capital raising purposes shall not be deemed a Change of Control for this purpose) or (ii) a sale, exclusive license or other disposition of all or substantially all of the assets of the Company, including a sale, exclusive license or other disposition of all or substantially all of the assets of the Company’s subsidiaries, if such assets constitute substantially all of the assets of the Company and such subsidiaries taken as a whole.

(c) “IPO Price” means the price per share of the Company's Common Stock offered to public investors in an IPO, without regard to any underwriting discount or expense (as appropriately adjusted to reflect stock dividends, stock splits, combinations, recapitalizations and the like with respect to the Company’s capital stock after the date hereof).

(d) “Private Equity Financing” means a privately marketed equity financing resulting in gross proceeds in excess of $250,000 which closes before the Calendar Due Date; provided, however, that none of the following issuances of securities shall constitute a “Private Equity Financing”: (i) this Offering and any subsequent offerings of senior secured convertible promissory notes or any other debt offering; (ii) securities issued without consideration in connection with any stock or unit split of, or stock or unit dividend on, the Company’s Common Stock; (iii) securities issued to the Company’s employees, officers, directors, consultants, advisors or service providers pursuant to any plan, agreement or similar arrangement unanimously approved by the Company’s board of directors; (iv) securities issued to banks or equipment lessors; (v) securities issued in connection with sponsored research, collaboration, technology license, development, original equipment manufacturing (OEM), marketing or other similar agreements or strategic partnerships; (vi) securities issued in connection with a bona fide business acquisition of or by the Company (whether by merger, consolidation, sale of assets, sale or exchange of stock or otherwise); (vii) the Investment Unit dated October 1, 2010, issued by the Company to the Office of the Governor Economic Development and Tourism, and any securities relating to the conversion or exercise thereof; or (viii) any right, option or warrant to acquire any security convertible into or exercisable for the securities listed in clauses (i) through (vii) above.

(e) “Private Equity Financing Price” means the price per share paid by investors in a Private Equity Financing.

3. Closing.

(a) On or prior to the applicable Closing Date (as defined below), the Purchaser shall deliver or cause to be delivered to the Escrow Holder the following in accordance with the subscription procedures described in Section 2(b) below:

(i) a completed and duly executed signature page of this Agreement;

(ii) the completed Purchaser Information included on pages 14 and 15 of this Agreement;

(iii) a spousal consent substantially in the form of Exhibit B, attached hereto (the “Spousal Consent”); and

(iv) duly executed signature pages of the Registration Rights Agreement, the Security Agreement and the Escrow Agreement.

(b) The Purchaser shall deliver or cause to be delivered, preferably by fax or e-mail, the closing deliveries described above to the Escrow Holder at the following address:

Georgina Thomas

Assistant Vice President

U.S. Bank Corporate Trust Services

633 West 5th Street, 24th Floor

Los Angeles, CA 90071

Ph. (213) 615-6001

Fax (213) 615-6199

Georgina.thomas@usabank.com

Immediately following receipt of the deliverables from all of the Purchasers and acceptance by the Company in accordance with subsection (c) below, wire instructions will be forwarded to the Purchaser and the Purchaser shall be obligated to deliver funds no later than three business days thereafter.

(c) This Agreement sets forth various representations, warranties, covenants and agreements of the Company and of the Purchaser, as the case may be, all of which shall be deemed made, and shall be effective without further action by the Company and the Purchaser, immediately upon the Company’s acceptance of the Purchaser’s subscription and shall thereupon be binding upon the Company and the Purchaser. Acceptance shall be evidenced only by execution of this Agreement by the Company on its signature page attached hereto and the Company shall have no obligation hereunder to the Purchaser until a fully executed copy of this Agreement shall have been delivered to the Purchaser. Upon the Company's acceptance of the Purchaser's subscription and receipt of the Subscription Amount, on the applicable Closing Date the Placement Agent shall deliver to the Purchaser a duly executed copy of each of the Agreement, the Note, the Warrant, the Registration Rights Agreement, the Security Agreement and the Escrow Agreement.

(d) The purchase and sale of the Securities shall be consummated on or before [__________], 2012 (the “Initial Closing Date”); provided, however, that the Company reserves the right to extend the Offering for up to an additional 30 days beyond the Initial Closing Date (the “Final Closing Date” and together with the Initial Closing Date, the “Closing Date” or the “Closing Dates”, depending on the context used).

4. Company Representations and Warranties. The Company hereby represents and warrants that, as of the Closing Date applicable to the Purchaser:

(a) Organization and Business. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Texas and has all requisite corporate power and authority to carry on its business as now conducted and as proposed to be conducted. The Company has no direct or indirect subsidiaries. The Company is duly qualified as a foreign corporation to do business and is in good standing in every jurisdiction in which its ownership or use of property or the nature of the business conducted by it makes such qualification necessary except where the failure to be so qualified or in good standing would not have a Material Adverse Effect. As used in this Agreement, the term “Material Adverse Effect” means any material adverse effect on the business, operations, assets (including intangible assets), liabilities (actual or contingent), financial condition, or prospects of the Company, if any, taken as a whole, or on the transactions contemplated hereby or by the Transaction Documents (as defined below). Information about the Company’s business is included on Exhibit A to this Agreement (the “Company Information”).

(b) Capitalization.

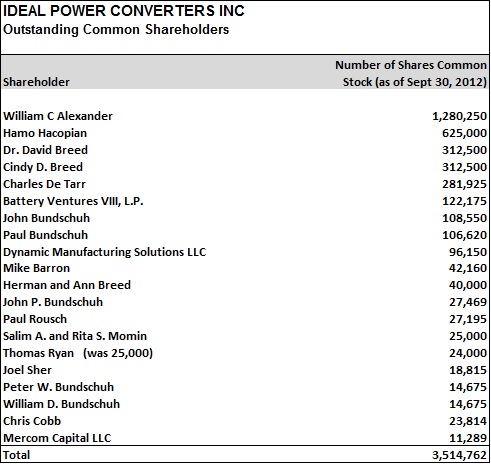

(i) The Company has two classes of authorized capital stock consisting of 5,000,000 shares of Common Stock and 275,000 shares of Preferred Stock, of which 3,514,762 shares of Common Stock are issued and outstanding and no shares of Preferred Stock are issued and outstanding. Schedule 4(b)(i) includes a detailed schedule of the Company's capitalization as of the date of this Agreement.

(ii) Except as set forth on Schedule 4(b)(ii) to this Agreement: (A) there are no outstanding options, warrants, scrip, rights to subscribe for, puts, calls, rights of first refusal, agreements, understandings, claims or other commitments or rights of any character whatsoever relating to, or securities or rights convertible into or exchangeable for, any capital stock of the Company, or arrangements by which the Company is or may become bound to issue additional capital stock, (B) there are no agreements or arrangements under which the Company is obligated to register the sale of any of its or their securities under the Securities Act of 1933, as amended (the “Securities Act”) and (C) there are no anti-dilution or price adjustment provisions contained in any security issued by the Company (or in any agreement providing rights to security holders) that will be triggered by the issuance of the Securities.

(iii) No shares of capital stock of the Company are subject to preemptive rights or any other similar rights of anyone or any mortgage, lien, title claim, assignment, encumbrance, security interest, adverse claim, contract of sale, restriction on use or transfer (other than restrictions on transfer under applicable state and federal securities laws or “blue sky” or other similar laws (collectively, the “Securities Laws”)) or other defect of title of any kind (each, a “Lien”) imposed through the actions or failure to act of the Company.

(c) Authorization; Enforceability. All corporate action on the part of the Company, its officers, directors and shareholders necessary for the authorization, execution and delivery of the Transaction Documents (as defined in subsection (f) below), the performance of all obligations of the Company under the Transaction Documents, and the authorization, issuance, sale and delivery of the Securities has been taken, and each Transaction Document constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except to the extent limited by applicable bankruptcy, insolvency, reorganization, moratorium or other laws of general application affecting enforcement of creditors’ rights and general principles of equity that restrict the availability of equitable or legal remedies.

(d) Valid Issuance. The Securities being acquired by the Purchasers hereunder, when issued, sold and delivered in accordance with the terms of this Agreement for the consideration expressed herein, will be duly and validly issued, fully paid, and non-assessable, and will be free of Liens other than restrictions on transfer under this Agreement.

(e) Litigation. There is no action, suit, proceeding or investigation pending or, to the Company’s knowledge, currently threatened against the Company. The Company is not a party or subject to the provisions of any order, writ, injunction, judgment or decree of any court or government agency or instrumentality. There is no action, suit, proceeding or investigation by the Company currently pending or that the Company intends to initiate.

(f) No Conflict. The execution, delivery and performance of this Agreement, the Security Agreement, the Note, the Warrant, the Registration Rights Agreement, the Escrow Agreement, and the other agreements entered into by the Company in connection with the Offering, and including the Subordination Agreement entered into in conjunction with the offer of the August 2012 Notes (the “Transaction Documents”) and the consummation by the Company of the transactions contemplated hereby and thereby will not: (i) conflict with or result in a violation of any provision of the charter or by-laws of the Company or (ii) violate or conflict with, or result in a breach of any provision of, or constitute a default (or an event which with notice or lapse of time or both could become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture, patent, patent license or instrument to which the Company is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations and regulations of any self-regulatory organizations to which the Company or its securities are subject) applicable to the Company or by which any property or asset of the Company is bound or affected. The Company is not in violation of its charter, bylaws, or other organizational documents. The business of the Company is not being conducted in violation of any law, rule, ordinance or regulation of any governmental entity, except for possible violations which would not, individually or in the aggregate, have a Material Adverse Effect. Except for filings pursuant to Regulation D of the Securities Act, and applicable state securities laws, which have been made or will be made by the Company in the required time thereunder, the Company is not required to obtain any consent, authorization or order of, or make any filing or registration with, any court, governmental agency, regulatory agency, self-regulatory organization or stock market or any third party in order for it to execute, deliver or perform any of its obligations under this Agreement or any Transaction Document in accordance with the terms hereof or thereof or to issue and sell the Securities in accordance with the terms hereof.

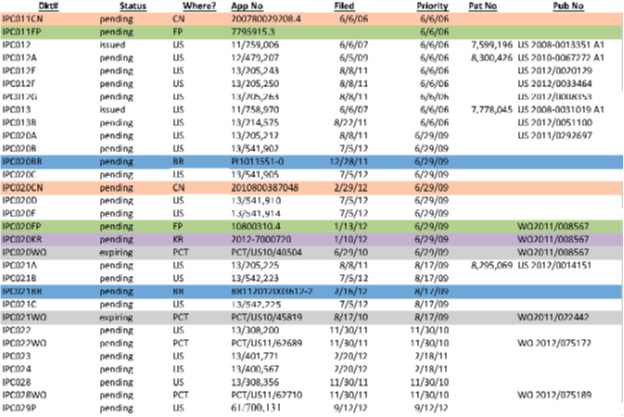

(g) Intellectual Property. Other than inventions of the Company whose patent applications have yet to be filed (the “Confidential IP”), Schedule 4(g) to this Agreement sets forth a complete and accurate listing of all of the Company’s patents and patent applications (“Patents”). At the Purchaser’s request the Company shall make available to the Purchaser prior to the applicable Closing Date a schedule of Confidential IP, provided that the Purchaser execute and deliver a non-disclosure agreement relating to the Confidential IP that is reasonably acceptable to the Company. The Company owns valid title, free and clear of any Liens, or possesses the requisite valid and current licenses or rights, free and clear of any Liens, to use all Patents in connection with the conduct of its business as now operated, and to the best of the Company’s knowledge, as presently contemplated to be operated in the future. There is no claim or action by any person pertaining to, or proceeding pending, or to the Company’s knowledge threatened, which challenges the right of the Company with respect to any Patents necessary to enable it to conduct its business as now operated, and to the Company’s knowledge, as presently contemplated to be operated in the future. To the Company’s knowledge, the Company’s current and intended products, services and processes do not infringe on any Intellectual Property or other rights held by any person, and the Company is unaware of any facts or circumstances which might give rise to any of the foregoing. The Company has not received any notice of infringement of, or conflict with, the asserted rights of others with respect to the Patents. It will not be necessary to use any inventions of any of its employees or consultants (or persons it currently intends to hire) made prior to their employment by the Company. Each employee and consultant of the Company has assigned to the Company all intellectual property rights he or she owns that are related to the Company’s business as now conducted and as presently proposed to be conducted.

(h) Management. As of the date of this Agreement, the Company's Board of Directors consists of five members, namely, Christopher Cobb, Bill Alexander, Dr. David Breed, Hamo Hacopian and Charles De Tarr, and the Company has the following officers:

| |

Paul Bundschuh |

Chief Executive Officer |

| |

Christopher Cobb |

President and Chief Operating Officer |

| |

Charles De Tarr |

Chief Financial Officer, Secretary |

| |

Bill Alexander |

Chief Technology Officer |

Prior to an offering of the Common Stock to the public, the Company intends to enter into a formal employment agreement with the Chief Executive Officer.

(i) Financial Statements. Schedule 4(i) to this Agreement includes a true and complete copy of (A) the audited financial statements for 2011, 2010 and 2009 and (B) un-audited balance sheet as of June 30, 2012 and the un-audited income statement for the six month period ended June, 2012. (the "Income Statements" and collectively with the Balance Sheet, the "Financial Statements"). The Financial Statements fairly present the financial condition and operating results of the Company as of the dates, and for the periods, indicated therein, subject to normal year-end audit adjustments. Except as set forth in the Financial Statements, the Company has no material liabilities or obligations, contingent or otherwise, other than liabilities incurred in connection with the consummation of the transactions contemplated under the Offering, an estimate of which is set forth on Schedule 4(i), and those incurred in the ordinary course of business subsequent to June 30, 2012. Since June 30, 2012, nothing has occurred which would have a Material Adverse Effect.

(j) Financial Information and Projections. Any financial estimates and projections in the Company Information and/or Budget have been prepared by management of the Company and are the most current financial estimates and projections available by the Company. Although the Company does not warrant that the results contained in such projections will be achieved, to the best of the Company’s knowledge and belief, such projections are reasonable estimations of future financial performance of the Company and its expected financial position, results of operations, and cash flows for the projection period (subject to the uncertainty and approximation inherent in any projection). At the time they were made, all of the material assumptions upon which the projections are based were, to the best of the Company’s knowledge and belief, reasonable and appropriate. Nothing in this Section 4(j) is intended to modify or amend in any way the representations and warranties of Purchaser in Section 5.

(k) Tax Matters. The Company has made or filed all federal, state and foreign income and all other tax returns, reports and declarations required by any jurisdiction to which it is subject and has paid all taxes and other governmental assessments and charges, shown or determined to be due on such returns, reports and declarations, except those being contested in good faith and has set aside on its books provisions reasonably adequate for the payment of all taxes for periods subsequent to the periods to which such returns, reports or declarations apply. All such tax returns and reports filed on behalf of the Company were complete and correct and were prepared in good faith without willful misrepresentation. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Company know of no basis for any such claim. The Company has not executed a waiver with respect to the statute of limitations relating to the assessment or collection of any foreign, federal, state or local tax. The Company has not received notice that any of its tax returns is presently being audited by any taxing authority.

(l) Certain Transactions. Except as set forth on Schedule 4(l) to this Agreement, there are no loans, leases, royalty agreements or other transactions between: (i) the Company or any of its respective customers or suppliers, and (ii) any officer, employee, consultant or director of the Company or any person owning 5% or more of the ownership interests of the Company or any member of the immediate family of such officer, employee, consultant, director, shareholder or owner or any corporation or other entity controlled by such officer, employee, consultant, director, shareholder or owner, or a member of the immediate family of such officer, employee, consultant, director, shareholder or owner.

(m) Material Agreements. Except as disclosed on Schedule 4(m) to this Agreement (each contract, agreement, commitment or understanding disclosed on Schedule 4(m) being hereinafter referred to as a "Material Agreement") or as contemplated by this Agreement or any Transaction Document, there are no agreements, understandings, commitments, instruments, contracts, employment agreements, proposed transactions or judgments to which the Company is a party or by which it is bound which may involve obligations (contingent or otherwise), or a related series of obligations (contingent or otherwise), of or to, or payments, or a related series of payments, by or to the Company in excess of $10,000 in any one year. All Material Agreements are in full force and effect and constitute legal, valid and binding obligations of the Company, and to the Company's knowledge, the other parties thereto, and are enforceable in accordance with their respective terms. Neither the Company nor any person is in default under the terms of any Material Agreement, and no circumstance exists that would, with the giving of notice or the passage of time, constitute a default under any Material Agreement.

(n) Title to Assets. The Company has good and marketable title to all real and personal property owned by it that is material to the business of the Company, in each case free and clear of all liens and encumbrances, except those, if any, included on Schedule 4(n) or incurred in the ordinary course of business consistent with past practice. Any real property and facilities held under lease by the Company are held by it under valid, subsisting and enforceable leases (subject to laws of general application relating to bankruptcy, insolvency, reorganization, or other similar laws affecting creditors' rights generally and other equitable remedies) with which the Company is in compliance in all material respects.

(o) Subsidiaries; Joint Ventures. Except for the subsidiaries described in Schedule 4(o), the Company has no subsidiaries and (i) does not otherwise own or control, directly or indirectly, any other Person and (ii) does not hold equity interests, directly or indirectly, in any other Person. Except as described in Schedule 4(o), the Company is not a participant in any joint venture, partnership, or similar arrangement material to its business. "Person" means an individual, entity, partnership, limited liability company, corporation, association, trust, joint venture, unincorporated organization, and any government, governmental department or agency or political subdivision thereof.

(p) No General Solicitation. Neither the Company nor any person participating on the Company’s behalf in the transactions contemplated hereby has conducted any “general solicitation,” as such term is defined in Regulation D promulgated under the Securities Act, with respect to any securities offered in the Offering.

(q) No Integrated Offering. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf, has directly or indirectly made any offers or sales in any security or solicited any offers to buy any security under circumstances that would require registration under the Securities Act of the issuance of the Securities. The issuance of the Securities will not be integrated (as defined in Rule 502 of the Securities Act) with any other issuance of the Company’s securities (past, current or future) that would require registration under the Securities Act of the issuance of the Securities. The offering of the August 2012 Notes may be integrated with this Offering, but such integration would not require registration under the Securities Act.

(r) No Brokers. The Company has taken no action which would give rise to any claim by any person for brokerage commissions, transaction fees or similar payments relating to this Agreement or the transactions contemplated hereby, other than to the Placement Agent, whose fee is described in Section 5(g).

(s) Offering. Subject to the accuracy of the Purchaser’s representations and warranties in Section 5 of this Agreement, and the accuracy of other purchasers’ representations and warranties in their respective Securities Purchase Agreements, the offer, sale and issuance of the Securities in the Offering, constitute transactions exempt from the registration requirements of Section 5 of the Securities Act and from the registration or qualification requirements of applicable state securities laws, and neither the Company nor any authorized agent acting on its behalf will take any action hereafter that would cause the loss of such exemption.

(t) Risks Related to the Company and the Offering. An investment in the Securities involves a high degree of risk and uncertainty. Schedule 4(t) includes information about the material risks faced by the Company, however, they may not be the only risks. Additional unknown risks or risks that the Company currently considers to be immaterial may also impair the Company's business operations. If any of the events or circumstances described in Schedule 4(t) actually occurs, the Company's business, financial condition or results of operations could suffer.

5. Purchaser Acknowledgements and Representations. In connection with the purchase of the Securities, Purchaser represents and warrants as of the Closing Date applicable to the Purchaser and/or acknowledges, to the Company, the following:

(a) Acceptance. The Company may accept or reject this Agreement and the number of Securities subscribed for hereunder, in whole or in part, in its sole and absolute discretion. The Company has no obligation to issue any of the Securities to any person who is a resident of a jurisdiction in which the issuance of the Securities would constitute a violation of the Securities Laws.

(b) Irrevocability. This Agreement is and shall be irrevocable, except that the Purchaser shall have no obligations hereunder to the extent that this Agreement is rejected by the Company.

(c) Binding. This Agreement and the rights, powers and duties set forth herein shall be binding upon the Purchaser, the Purchaser's heirs, estate, legal representatives, successors and assigns and shall inure to the benefit of the Company, its successors and assigns.

(d) No Governmental Review. No federal or state agency has made any finding or determination as to the fairness of the Offering for investment, or any recommendation or endorsement of the Securities.

(e) No Preemptive or Voting Rights. Unless and until the entire Principal Amount or a portion of it is converted into Common Stock or the Warrant exercised and the Common Stock issued, the Purchaser is not entitled to voting rights. The Securities do not entitle the Purchaser to preemptive rights.

(f) Professional Advice; Investment Experience. The Company has made available to the Purchaser, or to the Purchaser's attorney, accountant or representative, all documents that the Purchaser has requested, and the Purchaser has requested all documents and other information that the Purchaser has deemed necessary to consider respecting an investment in the Company. The Company has provided answers to all questions concerning the Offering and an investment in the Company. The Purchaser has carefully considered and has, to the extent the Purchaser believes necessary, discussed with the Purchaser's professional technical, legal, tax and financial advisers and his/her/its representative (if any) the suitability of an investment in the Company for the Purchaser's particular tax and financial situation. All information the Purchaser has provided to the Company concerning the Purchaser and the Purchaser's financial position is, to Purchaser’s knowledge, correct and complete as of the date set forth below, and if there should be any material adverse change in such information prior to the acceptance of this Agreement by the Company, the Purchaser will immediately provide such information to the Company. The Purchaser has such knowledge, skill, and experience in technical, business, financial, and investment matters so that he/she/it is capable of evaluating the merits and risks of an investment in the Securities. To the extent necessary, the Purchaser has retained, at his/her/its own expense, and relied upon, appropriate professional advice regarding the technical, investment, tax, and legal merits and consequences of this Agreement and owning the Securities. The Purchaser acknowledges and understands that the proceeds from the sale of the Securities will be used as described in Section 7(b).

(g) Brokers and Finders; Placement Agent Services. Schedule 5(g) includes information regarding the compensation to be paid to the Placement Agent for various services rendered or to be rendered to the Company.

(h) Investment Purpose. Purchaser is purchasing the Securities for investment for his, her or its own account only and not with a view to, or for resale in connection with, any “distribution” thereof within the meaning of the Securities Act in violation of such act. Purchaser further represents that he/she/it does not presently have any contract, undertaking, agreement or arrangement with any person to sell, transfer or grant participations to such person or to any third person, with respect to any of the Securities. If the Purchaser is an entity, the Purchaser represents that it has not been formed for the specific purpose of acquiring the Securities. Purchaser acknowledges that an investment in the Securities is a high-risk, speculative investment.

(i) Reliance on Exemptions. Purchaser understands that the Securities are being offered and sold to it in reliance upon specific exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying upon the truth and accuracy of, and the Purchaser’s compliance with, the representations, warranties, agreements, acknowledgments and understandings of Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of the Purchaser to acquire the Securities.

(j) Restricted Securities. Purchaser understands that the Securities are “restricted securities” under applicable Securities Laws and that, pursuant to these laws, Purchaser must hold the Securities indefinitely unless they are registered with the Securities and Exchange Commission and qualified by state authorities, or an exemption from such registration and qualification requirements is available. Purchaser acknowledges that the Company has no obligation to register or qualify the Securities for resale, except as provided in Section 11 herein. Purchaser further acknowledges that if an exemption from registration or qualification is available, it may be conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Securities, and requirements relating to the Company which are outside of the Purchaser's control, and which the Company is under no obligation and may not be able to satisfy.

(k) Professional Advice. The Company has not received from its legal counsel, accountants or professional advisors any independent valuation of the Company or any of its equity securities, or any opinion as to the fairness of the terms of the Offering or the adequacy of disclosure of materials pertaining to the Company or the Offering.

(l) Risk of Loss. The Purchaser has adequate net worth and means of providing for his/her/its current needs and personal contingencies to sustain a complete loss of the investment in the Company at the time of investment, and the Purchaser has no need for liquidity in the investment in the Securities. The Purchaser understands that an investment in the Securities is highly risky and that he/she/it could suffer a complete loss of his/her/its investment.

(m) Information. The Purchaser understands that any plans, estimates and projections, provided by or on behalf of the Company, involve significant elements of subjective judgment and analysis that may or may not be correct; that there can be no assurance that such plans, projections or goals will be attained; and that any such plans, projections and estimates should not be relied upon as a promise or representation of the future performance of the Company. The Purchaser acknowledges that neither the Company, the Placement Agent nor anyone acting on the Company’s behalf makes any representation or warranty, express or implied, as to the accuracy or correctness of any such plans, estimates and projections, and there are no assurances that such plans, estimates and projections will be achieved. The Purchaser understands that the Company’s technology and products are new, and not all of the technology and/or products may be tested and commercialized, and that there is no guarantee that the technology and products will be commercially successful. The Purchaser understands that all of the risks associated with the technology are not now known. Before investing in the Offering, the Purchaser has been given the opportunity to ask questions of the Company about the technology and the Company’s business and the Purchaser has received answers to those questions.

(n) Authorization; Enforcement. Each Transaction Document to which a Purchaser is a party: (i) has been duly and validly authorized, (ii) has been duly executed and delivered on behalf of the Purchaser, and (iii) will constitute, upon execution and delivery by the Purchaser thereof and the Company, the valid and binding agreements of the Purchaser enforceable in accordance with their terms, except to the extent limited by applicable bankruptcy, insolvency, reorganization, moratorium or other laws of general application affecting enforcement of creditors’ rights and general principles of equity that restrict the availability of equitable or legal remedies.

(o) Residency. If the Purchaser is an individual, then Purchaser resides in the state or province identified in the address of such Purchaser set forth in Section 6; if the Purchaser is a partnership, corporation, limited liability company or other entity, then the office or offices of the Purchaser in which its principal place of business is identified in the address or addresses of the Purchaser set forth in Section 6.

(p) Communication of Offer. The Purchaser was contacted by either the Company or the Placement Agent with respect to a potential investment in the Securities. The Purchaser is not purchasing the Securities as a result of any “general solicitation” or “general advertising,” as such terms are defined in Regulation D of the Securities Act, which includes, but is not limited to, any advertisement, article, notice or other communication regarding the Securities published in any newspaper, magazine or similar media or on the internet or broadcast over television, radio or the internet or presented at any seminar or any other general solicitation or general advertisement.

(q) No Conflicts. The execution, delivery and performance by the Purchaser of this Agreement and the consummation by the Purchaser of the transactions contemplated hereby will not (i) result in a violation of the organizational documents of the Purchaser (if the Purchaser is an entity), (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Purchaser is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws) applicable to the Purchaser.

(r) Organization. If the Purchaser is an entity, it is duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization with the requisite corporate or partnership power and authority to enter into and to consummate the transactions contemplated by the applicable Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. If the Purchaser is an entity, the execution, delivery and performance by the Purchaser of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate or, if the Purchaser is not a corporation, such partnership, limited liability company or other applicable like action, on the part of the Purchaser.

(s) No Other Representations. Other than the representations and warranties contained herein, the Purchaser has not received and is not relying on any representation, warranties or assurances as to the Company, its business or its prospects from the Company or any other person or entity.

[Remainder of Page Intentionally Blank; Agreement Continues on Following Page]

6. Purchaser Information.

(a) Status as an Accredited Investor. By initialing the appropriate space(s) below, the Purchaser represents and warrants that he/she/it is an “Accredited Investor” within the meaning of Regulation D of the Securities Act.

|

o a.

|

A director, executive officer or general partner of Company.

|

|

o b.

|

A natural person whose individual net worth or joint net worth with spouse at time of purchase exceeds $1,000,000. (In calculation of net worth, you may include equity in personal property and real estate (excluding your principal residence), cash, short term investments, stocks and securities. Equity in personal property and real estate should be based on the fair market value of such property less debt secured by such property.)

|

|

o c.

|

A natural person who had an individual income in excess of $200,000 in each of two most recent years or joint income with spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching same level of income in current year.

|

|

o d.

|

A corporation, limited liability company, partnership, tax-exempt organization (under Section 501(c)(3) of Internal Revenue Code of 1986, as amended) or Massachusetts or similar business trust (i) not formed for specific purpose of acquiring Common Stock and (ii) having total assets in excess of $5,000,000.

|

|

o e.

|

An entity which falls within one of following categories of institutional accredited investors, set forth in 501(a) of Regulation D under Securities Act [if you have marked this category, also mark which of following items describes you:]

|

| |

o 1.

|

A bank as defined in Section 3(a)(2) of Securities Act, or any savings and loan association or other institution as defined in Section 3(a)(5)(A) of Securities Act whether acting in its individual or a fiduciary capacity.

|

| |

o 2.

|

A broker/dealer registered pursuant to Section 15 of Securities Exchange Act of 1934.

|

| |

o 3.

|

An insurance company as defined in Section 2(13) of Securities Act.

|

| |

o 4.

|

An investment company registered under Investment Company Act of 1940 or a business development company as defined in Section 2(a)(48) of that act.

|

| |

o 5.

|

A Small Business Investment Company licensed by U.S. Small Business Administration under Section 301(c) or (d) of Small Business Investment Act of 1958.

|

| |

o 6.

|

Any plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions for benefit of its employees, if such plan has total assets in excess of $5,000,000.

|

| |

o 7.

|

Any private business development company as defined in Section 202(a)(22) of Investment Advisers Act of 1940.

|

| |

o 8.

|

An employee benefit plan within meaning of Employee Retirement Income Security Act of 1974, if investment decision is made by a plan fiduciary, as defined in Section 3(21) of such act, which is either a bank, savings and loan association, insurance company or registered investment adviser, or if employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors.

|

| |

o 9.

|

A trust, with total assets in excess of $5,000,000, not formed for specific purpose of acquiring Class A Common Stock offered, whose purchase is directed by sophisticated person as described in Rule 506(b)(2)(ii) of Regulation D.

|

|

o f.

|

An entity in which all equity owners are accredited investors as described above.

|

PURCHASER MUST INDICATE THE APPLICABLE CATEGORY OR CATEGORIES BY INITIALING EACH APPLICABLE SPACE ABOVE; IF JOINT INVESTORS, BOTH PARTIES MUST INITIAL.

(b) Subscription Information. Please complete the following information.

Requested Subscription Amount: $_______________

(subject to Company acceptance)

Name of Purchaser as it is to appear on the Senior Secured Convertible Promissory Note and Warrant

Indicate ownership as:

____ (a) Individual

____ (b) Community Property

____ (c) Joint Tenants with Right of Survivorship ) All parties

____ (d) Tenants in Common ) must sign

____ (e) Corporate

____ (f) Partnership

____ (g) Trust

|

____________________________________

Address of Residence

(or Business, if not an individual)

|

__________________________________

Address for Sending Notices

(if different)

|

|

__________________________________

City, State and Zip Code

|

__________________________________

City, State and Zip Code

|

|

__________________________________

Telephone

|

__________________________________

Telephone

|

|

__________________________________

State of Residence

(or State of Organization, if an entity)

|

__________________________________

State of Residence

(or State of Organization, if an entity)

|

|

__________________________________

SSN/TIN

|

__________________________________

SSN/TIN

|

|

__________________________________

E-mail

|

__________________________________

E-mail

|

[Remainder of Page Intentionally Left Blank; Agreement Continues on Following Page]

7. Covenants.

(a) In addition to the other agreements and covenants set forth herein, as long as a Note (or any August 2012 Note) is outstanding, without the consent of a majority in interest of the Purchasers (including the Purchasers of the August 2012 Notes), the Company will not, and will not permit any of its subsidiaries to, directly or indirectly, to undertake the following:

(i) The Company will not enter into any equity line of credit or similar agreement, nor issue nor agree to issue any floating or Variable Rate Securities nor any of the foregoing or equity with price reset rights. For purposes hereof, “Equity Line of Credit” shall include any transaction involving a written agreement between the Company and an investor or underwriter whereby the Company has the right to “put” its securities to the investor or underwriter over an agreed period of time and at an agreed price or price formula, and “Variable Rate Securities” shall include: (A) any debt or equity securities which are convertible into, exercisable or exchangeable for, or carry the right to receive additional shares of Common Stock or with a fixed conversion, exercise or exchange price that is subject to being reset at some future date at any time after the initial issuance of such debt or equity security, and (B) any amortizing convertible security which amortizes prior to its maturity date, where the Company is required or has the option to (or any investor in such transaction has the option to require the Company to) make such amortization payments in shares of Common Stock.

(ii) The Company will not enter into an agreement to issue, nor will the Company issue, any equity, convertible debt or other securities convertible into Common Stock or other equity of the Company nor modify any of the foregoing which may be outstanding.

(iii) The Company will not enter into any transaction that results in a merger, sale of assets or other corporate reorganization or acquisition; results in the distribution of a dividend or the repurchase of outstanding shares of Common Stock (except in accordance with the provisions of the Company's equity incentive plan); causes a liquidation proceeding or bankruptcy proceeding; results in a change to the Company's corporate status; or results in the incurrence of debt outside of normal trade debt.

(b) In addition to the other agreements and covenants set forth herein, the Company agrees to the following:

(i) Until the Notes (including the August 2012 Notes) are paid in full, the Company will not engage in any of the following without the consent of the Placement Agent: (i) change the size of the Board of Directors; (ii) purchase shares of the Company's Common Stock other than in accordance with the Company's equity incentive plan; (iii) engage in any transactions with affiliates; (iv) increase the number of authorized shares of Common Stock included in the Company's equity incentive plan; (v) make changes in senior management or the compensation of senior management; (vi) approve an annual budget; (vii) engage or dismiss its accountants; (viii) alter any provision of its Certificate of Incorporation, including increasing or decreasing the authorized number of shares of Common Stock or Preferred Stock. For purposes of this subparagraph (i), the term "affiliates" refers to the officers, directors and holders of 10% or more of the Company's common stock.

(ii) The Company will use the net proceeds from the Offering for the following purposes:

|

Use of Proceeds

|

|

(in thousands)

|

|

|

Payroll, payroll taxes and benefits

|

|

$ |

1,795 |

|

|

Product testing and development

|

|

|

255 |

|

|

IP development

|

|

|

140 |

|

|

Working capital

|

|

|

240 |

|

|

Marketing and promotion (excluding pay)

|

|

|

163 |

|

|

Capital expenditures

|

|

|

90 |

|

|

Placement agent fees

|

|

|

325 |

|

|

General and administrative, other

|

|

|

242 |

|

|

Total Use of Proceeds

|

|

$ |

3,250 |

|

The Company expects that the proceeds of the Offering will be sufficient to support its operations for approximately 12 months.

(iii) The Company will retain the services of a PCAOB registered auditor prior to an IPO and such auditor will perform and complete the audits of the financial statements necessary to meet SEC filing and the listing requirements of NASDAQ or AMEX exchanges.

(iv) The Company will have a capital structure acceptable to the Placement Agent and, as noted above, will cause the conversion of all promissory notes and preferred shares outstanding prior to this Offering (including securities owned by TETF) to Common Stock at the time of an IPO. The promissory notes (with the exception of the August 2012 Notes) will convert at the IPO Price according to their terms and the TETF owned securities at the IPO Price less their contractual discount. All rights attached shall be extinguished. Existing warrant holders will continue to maintain the existing warrants under the terms of the warrant agreement as issued.

(v) Within 90 days of the Closing Date, the Company's Board of Directors shall be composed of five members with three independent directors mutually acceptable to the Company and the Placement Agent.

(vi) The Company and the Placement Agent will agree to an intellectual property strategy, which the Company will implement.

(vii) The Company will institute an employee stock option or equity incentive plan acceptable to the Placement Agent.

(viii) In addition to the shares of Common Stock that will be locked up in accordance with Section 8 below, the shares of Common Stock or securities convertible into or exercisable for shares of Common Stock which are held by (A) all officers, directors and employees of the Company, (B) 5% or greater holders as determined pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended, (C) merger participants, if any and (D) the Placement Agent and IP Development Company will be locked up until the later of (x) 12 months following the date of the final prospectus for the IPO and (y) the listing of the Company's Common Stock on an exchange, which may include a listing on any listing level of Nasdaq.

8. Market Stand-Off; Purchaser Distribution.

(a) Lock-Up. In connection with the initial underwritten public offering by the Company of its equity securities pursuant to an effective registration statement filed under the Securities Act, Purchaser shall not, without the prior written consent of the Company’s managing underwriter, (i) lend, offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any shares of Common Stock or any securities convertible into or exercisable or exchangeable for Common Stock (whether such shares or any such securities are then owned by the Purchaser or are thereafter acquired), or (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of Common Stock or any securities convertible into or exercisable or exchangeable for Common Stock, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of stock or such other securities, in cash or otherwise. Such restriction (the “Market Stand-Off”) shall be in effect for such period of time following the date of the final prospectus for the offering as may be requested by the Company or such underwriters. In no event, however, shall such period exceed 180 days or such longer period requested by the underwriters to comply with regulatory restrictions on the publication of research reports (including, without limitation, NASD Rule 2711). In the event of the declaration of a stock dividend, a spin-off, a stock split, an adjustment in conversion ratio, a recapitalization or a similar transaction affecting the Company's outstanding securities without receipt of consideration, any new, substituted or additional securities that are by reason of such transaction distributed with respect to any Company Common Stock subject to the Market Stand-Off, or into which such Company Common Stock thereby becomes convertible, shall immediately be subject to the Market Stand-Off. To enforce the Market Stand-Off, the Company may impose stop-transfer instructions with respect to the Securities until the end of the applicable stand-off period. This Section 8(a) shall not apply to Securities registered in the public offering under the Securities Act, and the Purchaser shall be subject to this Section 8(a) only if the directors and officers of the Company are subject to the lockup arrangements included in Section 7(b)(viii) above.

(b) Securities. As used in this Section 8 and in Section 9, the term “securities” also refers to the purchased Securities, all securities received in conversion, exercise, or replacement thereof, or in connection with the Securities pursuant to stock dividends or splits, all securities received in replacement of the Securities in a recapitalization, merger, reorganization, exchange or the like, and all new, substituted or additional securities or other properties to which Purchaser is entitled by reason of Purchaser’s ownership of the Securities.

9. Restrictive Legends and Stop-Transfer Orders.

(a) Legends. The certificate or certificates representing the Securities shall bear the following legends (as well as any legends required by applicable state corporate law and the Securities Laws):

|

(i)

|

THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISTRIBUTION MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL (OR OTHER EVIDENCE) IN A FORM SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933.

|

|

(ii)

|

THE SECURITIES REPRESENTED HEREBY MAY BE TRANSFERRED ONLY IN ACCORDANCE WITH THE TERMS OF A SECURITIES PURCHASE AGREEMENT BETWEEN THE COMPANY AND THE SECURITY HOLDER DATED ____________, 2012, A COPY OF WHICH IS ON FILE WITH THE SECRETARY OF THE COMPANY.

|

|

(iii)

|

Any legend required to be placed thereon by any appropriate securities commissioner.

|

(b) Stop-Transfer Notices. The Purchaser agrees that, to ensure compliance with the restrictions referred to herein, the Company may issue appropriate “stop transfer” instructions to its transfer agent, if any, and that, if the Company transfers its own securities, it may make appropriate notations to the same effect in its own records.

(c) Refusal to Transfer. The Company shall not be required (i) to transfer on its books any Securities that have been sold or otherwise transferred in violation of any of the provisions of this Agreement or (ii) to treat as owner of such Securities or to accord the right to vote or pay dividends to any purchaser or other transferee to whom such Securities shall have been so transferred.

(d) Removal of Legend. The Securities held by Purchaser will no longer be subject to the legend referred to in Section 9(a)(ii) following the expiration or termination of the lock-up provisions of Section 8 (and of any agreement entered pursuant to Section 8). After such time, and upon Purchaser's request, a new certificate or certificates representing the Securities shall be issued without the legend referred to in Section 9(a)(ii), and delivered to Purchaser. The Company will bear any cost or expense related to removing the legend.

10. Conditions to Closing.

(a) Conditions to the Company’s Obligation to Sell. The obligation of the Company hereunder to issue and sell the Securities to the Purchaser is subject to the satisfaction, at or before the applicable Closing Date of each of the following conditions, provided that these conditions are for the Company’s sole benefit and may be waived by the Company at any time in its sole discretion:

(i) The Purchaser shall have complied with Section 3(a);

(ii) The representations and warranties of the Purchaser shall be true and correct in all material respects; and

(iii) No litigation, statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by or in any court or governmental authority of competent jurisdiction or any self-regulatory organization having authority over the matters contemplated hereby which prohibits the consummation of any of the transactions contemplated by this Agreement.

(b) Conditions to Each Purchaser’s Obligation to Purchase. The obligation of the Purchaser hereunder to purchase the Securities is subject to the satisfaction, at or before the applicable Closing Date of each of the following conditions, provided that these conditions are for the Purchaser’s sole benefit and may be waived by the Purchaser at any time in his/her/its sole discretion:

(i) The Company shall have complied with Section 3(c);

(ii) The representations and warranties of the Company shall be true and correct as of the applicable Closing Date, and the Company shall have performed, satisfied and complied with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by the Company at or prior to the applicable Closing Date. The Purchaser shall have received a certificate or certificates, executed by the Chief Executive Officer of the Company, dated as of the applicable Closing Date, to the foregoing effect and as to such other matters as may be reasonably requested by the Purchaser including, but not limited to, certificates with respect to the Company’s charter, by-laws and Board of Directors’ resolutions relating to the transactions contemplated hereby;

(iii) No litigation, statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by or in any court or governmental authority of competent jurisdiction or any self-regulatory organization having authority over the matters contemplated hereby which prohibits the consummation of any of the transactions contemplated by this Agreement;

(iv) No event shall have occurred which would reasonably be expected to have a Material Adverse Effect;

(v) The Company shall have caused its legal counsel, Richardson & Patel LLP to deliver a legal opinion addressed to the Purchasers and to the Placement Agent with respect to the matters set forth on Exhibit H attached hereto; and

(vi) The Company shall have provided such other documents as the Placement Agent may reasonably request, each in form and substance satisfactory to the Placement Agent.

11. Public Company Status; Registration Rights. The Company will use reasonable best efforts to become a publicly traded and publicly reporting company under both the Securities Act and the Securities Exchange Act of 1934 and the Purchaser shall have certain registration rights, all in accordance with the Registration Rights Agreement of even date herewith.

12. Miscellaneous.

(a) Governing Law. This Agreement and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall be governed, construed and interpreted in accordance with the laws of the State of New York, without giving effect to principles of conflicts of law.

(b) Entire Agreement; Enforcement of Rights. This Agreement together with the exhibits and schedules attached hereto, set forth the entire agreement and understanding of the parties relating to the subject matter herein and supersedes any and all prior agreements or discussions between them, including any term sheet, letter of intent or other document executed by the parties prior to the date hereof relating to such subject matter. No modification of or amendment to this Agreement, nor any waiver of any rights under this Agreement, shall be effective unless in writing signed by the parties to this Agreement; provided, however, that the Purchaser acknowledges and agrees that the Placement Agent may, in its sole discretion acting by prior written consent on behalf of Purchaser, waive any covenant of the Company described in Section 7. The failure by either party to enforce any rights under this Agreement shall not be construed as a waiver of any rights of such party.

(c) Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, the parties agree to renegotiate such provision in good faith. If the parties cannot reach a mutually agreeable and enforceable replacement for such provision, then (i) such provision shall be excluded from this Agreement, (ii) the balance of the Agreement shall be interpreted as if such provision were so excluded and (iii) the balance of the Agreement shall be enforceable in accordance with its terms.

(d) Construction. This Agreement is the result of negotiations between and has been reviewed by each of the parties hereto and their respective counsel, if any; accordingly, this Agreement shall be deemed to be the product of all of the parties hereto, and no ambiguity shall be construed in favor of or against any one of the parties hereto.

(e) Notices. Any notice required or permitted by this Agreement shall be in writing and shall be deemed sufficient when delivered personally (including two business days after deposit with a reputable overnight courier service, properly addressed to the party to receive the same) or sent by fax or 48 hours after being deposited in the U.S. mail, as certified or registered mail, with postage prepaid, and addressed to the party to be notified at such party's address or fax number as set forth herein or as subsequently modified by written notice.

(f) Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument.

(g) Successors and Assigns. The rights and benefits of this Agreement shall inure to the benefit of, and be enforceable by the Company's successors and assigns. The covenants and obligations of the Company hereunder shall inure to the benefit of, and be enforceable by the Purchaser against the Company, its successors and assigns, including any entity into which the Company is merged. The rights and obligations of Purchasers under this Agreement may only be assigned with the prior written consent of the Company.

(h) Third Party Beneficiary. This Agreement is intended for the benefit of the undersigned parties and their respective permitted successors and assigns, and the Placement Agent, and is not for the benefit of, nor may any provision hereof be enforced by, any other person.

(i) Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

(j) Expenses. The Company shall pay all costs and expenses incurred by the Company and the Placement Agent with respect to the negotiation, execution, delivery and performance of the Agreement, including $25,000 in legal fees and expenses of counsel to the Placement Agent.

(k) Survival. The representations, warranties, covenants and agreements made herein shall survive the closing of the transaction contemplated hereby. All statements as to factual matters contained in any certificate or other instrument delivered by or on behalf of the Company pursuant hereto in connection with the transactions contemplated hereby shall be deemed to be representations and warranties by the Company hereunder solely as of the date of such certificate or instrument. The representations, warranties, covenants and obligations of the Company, and the rights and remedies that may be exercised by the Purchaser, shall not be limited or otherwise affected by or as a result of any information furnished to, or any investigation made by or knowledge of, any of the Purchasers or any of their representatives.

(l) Attorneys’ Fees. In the event that any suit or action is instituted under or in relation to this Agreement, including without limitation to enforce any provision in this Agreement, the prevailing party in such dispute shall be entitled to recover from the losing party all fees, costs and expenses of enforcing any right of such prevailing party under or with respect to this Agreement, including without limitation, such reasonable fees and expenses of attorneys and accountants, which shall include, without limitation, all fees, costs and expenses of appeals.

(m) Remedies. All remedies afforded to any party by law or contract, shall be cumulative and not alternative and are in addition to all other rights and remedies a party may have, including any right to equitable relief and any right to sue for damages as a result of a breach of this Agreement. Without limiting the foregoing, no exercise of a remedy shall be deemed an election excluding any other remedy.

(n) Consent of Spouse. If the Purchaser is married on the date of this Agreement, such Purchaser’s spouse shall execute and deliver to the Company the Spousal Consent, effective on the date hereof. Notwithstanding the execution and delivery thereof, such consent shall not be deemed to confer or convey to the spouse any rights in such Purchaser’s Securities that do not otherwise exist by operation of law or the agreement of the parties. If any Purchaser should marry or remarry subsequent to the date of this Agreement, such Purchaser shall within 30 days thereafter obtain his/her new spouse’s acknowledgement of and consent to the existence and binding effect of all restrictions contained in this Agreement by causing such spouse to execute and deliver a Consent of Spouse acknowledging the restrictions and obligations contained in this Agreement and agreeing and consenting to the same.

[Remainder of Page Intentionally Left Blank]

The Purchaser, by his or her signature below, or by that of its authorized representative, confirms that Purchaser has carefully reviewed and understands this Agreement.

IN WITNESS WHEREOF, the Purchaser has executed this Agreement as of October __, 2012.

|

PURCHASER (if individual):

Signature

Name (type or print)

|

PURCHASER (if entity):

Name of Entity

By:

|

|

Signature of Co-Signer (if any)

Name of Co-Signer (type or print)

|

Name:

Its:

|

| |

|

AGREED AND ACCEPTED as of __________, 2012.

IDEAL POWER CONVERTERS, INC.

By: ___________________________________

Paul Bundschuh

Chief Executive Officer

Subscription Amount (as accepted by the Company):

$________________________

EXHIBIT A

COMPANY INFORMATION

[see attached]

EXHIBIT B

SPOUSAL CONSENT

I, ________________________________, spouse of ____________, have read and hereby approve the foregoing Agreement. In consideration of the Company's granting my spouse the right to purchase the Securities as set forth in the Agreement, I hereby agree to be irrevocably bound by the Agreement and further agree that any community property or similar interest that I may have in the Securities shall be similarly bound by the Agreement. I hereby appoint my spouse as my attorney-in-fact with respect to any amendment or exercise of any rights under the Agreement.

Spouse of ___________________________

OR

I hereby represent and warrant that I am unmarried as of the date of this Agreement.

Signature

EXHIBIT C

FORM OF NOTE

[see attached]

EXHIBIT D

FORM OF WARRANT

[see attached]

EXHIBIT E

SECURITY AGREEMENT

[see attached]

EXHIBIT F

SUBORDINATION AGREEMENT

[see attached]

EXHIBIT G

REGISTRATION RIGHTS AGREEMENT

[see attached]

EXHIBIT H

FORM OF LEGAL OPINIONS

1. The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Texas and has all requisite corporate power and authority to carry on its business as now conducted and as proposed to be conducted. The Company has no direct or indirect subsidiaries. The Company is duly qualified as a foreign corporation to do business and is in good standing in every jurisdiction in which its ownership or use of property or the nature of the business conducted by it makes such qualification necessary except where the failure to be so qualified or in good standing would not have a Material Adverse Effect.

2. The Company has the requisite corporate power and authority to execute, deliver and perform its obligations under the Transaction Documents. The Transaction Documents, and the issuance of the Notes, and Warrants and the reservation and issuance of Common Stock issuable upon conversion of the Notes and exercise of the Warrants have been (a) duly approved by the Board of Directors of the Company, and (b) the Securities, when issued pursuant to the Agreement and upon delivery, shall be validly issued and outstanding, fully paid and non-assessable.