As filed with the Securities and Exchange Commission on August 6, 2013

Registration No. 333-_________

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IDEAL POWER INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

14-1999058

|

|||

|

(State or other jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

(512) 264-1542

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul Bundschuh

Chief Executive Officer

Ideal Power Inc.

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

(512) 264-1542

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Kevin Friedmann, Esq.

Richardson & Patel LLP

The Chrysler Building, 49th Floor

405 Lexington Avenue

New York, New York 10174

Telephone: (212) 561-5559

Fax: (917) 591-6898

|

Scott Bartel, Esq.

Eric Stiff, Esq.

Locke Lord LLP

500 Capitol Mall, Suite 1800

Sacramento, California 95814

Telephone: (916) 930-2500

Fax: (916) 930-2501

|

As soon as practicable after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. [ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Amount to be

Registered

(1)

|

Proposed

Maximum

Offering

Price Per

Share

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount of

Registration

Fee

|

|||||||||||||

|

Title of Each Class of Securities to be Registered

|

||||||||||||||||

|

Common Stock, $0.001 par value per share(2)

|

2,875,000

|

$

|

5.00

|

$

|

14,375,000

|

$

|

1,960.75

|

|||||||||

|

Underwriter Warrant (3)(4)

|

$

|

$

|

1,000

|

$

|

0.14

|

|||||||||||

|

Common Stock underlying Underwriter's Warrant

|

287,500

|

$

|

6.25

|

$

|

1,796,875

|

$

|

245.09

|

|||||||||

|

Total

|

$

|

16,172,875

|

$

|

2,205.98

|

||||||||||||

|

(1)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, for the public offering and Rule 457(a) for the offering by the security holder.

|

|

(2)

|

Includes 375,000 shares of common stock representing 15% of the shares offered to the public that the underwriter has the option to purchase to cover over-allotments, if any.

|

|

(3)

|

No registration fee required pursuant to Rule 457(g) under the Securities Act of 1933.

|

|

(4)

|

Represents a warrant granted to the underwriter to purchase shares of common stock in an amount up to 10% of the number of shares sold to the public in this offering.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment, which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND WE ARE NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED AUGUST 6, 2013

PRELIMINARY PROSPECTUS

2,500,000 Shares of Common Stock

We are offering 2,500,000 shares of our common stock, $0.001 par value, in a firm commitment offering, which share number reflects our proposed one for 2.381 reverse stock split (the “reverse stock split”) described in this prospectus. After the effectiveness of the registration statement, of which this prospectus is a part, and concurrently with the pricing of the offering, we will effect the reverse stock split.

This is an initial public offering of our common stock. We expect the public offering price to be $5.00 per share (assuming the reverse stock split). There is presently no public market for our common stock. We intend to apply for listing of our common stock on the Nasdaq Capital Market under the symbol “IPWR,” which listing we expect to occur upon consummation of this offering. No assurance can be given that our application will be approved. If our application to the Nasdaq Capital Market is not approved, or if we do not raise at least $10 million in this offering, we will not complete the offering or effect the reverse stock split.

We are an “emerging growth company” under the federal securities laws and will have the option to use reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 9 for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

MDB Capital Group, LLC is the underwriter for our initial public offering. If we sell all of the common stock we are offering, we will pay to MDB Capital Group, LLC $1,250,000, or 10%, of the gross proceeds of this offering and non-accountable expenses equal to $187,500. For a more complete discussion of the compensation we will pay to the underwriter, please see the section of this prospectus titled “Underwriting”. In connection with this offering, we have also agreed to issue to MDB Capital Group, LLC a warrant to purchase shares of our common stock in an amount up to 10% of the shares of common stock sold in the public offering, with an exercise price equal to 125% of the per-share public offering price.

|

Per Share

|

Total

|

|||||||

|

Public offering price

|

$

|

5.00

|

$

|

12,500,000.00

|

||||

|

Underwriting discounts and commissions

|

$

|

0.50

|

$

|

1,250,000.00

|

||||

|

Proceeds to us (before expenses) (1)

|

$

|

4.50

|

$

|

11,250,000.00

|

||||

|

(1)

|

Does not include a non-accountable expense allowance equal to $187,500 payable to MDB Capital Group, LLC, the underwriter. See “Underwriting” for a description of compensation payable to the underwriter.

|

The underwriter may also purchase an additional 375,000 shares of our common stock (assuming the reverse stock split) amounting to 15% of the number of shares offered to the public, within 45 days of the date of this prospectus, to cover over-allotments, if any, on the same terms set forth above.

The underwriter expects to deliver the shares on or about _____________________, 2013.

MDB Capital Group, LLC

The date of this prospectus is _______________, 2013.

TABLE OF CONTENTS

|

Page

|

||

|

PROSPECTUS SUMMARY

|

1

|

|

|

SUMMARY SELECTED FINANCIAL INFORMATION

|

8

|

|

|

RISK FACTORS

|

9

|

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS | 20 | |

|

BUSINESS

|

21

|

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

31

|

|

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

37

|

|

|

EXECUTIVE COMPENSATION

|

40

|

|

|

DESCRIPTION OF CAPITAL STOCK

|

42

|

|

|

MARKET FOR OUR COMMON STOCK, DIVIDEND POLICY AND OTHER STOCKHOLDER MATTERS

|

46

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

46

|

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

49

|

|

| CHANGES IN ACCOUNTANTS | 53 | |

|

UNDERWRITING

|

53

|

|

|

USE OF PROCEEDS

|

57

|

|

|

CAPITALIZATION

|

57

|

|

|

DILUTION

|

59

|

|

|

LEGAL MATTERS

|

60

|

|

|

EXPERTS

|

60

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

60

|

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

60

|

Unless otherwise stated or the context otherwise requires, the terms “IPWR,” “we,” “us,” “our” and the “Company” refer to Ideal Power Inc.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional or different information. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

No dealer, salesperson or any other person is authorized in connection with this offering to give any information or make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any circumstance in which the offer or solicitation is not authorized or is unlawful.

Prospectus Summary

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire prospectus, as well as the information to which we refer you, before deciding whether to invest in our common stock. You should pay special attention to the “Risk Factors” section of this prospectus to determine whether an investment in our common stock is appropriate for you.

This registration statement, including the exhibits and schedules thereto, contains additional relevant information about us and our securities. With respect to the statements contained in this prospectus regarding the contents of any agreement or any other document, in each instance, the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed or incorporated by reference as an exhibit to the registration statement.

About Ideal Power Inc.

We design and develop technologies that aim to improve key performance characteristics of electronic power converters and inverters, including manufacturing cost, installation cost, weight, efficiency, reliability and flexibility. Our Power Packet Switching Architecture™ (PPSA) is an entirely new power conversion topology that uses software switching and 100% indirect power transfer. With PPSA, all of the power flows into and is temporarily stored in an AC link magnetic storage component. This allows PPSA-enabled products to provide isolation (which enables grounding) and still be significantly smaller than both transformer-based inverters and transformer-less inverters.

We believe that our technology can allow owners and operators of systems with a wide variety of power conversion needs to benefit from reduced costs and increased efficiency, reliability and flexibility. In addition, PPSA can reduce the compliance burden faced by users of transformer-less power converters. (Transformer-less converters are smaller than transformer-based converters, but they do not provide isolation, so they need significant additional protections to meet United States safety regulations.)

Our initial target markets will be the PV inverter, electrified vehicle DC charging, and distributed storage markets.

We were incorporated in Texas on May 17, 2007. We converted to a Delaware corporation on July 15, 2013. The address of our corporate headquarters is 5004 Bee Creek Road, Suite 600, Spicewood, Texas 78669 and our telephone number is (512) 264-1542. Our website can be accessed at www.idealpower.com. The information contained on, or that may be obtained from, our website is not, and shall not be deemed to be, a part of this prospectus.

The Industry

Recent trends in the sources and uses of energy are driving demand for electronic power converters. These trends include the migration toward intermittent renewable resources, an increased consumer demand for electrified vehicles, and a growing need to improve grid reliability and enable low cost off-grid renewable power systems in remote locations. However, the power electronics systems used in these markets have limitations in size, weight, cost, safety, efficiency, flexibility and reliability. We believe PPSA can improve upon existing technology on all of these parameters.

Currently, isolated power conversion requires several bulky, inflexible devices. These include bulk capacitors, power switches, line reactors and isolation transformers. These components are heavy and expensive. In addition, they are often custom-built for fixed functions, making them inflexible and not scalable. This process also imposes high electrical and thermal stresses, which can create safety and reliability issues.

-1-

Our Proprietary Technology

With PPSA, power flows through, and is temporarily stored in, an AC link magnetic storage component. The power therefore moves like a packet, and the switching of that packet through the stages of the PPSA process is what gives Power Packet Switching Architecture its name. Critically, this means that the entire process of isolated power conversion can take place in a single PPSA enabled device. A brief outline of the process is as follows:

Stage One: The AC Link is charged from the input

Stage Two: The AC Link stores electrical energy and switches (rotates) the input voltage/current to match the output voltage/current requirements

Stage Three: The AC Link releases power to the output

This process has several benefits. Many of these stem from the fact that PPSA requires fewer hardware components than conventional designs:

|

·

|

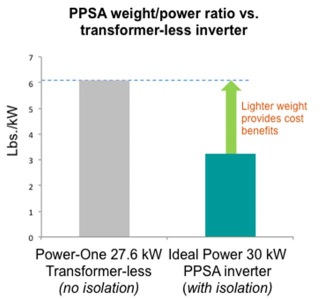

Improved power-to-weight ratio. This is another way of saying that PPSA can deliver the same power as a traditional inverter in a much smaller form factor and lower weight. Lower weight using standard materials can lower material and manufacturing costs, as well as logistic costs of shipping, installation and maintenance. For example, Power One (one of the leaders in the power conversion space) currently offers a 27.6 kW transformer-less inverter that weighs 168 lbs., for a power-to-weight ratio of approximately 6.09 lbs./kW. (Please note that transformer-less inverters do not provide isolation; one of the key benefits they provide over traditional inverters is that they are smaller.) Our 30 kW inverter weighs only 97 lbs., for a power-to-weight ratio of approximately 3.23 lbs./kW.

|

|

·

|

Best-of-class safety without significant additional safeguards. Stage Two of the PPSA process above provides electrical isolation between the input and the output without a transformer. This isolation means that PPSA systems can be grounded, so they achieve the same safety profile as transformer-based inverters. Transformer-less inverters, which cannot be grounded can only achieve that level of safety by integrating other safeguards, increasing system expense.

|

|

·

|

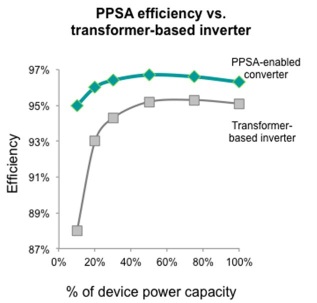

Greater efficiency. PPSA delivers efficiencies above 96%. The efficiency of competing systems varies significantly depending on the application, but in some of our target applications, our PPSA solution has half the power losses of conventional solutions.

|

-2-

|

·

|

Greater scalability/flexibility. The electronic power converter market is fragmented. PPSA can use a common hardware design with different embedded software to address different markets. PPSA’s flexibility enables uses below 10 kW to over 1 MW.

|

|

·

|

Greater reliability. Because PPSA uses no electrolytic capacitors, it eliminates many points of failure of conventional systems. We believe this and other design features will lead to increased reliability.

|

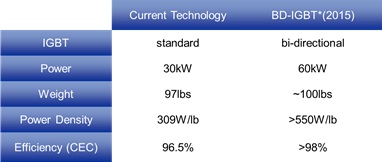

We are continuing to develop and extend the PPSA platform. This includes development work focused on bi-directional insulated gate bipolar transistors (BD-IGBTs). Using BD-IGBTs in our PPSA solution should yield further improvements in power density, manufacturing cost, and efficiency. The Department of Energy awarded us a $2.5 million ARPA-e grant to develop and commercialize BD-IGBT power switches to improve the performance of our solutions.

Our Business Model

Our business model is to license PPSA to original equipment manufacturers (OEMs). Our goal is to have OEMs sell our product to end users and share in the overall economic benefit; we expect this approach will allow us to save on staffing and working capital requirements. To serve the goal of licensing PPSA, we are building reference products that demonstrate the capabilities of PPSA to OEMs. We have already designed and built our first two reference products: a 30 kW photovoltaic (PV) inverter and a 30kW battery converter. These products have met rigorous industry standards and have been purchased by leading commercial and government customers, including Johnson Controls, Sharp Labs of America, the U.S. Navy, the National Renewable Energy Laboratory (NREL) and National Aeronautics and Space Administration (NASA). We are in the process of developing two more reference products: a 30kW 3-port hybrid converter and a 30kW micro-grid converter. Based on our research and testing, we believe our technology can scale down to 10 kW and up to 1 MW.

Our Target Markets

We believe there are dozens of markets that could benefit from PPSA’s unique method of isolated transformer-less power conversion. Our initial focus will be on three strategic markets: solar photovoltaic (PV), distributed storage and electrified vehicle DC charging. We have chosen these initial markets based on their size and growth, the strength of the PPSA value proposition for those markets, and our time-to-market.

|

·

|

PV inverter market: The PV inverter market is already large and still growing; industry analysts estimate it at $7.1 billion in 2013, with growth in the installed base from 30 GW in 2012 to over 58 GW in 2017 (a CAGR of 13.8%). Much of this growth is due to a rapid decline in the cost of solar cells. Operators who are trying to remove more cost from these systems have therefore now begun to turn to “balance of system” costs, as these now represent a larger percentage of total installation expense.

|

Our 30kW PV inverter weighs 97 pounds compared to 1200 pounds from a typical transformer-based PV inverter. It also weighs about half as much as typical transformer-less PV inverters, which do not provide isolation and therefore need additional safeguards to meet US regulatory guidelines. This reduced weight means that our 30kW PV inverter can be cheaper to manufacture than the competition; it also means that it is cheaper to ship and install.

Our reference product for this market is our 30kW PV inverter. As of March 31, 2013, this product had already been sold to 11 different PV inverter installation companies.

|

·

|

Distributed storage market: This market is also growing extremely fast; industry analysts estimate that the U.S. market will grow from 1.4 MW of PV systems with integrated storage in 2012 to 900 MW in 2017, a CAGR of 264%.

|

Our 30kW battery converter is our first reference product for this market. It is suitable for several emerging storage applications, including peak demand reduction. Our early customers for this application include Johnson Controls, Sharp and Powin Energy. We have also made commercial off the shelf (COTS) sales to NREL, the U.S. Navy and NASA.

-3-

Our next reference product for this market will be our 3-port hybrid converter, which will integrate PV with grid storage. We also plan to develop a 3-port micro-grid converter (expected Q4 2014) that will provide new embedded firmware capabilities supporting micro-grids. We expect this product will allow our customers to use our systems to lower the cost of combined PV and batteries for emergency backup power or to operate them in remote off-grid installations.

|

·

|

Electrified vehicle DC charging market: The DC charging market is sometimes called the fast-charging market, as it can reduce charge time for a standard electric vehicle from 8 hours to 30 minutes. This market is growing extremely fast, spurred on by EV manufacturers such as Tesla and Nissan; industry analysts estimate that it will grow from $713 million in 2013 to $3.8 billion in 2020 (a CAGR of 27.1%), as the number of DC chargers grows from about 9,000 to about 98,000 over the same time period.

|

Our 30 kW battery converter is our first reference product for this market, and is already installed at NREL in Colorado. We believe the efficiency, flexibility and cost benefits of PPSA will contribute to the spread of DC charging stations. Our partners in establishing early market leadership include the U.S. Department of Defense and NRG Energy.

Our next reference product for this market (expected Q1 2014) will be a 30 kW hybrid converter that will exploit the multi-port capabilities of PPSA; it will have the ability to integrate DC charging with PV or stationary battery storage.

|

·

|

Other markets: We plan to continue to evaluate new markets for PPSA based on their size and growth, the strength of the PPSA value proposition for those markets, and our time-to-market. We are studying PPSA’s applicability to markets such as variable frequency drives (VFDs) for AC motors, uninterruptible power supply (UPS), utility dispatchable PV, and solid state transformers.

|

Reverse Stock Split and Offering Requirements

We will close this offering only if our listing application is approved by the Nasdaq Capital Market and only if we raise a minimum of $10 million in gross proceeds. If we are unable to meet either of these requirements, we will terminate the offering.

On June 13, 2013, our Board of Directors, and on July 5, 2013, stockholders holding a majority of our outstanding voting power, approved resolutions authorizing our Board of Directors to effect a reverse split of our common stock at an exchange ratio of between one-for-two and one-for-ten, with our Board of Directors retaining the discretion as to whether to implement the reverse split and which exchange ratio to implement. The reverse stock split is intended to allow us to meet the minimum share price requirement of The Nasdaq Capital Market. During August 2013, our Board of Directors determined that following the effectiveness of the registration statement, of which this prospectus is a part, and prior to the closing of this offering, the Board of Directors will effect the reverse stock split at a ratio of 1 share for each 2.381 shares.

Except as otherwise indicated and except in our financial statements, all information regarding share amounts of common stock and prices per share of common stock contained in this prospectus assume the consummation of the reverse stock split to be effected following effectiveness of the registration statement, of which this prospectus forms a part, and prior to the closing of this offering.

Status as an Emerging Growth Company

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Securities Exchange Act) are required to comply with the new or revised financial accounting standard. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have irrevocably elected to opt out of the transition period, and we have not utilized any provisions of the JOBS Act to date.

-4-

Ability to Continue our Operations

We experienced net losses of $4,647,219 and $1,750,939 for the years ended December 31, 2012 and 2011, respectively. At December 31, 2012, our net loss from inception was $7,200,514. Net loss for the quarter ended March 31, 2013 was $1,824,503, which increased the accumulated net losses to $9,025,017 as of March 31, 2013.

We will need financing to continue our operations, particularly for the support of our research and development efforts. We have no committed sources of capital and do not know whether additional financing will be available when needed on terms that are acceptable, if at all. The failure to satisfy our capital requirements will adversely affect our business, financial condition, results of operations and prospects.

Unless we raise funds in this offering, we will not have sufficient capital to continue our operations for the next 12 months. Even if we raise funds in this offering, they may be insufficient to sustain our operations for the next 12 months if our costs are higher than projected or unforeseen expenses arise.

Convertible Promissory Notes

We have issued $750,000 in senior secured convertible promissory notes that must be paid or converted into shares of our common stock on or before July 29, 2014, $4 million in senior secured convertible promissory notes that must be paid or converted into shares of our common stock on or before November 21, 2013, $1.142 million in convertible promissory notes that must be paid or converted into shares of our common stock on or before December 31, 2013, and we expect to issue an additional $213,394 in convertible notes to our legal counsel for services rendered in connection with this offering. Collectively, we refer to these promissory notes as the “Convertible Notes” in this prospectus. If we raise at least $10 million in this offering, all of the Convertible Notes will be converted into shares of our common stock. We do not plan to consummate this offering unless we raise at least $10 million, so our disclosures in this prospectus assume full conversion of the Convertible Notes into 1,682,606 shares of our common stock.

Risks Related to Our Business

Our business is subject to a number of risks. You should understand these risks before making an investment decision. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. Below is a summary of some of the principal risks we face. The risks are discussed more fully in the section of this prospectus below titled “Risk Factors.”

|

·

|

We have a limited operating history and it is uncertain whether we will ever be profitable. We anticipate future losses and negative cash flow, which may limit or delay our ability to become profitable.

|

|

·

|

We may raise additional financing by issuing new securities that may have terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock and our business.

|

|

·

|

If we do not receive additional financing when and as needed in the future, we may not be able to continue our research and development efforts or accelerate the commercialization of our technology and materials.

|

|

·

|

If we are unable to keep up with rapid technological changes, our technology may become obsolete.

|

|

·

|

We may be unable to protect our intellectual property.

|

|

·

|

We may not be able to reach production scales that are required to maintain manufacturing costs low enough to become profitable.

|

|

·

|

We may not be able to convince customers to buy or to license our products due to our limited history.

|

|

·

|

We may have significant reliability problems with our products, requiring extensive recalls and repair costs.

|

|

·

|

We will face extensive competition from better-established power converter manufacturers.

|

-5-

THE OFFERING

The following summary contains basic information about our initial public offering and our common stock and is not intended to be complete. It does not contain all of the information that may be important to you. For a more complete understanding of our common stock, please refer to the section of this prospectus titled “Description of Capital Stock.”

|

Issuer

|

Ideal Power Inc., a Delaware corporation.

|

|

|

Common Stock Offered By Us

|

2,500,000 shares of common stock, par value $0.001 per share.

|

|

|

Over-allotment Option

|

We have granted an option to our underwriter to purchase up to an additional 375,000 shares of common stock within 45 days of the date of this prospectus in order to cover over-allotments, if any.

|

|

|

Common Stock Outstanding Prior To This Offering

|

1,480,262 shares of common stock (1)

|

|

|

Common Stock Outstanding After This Offering

|

5,688,038 shares of common stock (1)(2)(3)

|

|

|

Use of Proceeds

|

We intend to use the net proceeds from our sale of common stock in this offering as follows: approximately $1.5 million will be used for new product research and development, approximately $5 million will be used for existing product development and commercialization, approximately $1 million will be used for the protection of our intellectual property, approximately $1 million will be used for the purchase of equipment and software, and the balance of the funds will be used for general corporate purposes. See “Use of Proceeds” and “Plan of Operation” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

|

|

|

Market And Trading Symbol For The Common Stock

|

There is currently no market for our common stock. We intend to apply for listing of our common stock on the Nasdaq Capital Market under the symbol “IPWR”.

|

|

|

Underwriter Common Stock Purchase Warrant

|

In connection with this offering, we have also agreed to sell to MDB Capital Group, LLC and its designees a warrant to purchase up to 10% of the shares of common stock sold in this offering. If this warrant is exercised, each share may be purchased by MDB Capital Group, LLC at $6.25 per share (125% of the price of the shares sold in this offering.)

|

-6-

|

Lock-Up Agreements

|

Our officers, directors and employees, and 5% or greater holders of our equity securities as determined pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended, will have the securities they own locked up until the first anniversary of the Underwriting Agreement we will enter into with MDB Capital Group, LLC in conjunction with this offering (the “One Year Lock-Up”). The purchasers of our senior secured convertible promissory notes, including MDB Capital Group, LLC, are subject to lock-up requirements for periods that may last no more than 180 days following the date of this prospectus (the “Six Month Lock-Up”). The number of currently outstanding shares of common stock subject to the One Year Lock-Up totals 1,262,792 shares and the number of shares underlying options, warrants, and convertible promissory notes subject to the One Year Lock-Up totals 453,441 shares. The number of shares of common stock to be issued to, or that may be acquired by, the holders of our senior secured convertible promissory notes and MDB Capital Group, LLC that will be subject to the Six Month Lock-Up totals 2,455,231 shares. For more information about the lock-up agreements and requirements, see the section titled “Underwriting - Lock-Up Agreements” in this prospectus.

|

|||

|

Offering Termination

|

If we fail to obtain approval from The Nasdaq Stock Market to list our common stock on the Nasdaq Capital Market or if we fail to raise at least $10 million of gross proceeds in this offering, we will not complete the offering.

|

|||

|

(1)

|

The number of shares of our common stock to be outstanding both before and after this offering is based on the number of shares outstanding as of June 30, 2013 and excludes:

|

|||

|

●

|

158,108 shares of our common stock reserved for issuance under outstanding option agreements and 352,270 shares of our common stock reserved for issuance under option agreements that have been approved by the Compensation Committee of the Board of Directors but have not yet been issued;

|

|||

|

●

●

|

487,713 shares of our common stock reserved for future issuance under our 2013 Equity Incentive Plan;

1,519,095 shares of our common stock reserved for issuance under outstanding warrant agreements; and

|

|||

|

●

|

250,000 shares of our common stock issuable upon exercise of the warrant issued to MDB Capital Group, LLC.

|

|||

|

Unless otherwise specifically stated, information throughout this prospectus assumes that none of our outstanding options or warrants to purchase shares of our common stock are exercised.

|

|

|

(2)

|

Unless otherwise indicated, the number of shares of common stock presented in this prospectus excludes shares issuable pursuant to the exercise of the underwriter’s over-allotment option.

|

|

(3)

|

This number includes 2,500,000 shares of common stock that will be issued in this offering, 1,682,606 shares of common stock that will be issued to the holders of the Convertible Notes upon the completion of this offering, and 25,170 shares of common stock to be issued to our independent directors as compensation for their services.

|

-7-

SUMMARY SELECTED FINANCIAL INFORMATION

The table below includes historical selected financial data for each of the years ended December 31, 2012 and 2011, derived from our audited financial statements included elsewhere in this prospectus. The table below also includes historical financial data for the three-month periods ended March 31, 2013 and 2012, derived from our unaudited financial statements included elsewhere in this prospectus.

You should read the historical selected financial information presented below in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and our financial statements and the notes to those financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period.

|

For the Years Ended December 31,

|

For the Quarters Ended March 31, (unaudited)

|

|||||||||||||||

|

2012

|

2011

|

2013

|

2012

|

|||||||||||||

|

STATEMENT OF OPERATIONS:

|

||||||||||||||||

|

Revenue

|

$ | 1,126,907 | $ | 860,771 | $ | 380,135 | $ | 132,182 | ||||||||

|

Costs of goods sold

|

957,641 | 757,393 | 366,989 | 87,577 | ||||||||||||

|

Gross Profit

|

169,266 | 103,378 | 13,146 | 44,605 | ||||||||||||

|

Operating expenses

|

3,207,573 | 1,616,060 | 754,220 | 652,331 | ||||||||||||

|

Loss from operations

|

(3,038,307 | ) | (1,512,682 | ) | (741,074 | ) | (607,726 | ) | ||||||||

|

Interest expense, net

|

(1,608,912 | ) | (238,257 | ) | (1,083,429 | ) | (103,549 | ) | ||||||||

|

Net loss

|

$ | (4,647,219 | ) | $ | (1,750,939 | ) | $ | (1,824,503 | ) | $ | (711,275 | ) | ||||

|

Basic and diluted net loss per share

|

(1.33 | ) | (0.53 | ) | (0.52 | ) | (0.20 | ) | ||||||||

|

Weighted average number of basic and diluted common shares outstanding

|

3,489,963 | 3,282,520 | 3,524,505 | 3,477,050 | ||||||||||||

|

December 31, 2012

|

December 31, 2011

|

March 31, 2013 (unaudited)

|

||||||||||||||

|

BALANCE SHEET DATA:

|

||||||||||||||||

|

Cash and cash equivalents

|

$ | 1,972,301 | $ | 100,675 | $ | 1,215,986 | ||||||||||

|

Working capital (deficit)

|

528,603 | (61,437 | ) | (1,274,681 | ) | |||||||||||

|

Total assets

|

3,207,003 | 579,853 | 2,325,766 | |||||||||||||

|

Total liabilities

|

3,308,397 | 1,750,750 | 4,196,841 | |||||||||||||

|

Total stockholders’ deficit

|

(101,394 | ) | (1,170,897 | ) | (1,871,075 | ) | ||||||||||

-8-

RISK FACTORS

We are subject to various risks that may materially harm our business, prospects, financial condition and results of operations. An investment in our common stock is speculative and involves a high degree of risk. In evaluating an investment in shares of our common stock, you should carefully consider the risks described below, together with the other information included in this prospectus.

If any of the events described in the following risk factors actually occurs, or if additional risks and uncertainties that are not presently known to us or that we currently deem immaterial later materialize, then our business, prospects, results of operations and financial condition could be materially adversely affected. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment in our shares. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risks Related to Our Business

We lack an established operating history on which to evaluate our business and determine if we will be able to execute our business plan, and we can give no assurance that our operations will result in profits.

We were formed in Texas on May 17, 2007 and converted to a Delaware corporation on July 15, 2013; therefore we have a limited operating history that makes it difficult to evaluate our business. We have been granted patents by the United States of America and we have currently pending patent applications with the United States Patent and Trademark Office and equivalent offices in the European Union, India, Malaysia, Singapore, the Philippines, South Korea, China, Brazil and Canada for a power converter topology and our methods of operating said topology, as well as various improvements on and applications of our basic power converter design. We have also had our designs validated by UL certifications from Intertek (a Nationally Recognized Test Laboratory), the California Energy Commission, and several PV inverter installations. However, we have only recently begun sales of our products, and we cannot say with certainty when we will begin to achieve profitability. No assurance can be made that we will ever become profitable.

We have incurred losses in prior periods and expect to incur losses in the future. We may never be profitable.

Our independent registered public accounting firm has issued an unqualified opinion with an explanatory paragraph to the effect that there is substantial doubt about our ability to continue as a going concern. This unqualified opinion with an explanatory paragraph could have a material adverse effect on our business, financial condition, results of operations and cash flows. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” and Note 2 to our financial statements included elsewhere in this prospectus.

Since our inception on May 17, 2007 through December 31, 2012, we sustained $7,200,514 in net losses and we had net losses at December 31, 2012 and 2011 of $4,647,219 and $1,750,939, respectively. We expect to continue to sustain losses for the foreseeable future. Net loss for the three months ended March 31, 2013 was $1,824,503, which increased the accumulated net losses to $9,025,017 as of March 31, 2013.

We began product sales in 2011 and shipped 14 units for $165,000. In 2012 we shipped 25 units for $266,000. In the first quarter of 2013, we shipped 15 units for $122,000. We also sold $10,000 in ancillary equipment, PV combiners made by SolarBOS. As sales of our products have generated minimal operating revenues, we have relied on sales of our debt securities to continue our operations. If we are unable to raise funds through sales of our securities, there can be no assurance that we will be able to implement our business plan, generate sustainable revenue or ever achieve profitable operations. We expect to have operating losses until such time as we develop a substantial and stable revenue base. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future.

-9-

To date we have had a limited number of customers. We cannot assure you that our customer base will increase.

Two customers, the Department of Energy (ARPAE) and Lockheed Martin, accounted for 75% of net revenue for the year ended December 31, 2012. Two customers, Lockheed Martin and Meridian Solar, accounted for 85% of net revenues for the year ended December 31, 2011. The loss of one of these customers could cause an adverse effect on our operations. 72% of the Company’s accounts receivable balance at December 31, 2012 was from the Department of Energy and 100% of accounts receivable at December 31, 2011 was from Lockheed Martin. Separate from the work for the Department of Energy and Lockheed Martin, the Company sold its product to eleven customers in 2012.

We may not be able to meet our product development and commercialization milestones.

Product development and testing are subject to unanticipated and significant delays, expenses and technical or other problems. We cannot guarantee that we will successfully achieve our milestones within our planned timeframe or ever. Our plans and ability to achieve profitability depend on acceptance of our technology and our products by key market participants, such as vendors and marketing partners, and potential end-users of our products. We continue to educate designers and manufacturers about our solar PV inverters, grid-battery converters, and electric vehicle charging infrastructure. More generally, the commercialization of our products may also be adversely affected by many factors not within our control, including:

|

·

|

the willingness of market participants to try a new product and the perceptions of these market participants of the safety, reliability, functionality and cost effectiveness of our products;

|

|

·

|

the emergence of newer, possibly more effective technologies;

|

|

·

|

the future cost and availability of the raw materials and components needed to manufacture and use our products; and

|

|

·

|

the adoption of new regulatory or industry standards that may adversely affect the use or cost of our products.

|

Accordingly, we cannot predict that our products will be accepted on a scale sufficient to support development of mass markets for them.

We must achieve design wins to retain our existing customers and to obtain new customers, although design wins achieved do not necessarily result in substantial sales.

The constantly changing nature of technology in the markets we serve causes equipment manufacturers to continually design new systems. We must work with these manufacturers early in their design cycles to modify our equipment or design new equipment to meet the requirements of their new systems. Manufacturers typically choose one or two vendors to provide the components for use with the early system shipments. Selection as one of these vendors is called a design win. It is critical that we achieve these design wins in order to retain existing customers and to obtain new customers.

We believe that equipment manufacturers often select their suppliers based on factors including long-term relationships and end user demand. Accordingly, we may have difficulty achieving design wins from equipment manufacturers who are not currently our customers. In addition, we must compete for design wins for new systems and products of our existing customers, including those with whom we have had long-term relationships. Our efforts to achieve design wins are time consuming, expensive, and may not be successful. If we are not successful in achieving design wins, or if we do achieve design wins but our customers’ systems that utilize our products are not successful, our business, financial condition, and results of operations could be materially and adversely impacted.

Once a manufacturer chooses a component for use in a particular product, it is likely to retain that component for the life of that product. Our sales and growth could experience material and prolonged adverse effects if we fail to achieve design wins. However, design wins do not always result in substantial sales, as sales of our products are dependent upon our customers’ sales of their products.

-10-

The prototype of our new 3-port hybrid converter may not provide the results we expect, may prove to be too expensive to produce and market, or may uncover problems of which we are currently not aware, any of which could harm our business and prospects.

We are currently building a prototype of a 3-port hybrid converter, which is an integrated solar PV inverter and battery charger/inverter, based on improvements to our current PV inverter products. We do not yet know if the prototype will produce positive results consistent with our expectations. The prototype may also cost significantly more than expected, and the prototype design and construction process may uncover problems of which we are currently not aware. These and other prototypes of emerging products are a material part of our business plan, and if they are not proven to be successful, our business and prospects could be harmed.

We expect to license our technology in the future; however the terms of these agreements may not prove to be advantageous to us. If the license agreements we enter into do not prove to be advantageous to us, our business and results of operations will be adversely affected.

Ultimately, our goal is to license our technology to our customers. However, we may not be able to secure license agreements with customers on terms that are advantageous to us. Furthermore, the timing and volume of revenue earned from license agreements will be outside of our control. If the license agreements we enter into do not prove to be advantageous to us, our business and results of operations will be adversely affected.

We have not devoted significant resources towards the marketing and sale of our products and we continue to rely on the marketing and sales efforts of third parties whom we do not control.

To date, we have sold only our solar PV inverter and battery converter products and, even after adding industry veterans to our staff, we continue to experience a learning curve in the marketing and sale of products on a commercial basis. We expect that the marketing and sale of these products will continue to be conducted by a combination of independent manufacturers’ representatives, third-party strategic partners, distributors, or OEMs. Consequently, commercial success of our products will depend to a great extent on the efforts of others. We have entered and intend to continue entering into strategic marketing and distribution agreements or other collaborative relationships to market and sell our solar PV inverter, battery converter and other value added products. However, we may not be able to identify or establish appropriate relationships in the near term or in the future. We can give no assurance that these distributors or OEMs will focus adequate resources on selling our products or will be successful in selling them. In addition, third-party distributors or OEMs have or may require us to provide volume price discounts and other allowances, customize our products or provide other concessions that could reduce the potential profitability of these relationships. Failure to develop sufficient distribution and marketing relationships in our target markets will adversely affect our commercialization schedule and to the extent we have entered or enter into such relationships, the failure of our distributors and other third parties to assist us with the marketing and distribution of our products, or to meet their monetary obligations to us, may adversely affect our financial condition and results of operations.

A material part of our success depends on our ability to manage our suppliers and manufacturers. Our failure to manage our suppliers and manufacturers could materially and adversely affect our results of operations and relations with our customers.

We rely upon suppliers to provide the components necessary to build our products and on contract manufacturers to produce our products. There can be no assurance that key suppliers and manufacturers will provide components or products in a timely and cost efficient manner or otherwise meet our needs and expectations. Our ability to manage such relationships and timely replace suppliers and manufacturers, if necessary, is critical to our success. Our failure to timely replace our contract manufacturers and suppliers, should that become necessary, could materially and adversely affect our results of operations and relations with our customers.

-11-

We may in the future add production capabilities that would subject us to numerous additional risks and could adversely affect our business, financial condition, results of operations and prospects.

We currently rely on third parties to produce our products, but we may in the future add production capabilities and produce products ourselves. Adding production to our operations would subject us to numerous additional risks, including:

|

·

|

the need to use significant capital resources for equipment purchases;

|

|

·

|

increases to our operating expenses to add personnel and expertise to effectively and efficiently manufacture products;

|

|

·

|

inaccurate estimates of customer demand for our products and the resources needed to meet customer demand; and

|

|

·

|

diversion of management’s attention from other aspects of our business.

|

If we expand our business to produce our own products, we cannot assure you that we will be able to produce our products in a profitable manner or at all. If we add production capabilities and any of the risks above are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Our business is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flows in the future. We will require additional financing in order to sell our current products and to continue the research and development required to produce our next generation of products. We anticipate that we will need approximately $5 million during the next 12 months to sustain our business operations, including our research and development activities. We may not be able to obtain financing on commercially reasonable terms or at all. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

In conjunction with an award we received through the State of Texas, we have granted the Office of the Governor, Economic Development and Tourism (“OOGEDT”), a security interest in all of our assets. If we breach the award agreement and do not repay the award funds, the OOGEDT will be entitled to exercise its right to foreclose on our assets. If that were to happen, your investment would become worthless.

On October 1, 2010, we received a Texas Emerging Technology Fund Award in the amount of $1 million through the Office of the Governor, Economic Development and Tourism (“OOGEDT”). If we are in breach of the terms of the award because, for example, we move our operations to a jurisdiction other than Texas, we fail to continue our business, or because the Office of the Governor finds that we made false or misleading statements to the OOGEDT to induce that office to make the award, the OOGEDT may demand repayment of the award funds that have been disbursed, which currently total $1,152,690 as of March 31, 2013. The OOGEDT has taken a security interest in our assets to secure the repayment of the funds in the event that we breach the terms of the award. If we breach the terms of the award and fail to repay the award funds, the OOGEDT would be entitled to exercise its right to foreclose on our assets. If that were to happen, your investment would become worthless.

The economic downturn in the United States has adversely affected, and is likely to continue affecting, our ability to raise capital, which may potentially impact our ability to continue our operations.

As a company that is still in the process of developing its technology, we must rely on raising funds from investors to support our research and development activities and our operations. The economic downturn in the United States has resulted in a tightening of the credit markets, which has made it more difficult to raise capital. If we are unable to raise funds as and when we need them, we may be forced to curtail our operations or even cease operating altogether.

-12-

We are subject to credit risks.

Some of our customers may experience financial difficulties and/or may fail to meet their financial obligations to us. As a result, we may incur charges for bad debt provisions related to some trade receivables. In certain cases where our end customers utilize contract manufacturers or distributors, our accounts receivable risk may lie with the contract manufacturer or distributor and may not be guaranteed by the end customer. In addition, in connection with the growth of the renewable energy market, we are gaining a substantial number of new customers, some of which have relatively short histories of operations or are newly formed companies. As a result, it is difficult to ascertain financial information in order to appropriately extend credit to these customers. Further, the volatility in the renewable energy market may put additional pressure on our customers’ financial positions, as they may be required to respond to large swings in revenue. The renewable energy industry has also seen an increasing amount of bankruptcies and reorganizations as the availability of financing has diminished.

If customers fail to meet their financial obligations to us, or if the assumptions underlying our recorded bad debt provisions with respect to receivables obligations do not accurately reflect our customers’ financial conditions and payment levels, we could incur write-offs of receivables in excess of our provisions, which could have a material adverse effect on our cash flow and operating results.

We may not be able to control our warranty exposure, which could increase our expenses.

We currently offer and expect to continue to offer a warranty with respect to our power converters and we expect to offer a warranty with each of our future product applications. If the cost of warranty claims exceeds any reserves we may establish for such claims, our results of operations and financial condition could be adversely affected.

We may be exposed to lawsuits and other claims if our products malfunction, which could increase our expenses, harm our reputation and prevent us from growing our business.

Any liability for damages resulting from malfunctions of our products could be substantial, increase our expenses and prevent us from growing or continuing our business. Potential customers may rely on our products for critical needs, such as backup power. A malfunction of our products could result in warranty claims or other product liability. In addition, a well-publicized actual or perceived problem could adversely affect the market’s perception of our products. This could result in a decline in demand for our products, which would reduce revenue and harm our business. Further, since our products are used in devices that are made by other manufacturers, we may be subject to product liability claims even if our products do not malfunction.

We are highly dependent on certain key members of our executive management team. Our inability to retain these individuals could impede our business plan and growth strategies, which could have a negative impact on our business and the value of your investment.

Our ability to implement our business plan depends, to a critical extent, on the continued efforts and services of Paul Bundschuh (Chief Executive Officer) and William Alexander (Chief Technology Officer). If we lose the services of either of these persons, we would likely be forced to expend significant time and money in the pursuit of replacements, which may result in a delay in the implementation of our business plan and plan of operations. We can give no assurance that we could find satisfactory replacements for these individuals on terms that would not be unduly expensive or burdensome to us. We do not currently carry a key-man life insurance policy that would assist us in recouping our costs in the event of the death or disability of either of these executives.

Any failure by management to properly manage our expected rapid growth could have a material adverse effect on our business, operating results and financial condition.

If our business develops as expected, we anticipate that we will grow rapidly in the near future. Our failure to properly manage our expected rapid growth could have a material adverse effect on our ability to retain key personnel. Our expansion could also place significant demands on our management, operations, systems, accounting, internal controls and financial resources. If we experience difficulties in any of these areas, we may not be able to expand our business successfully or effectively manage our growth. Any failure by management to manage growth and to respond to changes in our business could have a material adverse effect on our business, financial condition and results of operations.

-13-

Risks Relating to the Industry

Our industry is intensely competitive. We cannot guarantee you that we can compete successfully.

Our business is highly competitive. We will be competing against providers of power converter systems that are highly established and have substantially greater manufacturing, marketing, management and financial resources including very substantial market position and name recognition. The competitors for our PV inverter products include ABB, Advanced Energy, Satcon, SMA and Chint Solar. All aspects of our business, including pricing, financing and servicing, as well as the general quality, efficiency and reliability of our products, are significant competitive factors. Our ability to successfully compete with respect to each of these factors is material to the acceptance of our products and our future profitability. In addition, the solar power industry may tend to be resistant to change and to new products from suppliers that are not major names in the field. Our competitors will use their established position to their competitive advantage. If our innovations are successful, our competitors may seek to adopt and copy our ideas, designs and features. Our competitors may develop or offer technologies and products that may be more effective or popular than our products and they may be more successful in marketing their products than we are in marketing ours. Pricing competition could result in lower margins for our products.

We expect to compete on the basis of our products’ significantly lower cost, smaller footprint, and higher efficiency. Technological advances in alternative energy products or other power converter technologies may negatively affect the development of our products or make our products non-competitive or obsolete prior to commercialization or afterwards.

We cannot assure you that we will be able to compete successfully in our markets, or compete effectively against current and new competitors as our industry continues to evolve.

The reduction or elimination of government subsidies and economic incentives for energy-related technologies could harm our business.

We believe that near-term growth of energy-related technologies, including power converter technology, relies on the availability and size of government and economic incentives and grants (including, but not limited to, the U.S. federal Investment Tax Credit and various state and local incentive programs). These incentive programs could be challenged by utility companies, or for other reasons found to be unconstitutional, and/or could be reduced or discontinued for other reasons. The reduction, elimination, or expiration of government subsidies and economic incentives could delay the development of our technology and harm our business.

Changes to the National Electrical Codes could adversely affect our technology and products.

Our products are installed by system integrators that must meet National Electrical Codes, including using equipment that meets industry standards such as UL1741. The NEC standards address the safety of these systems. The NEC standards, as well as the UL1741 and IEEE1547 requirements continue to evolve and are subject to change. If we respond to these changing standards and requirements more slowly than our competitors or if we are unable to meet new standards and requirements, our products will be less competitive.

New technologies in the alternative energy industry may supplant solar PV inverter devices, including our current products for which we have patents and pending patent applications, which would harm our business and operations.

The alternative energy industry is subject to rapid technological change. Our future success will depend on the cutting edge relevance of our technology, and thereafter on our ability to appropriately respond to changing technologies and changes in function of products and quality. If new technologies supplant our power converter technology, our business would be adversely affected and we will have to revise our plan of operation.

-14-

Businesses, consumers, and utilities might not adopt alternative energy solutions as a means for providing or obtaining their electricity and power needs.

On-site distributed power generation solutions that utilize our inverter products (such as photovoltaic systems), provide an alternative means for obtaining electricity and are relatively new methods of obtaining electrical power. There is a risk that businesses, consumers, and utilities may not adopt these new methods at levels sufficient to grow our business. Traditional electricity distribution is based on the regulated industry model whereby businesses and consumers obtain their electricity from a government regulated utility. For alternative methods of distributed power to succeed, businesses, consumers and utilities must adopt new purchasing practices and must be willing to rely upon less traditional means of providing and purchasing electricity. As larger solar projects come online, utilities are becoming increasingly concerned with grid stability, power management and the predictable loading of such power onto the grid.

We cannot be certain that businesses, consumers, and utilities will choose to utilize on-site distributed power at levels sufficient to sustain our business. The development of a mass market for our products may be impacted by many factors which are out of our control, including:

|

·

|

market acceptance of photovoltaic systems that incorporate our products;

|

|

·

|

the cost competitiveness of these systems;

|

|

·

|

regulatory requirements; and

|

|

·

|

the emergence of newer, more competitive technologies and products.

|

If a mass market fails to develop or develops more slowly than we anticipate, we may be unable to recover the costs we will have incurred to develop these products.

The industries in which we compete are subject to volatile and unpredictable cycles.

As a supplier to the solar, grid storage, electrified vehicle charging infrastructure, wind, electric motor and related industries, we are subject to business cycles, the timing, length, and volatility of which can be difficult to predict. These industries historically have been cyclical due to sudden changes in customers’ manufacturing capacity requirements and spending, which depend in part on capacity utilization, demand for customers’ products, inventory levels relative to demand, and access to affordable capital. These changes have affected the timing and amounts of customers’ purchases and investments in technology, and affect our orders, net sales, operating expenses, and net income. In addition, we may not be able to respond adequately or quickly to the declines in demand by reducing our costs. We may be required to record significant reserves for excess and obsolete inventory as demand for our products changes.

To meet rapidly changing demand in each of the industries we serve, we must effectively manage our resources and production capacity. During periods of decreasing demand for our products, we must be able to appropriately align our cost structure with prevailing market conditions, effectively manage our supply chain, and motivate and retain key employees. During periods of increasing demand, we must have sufficient manufacturing capacity and inventory to fulfill customer orders, effectively manage our supply chain, and attract, retain, and motivate a sufficient number of qualified individuals. If we are not able to timely and appropriately adapt to changes in our business environment or to accurately assess where we are positioned within a business cycle, our business, financial condition, or results of operations may be materially and adversely affected.

Risks Related to this Offering and Owning Our Common Stock

Prior to the completion of our initial public offering, there was no public trading market for our common stock.

The offering under this prospectus is an initial public offering of our securities. Prior to the closing of the offering, there will have been no public market for our common stock. While we plan to list our common stock on the Nasdaq Capital Market, we cannot assure you that our listing application will be approved, and that a public market for our common stock will develop. If our Nasdaq listing application is not approved, we will not complete the offering.

-15-

We are an "emerging growth company" under the JOBS Act of 2012 and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. At present, we do not intend to take advantage of these exemptions, other than as they apply to all other “smaller reporting companies,” though we may do so at some point in the future. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company,” we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our reporting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

If a public market for our common stock develops, it may be volatile. This may affect the ability of our investors to sell their shares as well as the price at which they sell their shares.

If a market for our common stock develops, the market price for the shares may be significantly affected by factors such as variations in quarterly and yearly operating results, general trends in the alternative energy industry, and changes in state or federal regulations affecting us and our industry. Furthermore, in recent years the stock market has experienced extreme price and volume fluctuations that are unrelated or disproportionate to the operating performance of the affected companies. Such broad market fluctuations may adversely affect the market price of our common stock, if a market for it develops.

Conversion of the Convertible Notes together with the exercise of outstanding warrants will result in substantial dilution to the investors in this offering.

Prior to the completion of this offering, we will have outstanding approximately $6.1 million in Convertible Notes with interest accrued, for the purpose of this discussion, through March 31, 2013. The Convertible Notes will be paid with 1,682,606 shares of our common stock. An additional 1,519,095 shares of our common stock may be purchased through the exercise of warrants and a right to purchase issued to the Office of the Governor, Economic Development and Tourism, in conjunction with the award we received from the Texas Emerging Technology Fund. Conversion of the notes and, if it occurs, exercise of all of the warrants, will result in substantial dilution to the investors in this offering.

-16-

We are required to register the shares of common stock underlying our senior secured convertible promissory notes and the warrants that were issued with them. The sale of these shares could cause the market price of our common stock to decline.

We have granted registration rights to the holders of our senior secured convertible promissory notes. Registration of the 1,370,267 shares of common stock underlying our senior secured convertible promissory notes and the 791,080 shares of common stock underlying the warrants issued with them could have the effect of driving down the price of our common stock in the market.

We have the right to issue shares of preferred stock. If we were to issue preferred stock, it is likely to have rights, preferences and privileges that may adversely affect the common stock.

We are authorized to issue 10,000,000 shares of “blank check” preferred stock, with such rights, preferences and privileges as may be determined from time-to-time by our board of directors. Our board of directors is empowered, without stockholder approval, to issue preferred stock in one or more series, and to fix for any series the dividend rights, dissolution or liquidation preferences, redemption prices, conversion rights, voting rights, and other rights, preferences and privileges for the preferred stock. No shares of preferred stock are presently issued and outstanding and we have no immediate plans to issue shares of preferred stock. The issuance of shares of preferred stock, depending on the rights, preferences and privileges attributable to the preferred stock, could adversely reduce the voting rights and powers of the common stock and the portion of the Company’s assets allocated for distribution to common stockholders in a liquidation event, and could also result in dilution in the book value per share of the common stock we are offering. The preferred stock could also be utilized, under certain circumstances, as a method for raising additional capital or discouraging, delaying or preventing a change in control of the Company, to the detriment of the investors in the common stock offered hereby. We cannot assure you that we will not, under certain circumstances, issue shares of our preferred stock.

We have not paid dividends in the past and have no immediate plans to pay dividends.

We plan to reinvest all of our earnings, to the extent we have earnings, in order to market our products and to cover operating costs and to otherwise become and remain competitive. We do not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot assure you that we would, at any time, generate sufficient surplus cash that would be available for distribution to the holders of our common stock as a dividend. Therefore, you should not expect to receive cash dividends on the common stock we are offering.

Management of our Company is within the control of the board of directors and the officers. You should not purchase our common stock unless you are willing to entrust management of our Company to these individuals.