IDEAL POWER INC.

September 17, 2013

VIA EDGAR

Ms. Amanda Ravitz, Assistant Director

Securities and Exchange Commission

Washington, D.C. 20549

Re: Ideal Power Inc.

Registration Statement on Form S-1

Filed August 6, 2013

File No. File No. 333-190414

Dear Ms. Ravitz:

This letter is in response to your letter dated August 30, 2013 to Ideal Power Inc. (the “Company”) regarding the Company’s Registration Statement on Form S-1 (the “Registration Statement”). For your ease of reference, we have repeated the comments included in your letter immediately above each response. In conjunction with this letter, the Company is providing amendment number 1 to the Registration Statement (the “Amendment”) for your review.

Prospectus Cover

1. Please revise the cover page to disclose your relationship with MDB Capital Group.

We have revised the cover page as you requested.

2. We note your disclosure that this is a firm commitment offering. Certain of disclosure throughout suggests a different arrangement, however. For example, we note disclosure on page 4 that you will terminate the offering if you fail to raise $10 million, which seems inconsistent with a firm commitment to take or pay for a certain number of shares. Please revise to clarify the underwriting arrangement.

We have revised the disclosure throughout to make clear that the offering is a firm commitment offering. Please see the prospectus cover page and pages 5, 6, 8, 20 and 51 of the Amendment.

3. Please define or remove technical terms and other jargon so that your document can be understood by an investor not in your industry. Examples include “topology,” “utility dispatchable PV,” “reference product,” “PV inverter,” and “distributed storage.” It may also be useful to include a brief introductory explanation of where your product fits into the electric power market. For example, is it a consumer or industrial product? Which types of OEMs might be interested in using your product?

We revised the disclosure throughout the Amendment, as you requested. We deleted all references to “topology,” “utility dispatchable PV” and “reference product.” We revised the disclosure to explain what a “PV inverter” and “distributed storage” are. We also provided a brief introductory explanation of the industry and where our products fit into the industry. Please see the discussion titled “About Ideal Power Inc.” at page 1 of the Amendment.

4. Please provide us support for the market and industry data that you cite in the sections entitled “Our Proprietary Technology” on page 2 and “Our Target Markets” on pages 3 and 4. Clearly mark the material you provide to identify the data you cite in your document, and tell us whether you commissioned any of the data disclosed in your prospectus.

We have included with this letter documents supporting the market and industry data together with an index that includes each statement for which support is provided and the location of the supporting information. The Company did not commission any of the data disclosed in the prospectus.

5. Please provide us support for your statements regarding your leadership throughout the prospectus, such as your statements about leadership in the first and last paragraphs on page 21 of the prospectus.

We have deleted all references regarding our leadership with the exception of the first sentence in the discussion of our business on page 23 of the Amendment.

Our Proprietary Technology, page 2

6. Please provide us with support for your claims in the bullet points in this section about best-of-class safety, greater efficiency and greater reliability. In addition, where you provide statistics, please explain what they mean. For example, what does 96% efficiency mean?

As noted in our response to comment number 4, we have included with this letter documents supporting the market and industry data together with an index that includes each statement for which support is provided and the location of the supporting information. We have also revised the disclosure as you requested. Please see pages 3 and 25 of the Amendment.

7. Please expand the disclosure in the first bullet point on page 3 about “uses below 10kW to over 1MW” to briefly provide examples of the types of uses at the low and high end of the range so that the uses at either end of the range can be understood by an investor not in your industry.

We have revised the disclosure as you requested. Please see page 3 of the Amendment.

8. We note the disclosure in the last sentence of this section about a government grant. Please expand the appropriate section to disclose, if applicable, any rights that the government has to your technology and patents.

We have revised the disclosure to include information about the rights of the government to our technology and patents. Please see pages 4, 26 and 27 of the Amendment.

9. We note the disclosure in the last sentence of this section about developing and commercializing power switches and the disclosure in the second paragraph on page 3 that you are in the process of developing two more reference products. Please expand the sections entitled “Plan of Operation” and “Business” to clearly discuss each step you must take to reach commercialization of your proposed products and your estimated capital needed to achieve each product. For example, you disclose on pages 3 and 24 that the bi-directional insulated gate bipolar transistor is being funded partially by a $2.5 million grant. However, you do not mention the total capital needed to achieve that product or the two other products mentioned on page 24.

We have revised the disclosure in the “Overview” discussion included in Management’s Discussion and Analysis of Financial Condition and Results of Operations and in the “Business” discussion, as you requested. Please see pages 27, 28 and 38 of the Amendment.

Our Business Model, page 3

10. Please expand the disclosure in the fifth sentence of this section to disclose the number of companies that have purchased your products. In addition, explain to us why you chose the customer names you included here. In this respect, please note that we do not consider name recognition to be a sufficient basis for identifying a customer in your disclosure.

We have revised the disclosure as you requested. Please see page 4 of the Amendment.

Our Target Markets, page 3

11. Refer to the first bullet point under this heading. It is not clear why the rapid decline in the cost of solar cells causes growth in the PV inverter market or helps your business. Please revise to clarify.

We have revised the disclosure as you requested. Please see page 4 of the Amendment.

12. Please eliminate disclosure that appears to be marketing. For example, we note the disclosure in this section about “dozens of markets that could benefit” and the “strength of the PPSA value proposition for those markets.”

We have revised the disclosure throughout the Amendment to eliminate a marketing emphasis.

13. Please expand the disclosure in the appropriate section of your filing to clarify your relationship with the U.S. Department of Defense and NRG Energy. In this regard, we note that you mention in the third bullet point of this section that the U.S. Department of Defense and NRG Energy are your “partners.”

We have revised the disclosure to delete the word “partners.” Our significant relationships are described at page 34 of the Amendment. We have also included additional information regarding NRG Energy at pages 5 and 33.

Status as an Emerging Growth Company, page 4

14. Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering.

The Company has not entered into any “testing the waters” activities and has not communicated with any potential investors in reliance on Section 5(d) of the Securities Act. To our knowledge, there have been no research reports about the Company published or distributed in reliance on Section 2(a)(3) of the Securities Act.

Please clarify that despite opting out of Section 102(b)(1) of the JOBS Act, you may still take advantage of all of the other provision of that Act.

We have revised the disclosure as you requested. Please see page 6 of the Amendment.

The Offering, page 6

15. We note that you disclose that you intend to use some proceeds for “existing product development and commercialization,” “protection of [y]our intellectual property” and “general corporate purposes.” However, on page 57 you state that you intend to use some proceeds for the “development of existing products, including product and equipment purchases,” “patent filings and the protection of intellectual property” and “working capital and general corporate purposes.” Please reconcile.

We have reconciled the disclosure as you requested. Please see pages 8, 38 and 65 of the Amendment.

To date we have had a limited number of customers, page 10

16. Please expand the disclosure in this risk factor to quantify the percentage of your net revenues in the fiscal year ended December 31, 2012 from the Department of Energy and Lockheed Martin, respectively. Also, expand the disclosure to quantify the percentage of your net revenues in the fiscal year ended December 31, 2011 from Lockheed Martin and Meridian Solar, respectively.

We have revised the disclosure as you requested. Please see page 12 of the Amendment.

17. If your revenues in the last two years from Lockheed Martin were received in connection with your agreements entered into in 2009 and you do not expect any additional revenues from these agreements, expand the disclosure in this risk factor and in your section entitled “Plan of Operation” to discuss the lack of future revenues from agreements with Lockheed Martin. In this regard, we note the disclosure in the last paragraph on page 28 about your agreements with Lockheed Martin.

We have revised the disclosure as you requested. Please see pages 12 and 41 of the Amendment.

18. If your grant revenues from the Department of Energy in the fiscal year ended December 31, 2012 and in the quarter ended March 31, 2013 represent substantially all of your revenues that you expect to receive from the grants from that agency mentioned in the third paragraph on page 29, expand the disclosure in this risk factor and in your section entitled “Plan of Operation” to discuss the lack of future revenues from those two grants from that agency.

We will continue to receive funds under the ARPA-E grant. Please see pages 34 and 39 of the Amendment.

We have not devoted significant resources toward the marketing and sale, page 11

19. Please expand the disclosure in the appropriate section of your filing to discuss the material terms of your strategic marketing and distribution agreements mentioned in this risk factor.

We have not entered into any strategic marketing or material distribution agreements at this time. We have revised the risk factor to clarify this. Please see page 13 of the Amendment.

Business Strategy, page 23

20. Since you do not appear to have sold any 30kW hybrid converters, 30kW micro-grid converters and bidirectional insulated gate transistors, please revise throughout to remove claims about the characteristics of these product or their benefits, or revise to indicate that they represent management's belief. Examples include the disclosure on page 24 about “charging systems with greater energy and cost efficiency,” the disclosure in Figure 5 on page 24 of the incremental benefits of BD-IGBT implementation, the disclosure on page 27 about a “lower cost, more efficient integrated solution” and the disclosure on page 28 about the product “should perform at lower cost and higher efficiency.”

We have revised the disclosure throughout the discussion of the business, as you requested.

Intellectual Property, page 24

21. We note the reference in this section to a “proven ideation process.” Please provide us support for your statement about a “proven” process. Also, please briefly explain the phrase “ideation process.”

We have revised the disclosure in this section to delete this phrase.

22. Please disclose the duration of your material patents.

We have revised the disclosure to include this information. Please see page 29 of the Amendment.

Revenue Recognition, page 33

23. We note that you have been awarded two significant grants from the U.S. Department of Energy and have received approximately $1.0 million in revenue to fund long-term research and next generation product development. Please revise to describe how you recognize revenue from grants. Describe how the revenue is earned and how you determine the timing for revenue recognition.

We have revised the disclosure as you requested. Please see page 39.

24. As a related matter, please clarify if the grants are for the reimbursement of costs and how you determined that grants are appropriately classified as revenue rather than netted against related expenses incurred. Please also clarify where you record expenses related to grant revenue in the statement of operations. We reference your disclosure on page F-7 that government grants are agreements that generally provide the company with cost reimbursement for certain type of research and development activities over a contractually defined period.

Our historic policy has been to recognize monies received from government research grants as a component of revenue in our statement of operations. We believe that one of our important business strategies is to build governmental awareness of our solutions that may reduce dependence on fossil fuel and improve grid resiliency. Performance of research and development activities under government grants represents a core strategy to the growth of our operations. Throughout our history, we have been able to supplement our research with U.S. government grants, including approximately $1.2 million in grant funds that remain available at June 30, 2013.

U.S. GAAP provides limited guidance on the accounting for government grants by for-profit companies. IAS 20 recognizes that there are two broad approaches for accounting for government grants: the income approach or the capital approach. We have assessed the nature of the grants and have determined to recognize grant receipts under the income approach, classifying the proceeds as revenue, as that best represents the economics of the arrangements. In following this policy, we adhere to the guidance of Statement of Financial Concepts No. 6, Elements of Financial Statements, paragraphs 78 — 79 (“CON 6”). Performing research and development activities under government grants has historically represented a major and central aspect of the Company’s ongoing operations as defined by CON 6 and therefore grant funds have been consistently recorded as revenue.

Expenses related to grant revenue are expensed under cost of revenues.

Stock-Based Compensation, page 33

25. Please revise to disclose how you determined each of the assumptions required in valuing stock options. In discussing how you determined the fair value of your common stock, disclose the following:

|

·

|

The aggregate intrinsic value of all outstanding options based on the midpoint of the estimated IPO price range. Please make sure to use the pre-reverse stock split IPO price.

|

|

·

|

Discuss the significant factors, assumptions and methodologies used in determining fair value for those options granted during the twelve months prior to the date of the most recent balance sheet.

|

|

·

|

Discuss each significant factor contributing to the difference between the fair value as of the date of grant and the estimated IPO price for options granted during the twelve months prior to the date of the most recent balance sheet.

|

|

·

|

Disclose the valuation method used and the reasons why you choose that method.

|

We have revised the disclosure as you requested. Please note that the common stock will be sold at $5.00 per share, so there is no mid-point. Furthermore, there were no option grants made during the 12 months prior to June 30, 2013. We used the Black Scholes pricing model, which we believe is the most commonly used valuation method, to determine the estimated fair value of our stock options. Please see page 40 of the Amendment.

26. Please also revise to include disclosure about how you value common stock issued for services and common stock warrants issued for consulting services.

We have revised the disclosure as you requested. Please see page 40 of the Amendment.

Convertible Promissory Notes and Warrants, page 34

27. Please revise to disclose the significant assumptions used to value warrants issued in connection with debt arrangements, including how you determined the estimated fair value of your common stock used in the valuation.

We have revised the disclosure as you requested. As we noted in our response to comment 25, we used the Black Scholes pricing model to determine the estimated fair value of our common stock. The assumptions used for the model were the same as the assumptions used to value the stock options. Please see page 40 of the Amendment.

Results of Operations, page 34

28. Please revise to discuss the reasons for the significant increase in grant revenue in fiscal 2012. Please also further discuss the significant decline in contract revenues from Lockheed Martin in fiscal 2012.

We have revised the disclosure as you requested. Please see pages 41 and 42 of the Amendment.

29. Please revise to discuss why general and administrative expense increased from the three months ended March 31, 2012 to March 31, 2013. Please also further discuss the reason for the significant increase in general and administrative expenses for fiscal 2012 compared to 2011 and clarify the nature of the significant increase in business consulting and legal services.

We have revised the disclosure as you requested. Please see pages 41 and 42 of the Amendment.

Capitalization, page 57

30. Please provide us the adjustments used to determine the “as adjusted for the effect of the reverse split, debt conversion and issuance of shares to directors” in the Capitalization table on page 58. In addition, provide a reconciliation of the “as adjusted” amounts in the table to the amounts in the balance sheets on page F-1.

Column 3 of the capitalization table takes into consideration the following: (i) $3,601,212 in convertible debt and (ii) common stock with a value of $87,497 to be issued to our directors for services provided to us. $1,740 is included as common stock at $0.001 par value and the remainder is included in paid-in-capital. Included in the promissory note issued to our legal counsel is $93,074 in third quarter legal expense that has not been accrued. This additional cost is charged to accumulated deficit in total stockholders equity.

Column 4 takes into consideration the net proceeds of our offering of 2,500,000 shares of common stock having a par value of $0.001 per share. We estimate the net proceeds will be $10,467,000. $2,500 is included as common stock at $0.001 par value and the remainder of $10,464,500 is included in paid-in-capital. As noted above, additional legal expense of $93,074 accrued after June 30, 2013 has been incorporated into the last two columns of the capitalization table.

Dilution, page 59

31. Please revise to disclose how the data in the table on page 59 would change assuming the exercise of all warrants and options.

We have revised the disclosure as you requested. Please see page 67 of the Amendment.

Financial Statements

32. Please update the financial statements when required by Rule 8-08 of Regulation S-X.

Condensed Financial Statements for the three months ended March 30, 2013

We have included the interim financial statements for the six months ended June 30, 2013, as required by Rule 8-08 of Regulation S-X.

Condensed Balance Sheets, page F-1

33. Please revise to separately identify outstanding debt that is convertible.

We have revised the balance sheet as you requested. Please see page F-1 of the Amendment.

Condensed Statement of Operations, page F-2

34. Please revise to disclose the pro forma net loss per share assuming the reverse stock split that you will effect after the effectiveness of the registration statement.

We have revised the statement of operations as you requested. Please see page F-2 of the Amendment.

Note 6. Patents, page F-10

35. We reference the disclosure that you have capitalized $426,000 for costs related to patents that have not been awarded. Please tell us the nature of the costs capitalized as patent assets. In addition, please tell us the basis in U.S. GAAP for capitalizing costs to obtain patents. We reference FASB ASC 350-30 which states that the costs of internally developing other intangible assets, such as those that are specifically identifiable, are expensed as incurred, unless other specific guidance calls for capitalization of those costs.

The costs that are capitalized are third party legal costs and filing fees associated with obtaining patents on our new inventions. We believe the costs capitalized have future value. Because the costs we capitalize have future value, they are capitalized under the guidance of Statement of Financial Accounting Concepts, Number 5, Recognition and Measurement in Financial Statements of Business Enterprises. In accordance with FASB ASC 350-30, none of the internal costs of internally developing the patents have been capitalized.

Note 9. Common and Preferred Stock, page F-14

36. Please explain to us the basis in U.S. GAAP for your accounting for the 29,680 shares of common stock for services that have not been issued. If the services have been performed, explain to us why the related expense is not recorded within net loss on the statement of operations.

We have revised the disclosure in note 9 to reflect that the service was expensed as performed. The 29,680 shares valued at $43,333 were recognized as a cost and expensed in Operating Expenses – General and Administrative, and more specifically under Stock Compensation Expense. The footnote has been changed accordingly. As of June 30, 2013 that number increased to 59,930 shares for a total expense of $87,497. Note that the 59,930 shares are pre-split shares; the number of shares after giving effect to the one-for-2.381 reverse split is 25,170 shares.

37. As a related matter, revise to disclose how you determined the fair value of common stock to be issued in connection with services rendered of $43,333.

We have revised note 9 to the financial statements for June 30, 2013 as you requested. Please see page F-14.

Exhibit 23.1. Consent of Independent Registered Public Accounting Firm

38. To the extent there is a delay in requesting effectiveness of your registration statement, or there is any change, other than typographical, made to the financial statements, or there have been intervening events since the prior filing that are material to the company, please provide a currently dated and signed consent from your independent accountant with your next amendment.

We have included a currently dated and signed consent from our independent accountant, as you requested.

In responding to your comments, the Company acknowledges that:

|

·

|

should the Commission or the staff, acting pursuant to delegated authority, declare the filing effective, it does not foreclose the Commission from taking any action with respect to the filing;

|

|

·

|

the action of the Commission or the staff, acting pursuant to delegated authority, in declaring the filing effective, does not relieve the company from its full responsibility for the adequacy and accuracy of the disclosure in the filing; and

|

|

·

|

the Company may not assert staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

We hope that this letter has adequately addressed your comments. If you have additional comments or questions, please contact Kevin Friedmann, Esq. via e-mail at kfriedmann@richardsonpatel.com or by telephone at (212) 561-5559.

Very truly yours,

IDEAL POWER INC.

By:/s/ Paul Bundschuh

Paul Bundschuh

Chief Executive Officer

IDEAL POWER INC.

SUPPORTING DOCUMENTATION INDEX

TO RESPONSE TO

SECURITIES AND EXCHANGE COMMISSION (“SEC”) COMMENT LETTER

|

Re:

|

Ideal Power Inc. (the “Company”)

Registration Statement on Form S-1

Filed August 6, 2013

File No. 333-190414

|

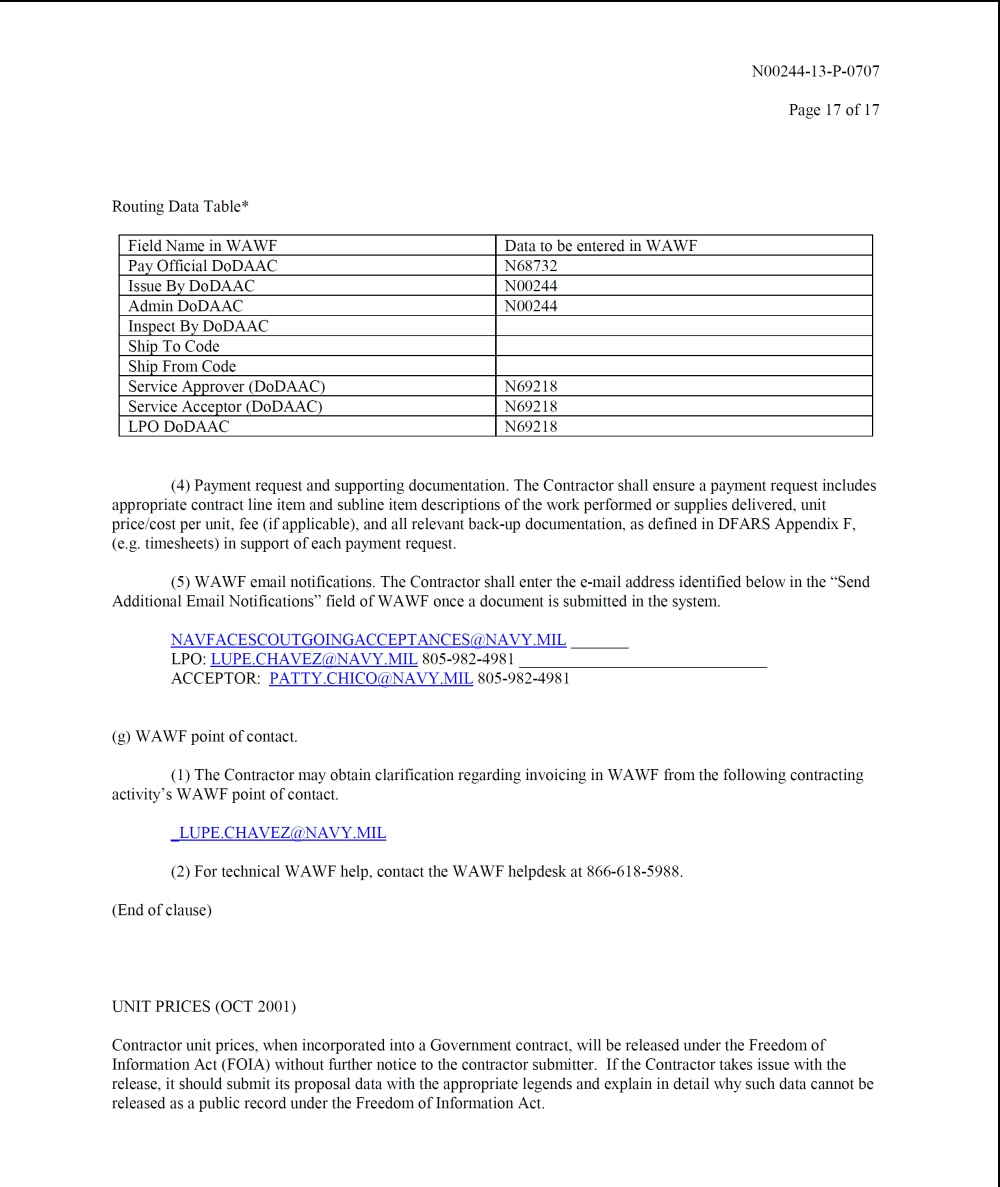

This information is provided in response to certain comments contained in the SEC staff’s letter to the Company, dated August 30, 2013 (the “Comment Letter”), concerning the above referenced registration statement (the “Original S-1”), which request additional support for certain statements in the Original S-1. The table below cites the name and reference number of the document(s) that provide(s) support for the applicable statement in the Company’s Original S-1. For convenience of reference, (i) the comments from the Comment Letter requesting additional support are repeated below and the number beside each comment corresponds to the comment number in the Comment Letter and (ii) each reference number cited below corresponds to the document number within the attached PDF entitled “Supporting Documentation.”

|

SEC

Comment

|

S-1

Page #

|

S-1 Statement

|

Supporting Documentation

|

|

Located in Prospectus Summary

|

|

4. Please provide us support for the market and industry data that you cite in the sections entitled “Our Proprietary Technology” on page 2 and “Our Target Markets” on page 3 and 4. Clearly mark the material you provide to identify the data you cite in your document, and tell us whether you commissioned any of the data disclosed in your prospectus.

|

2

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

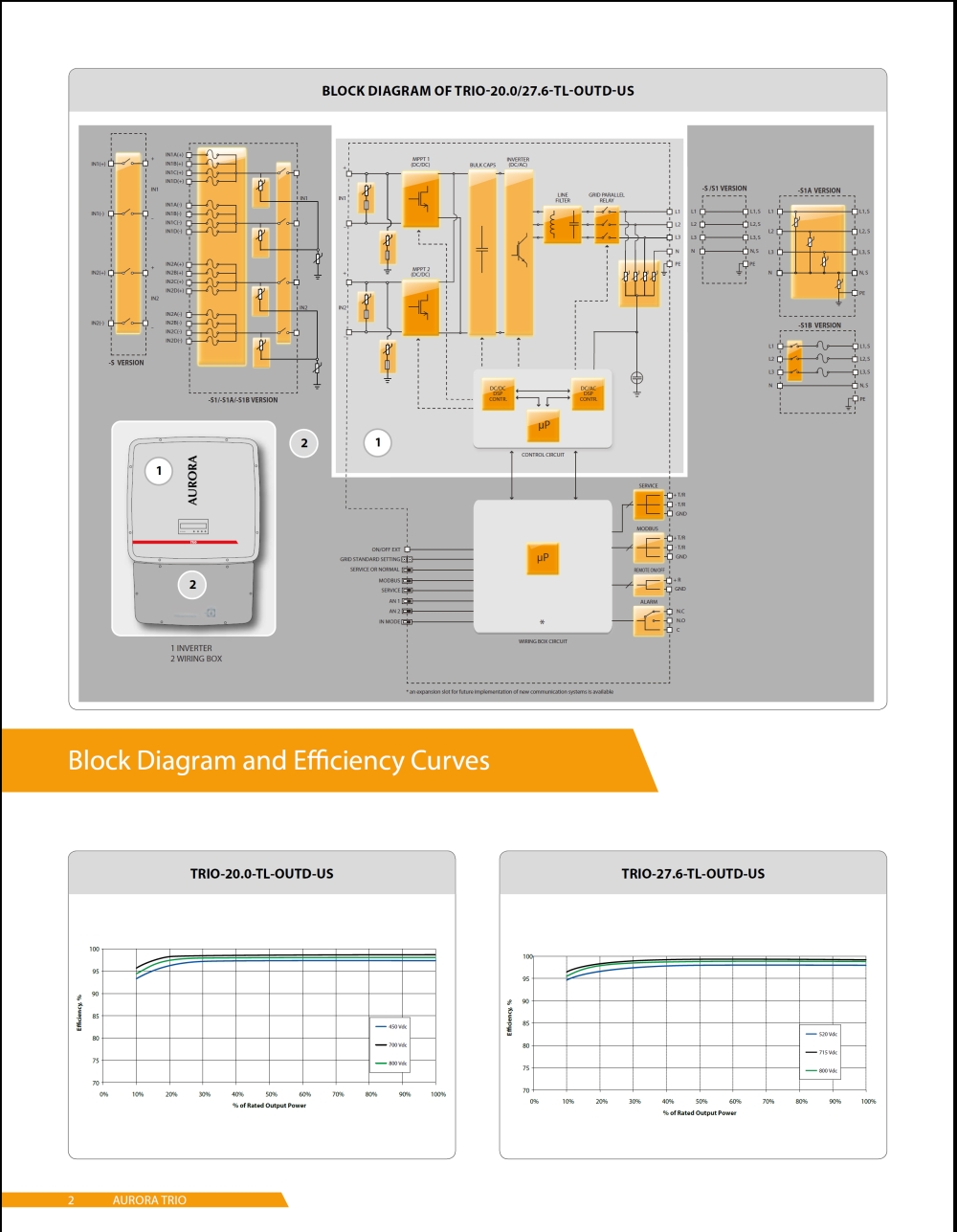

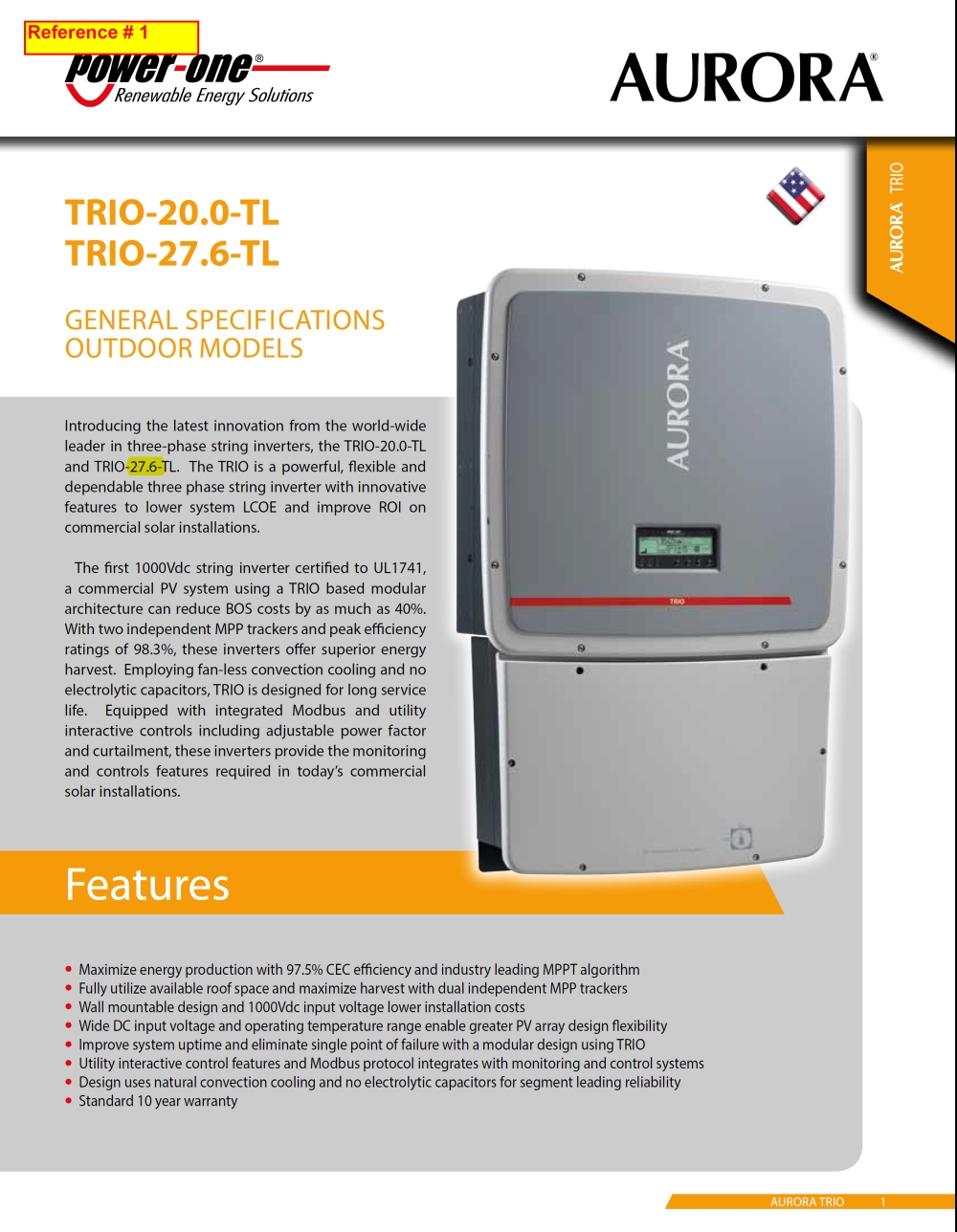

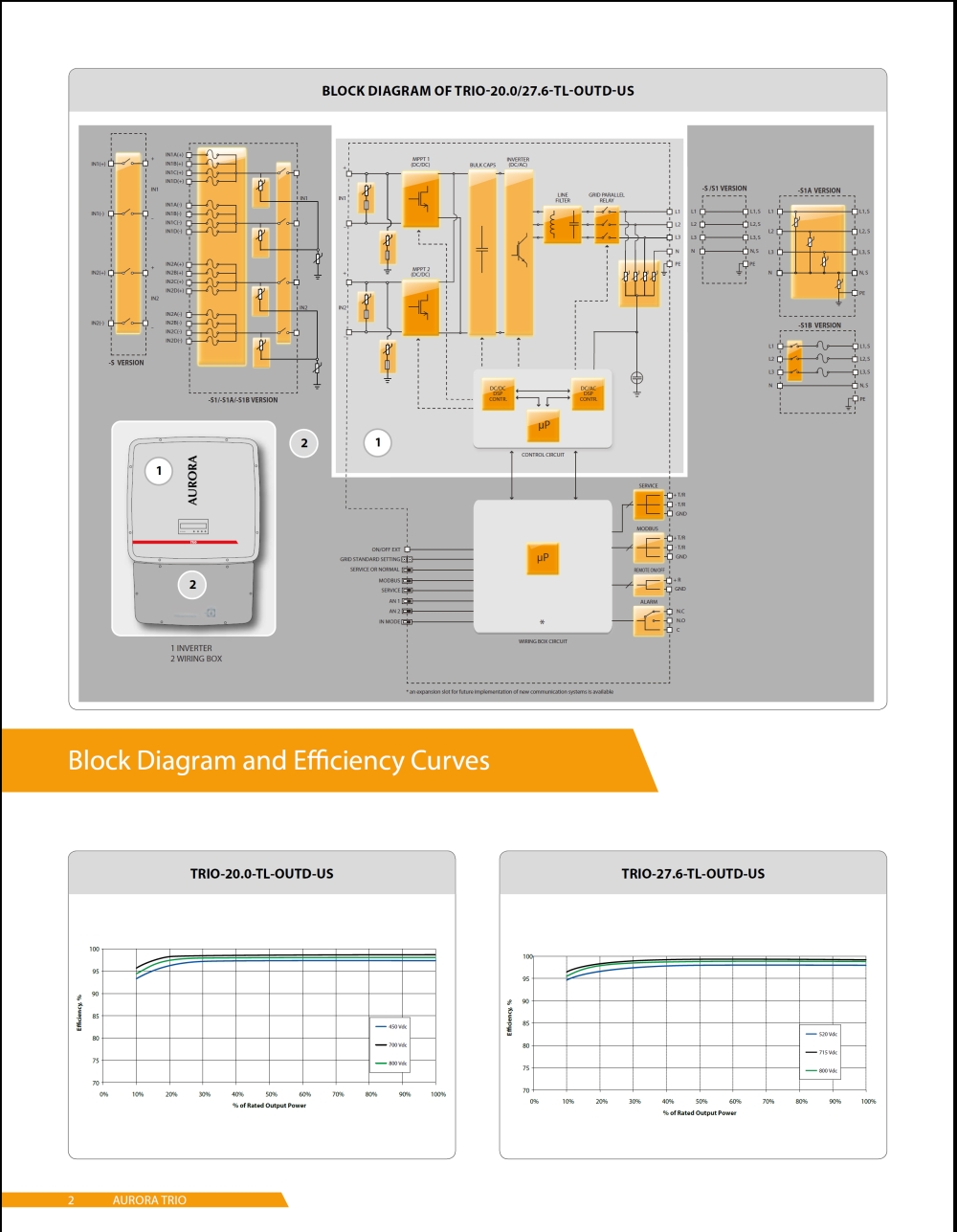

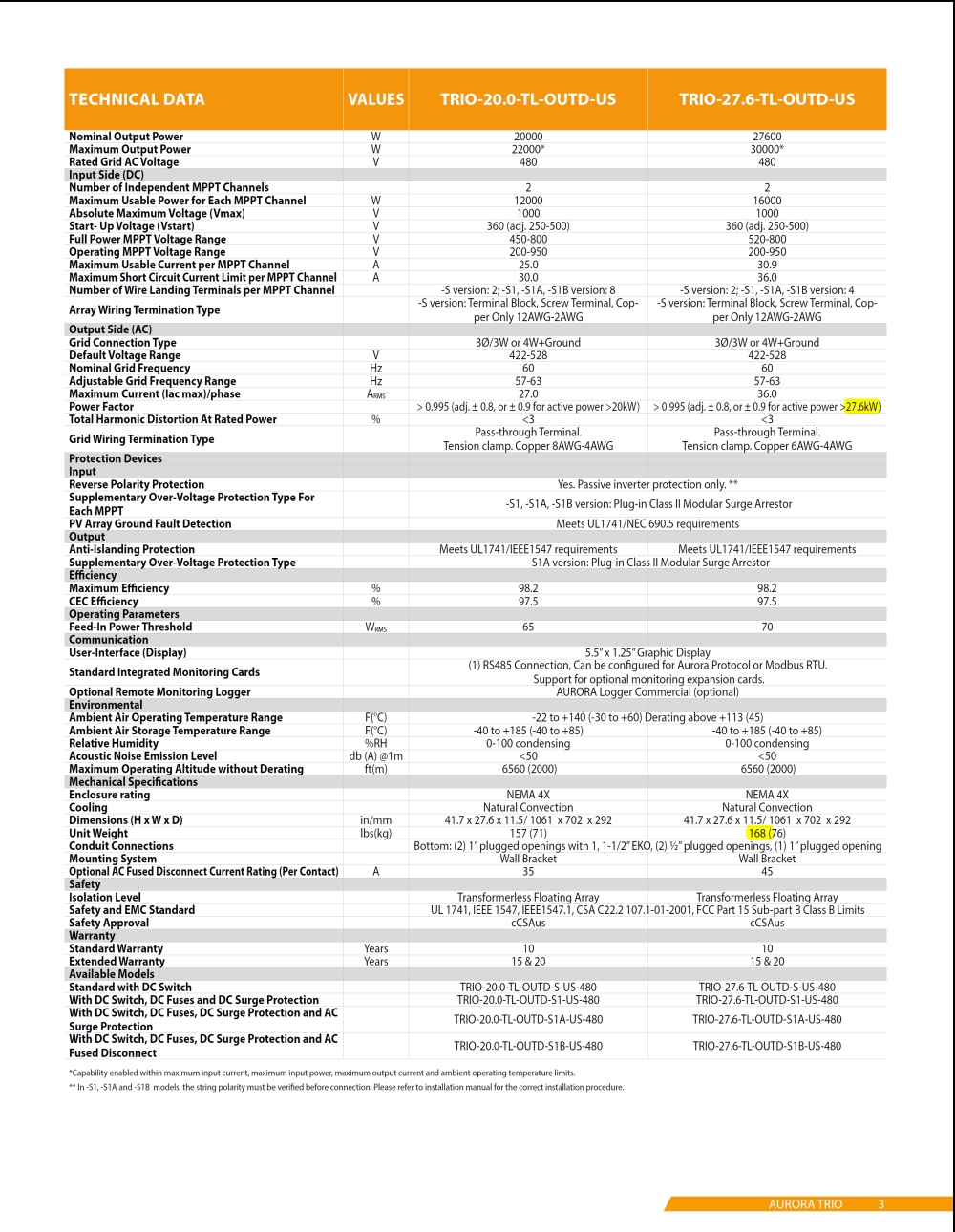

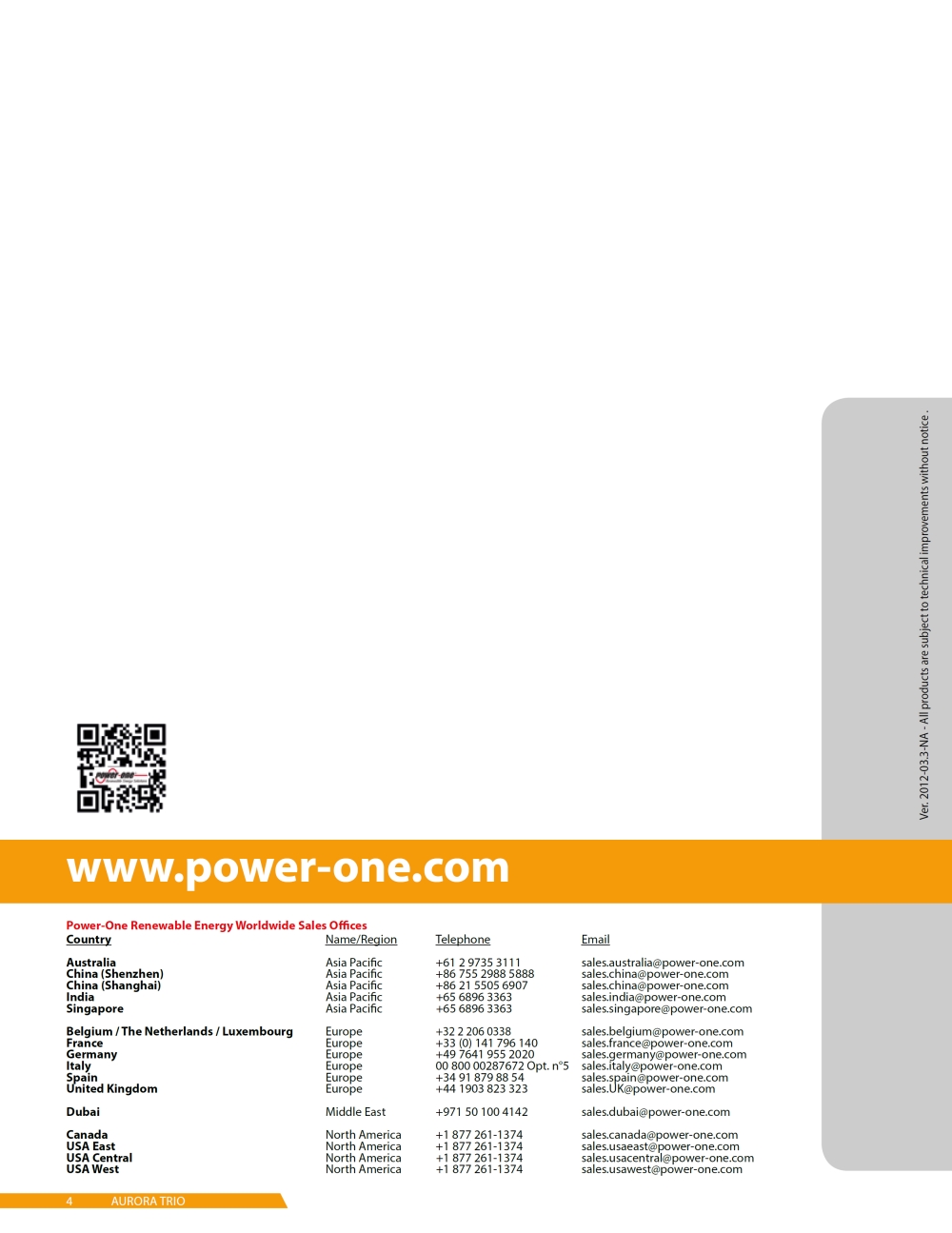

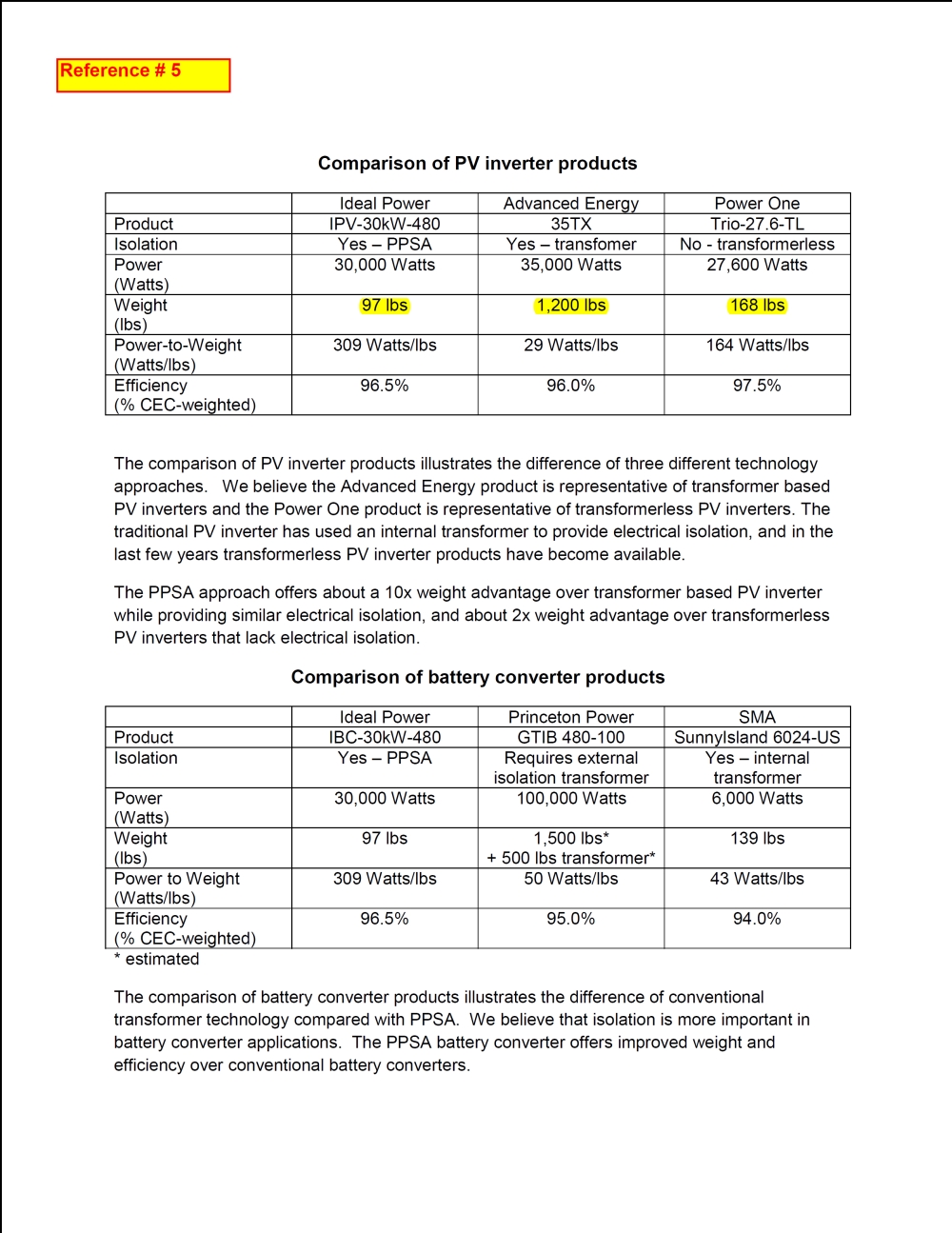

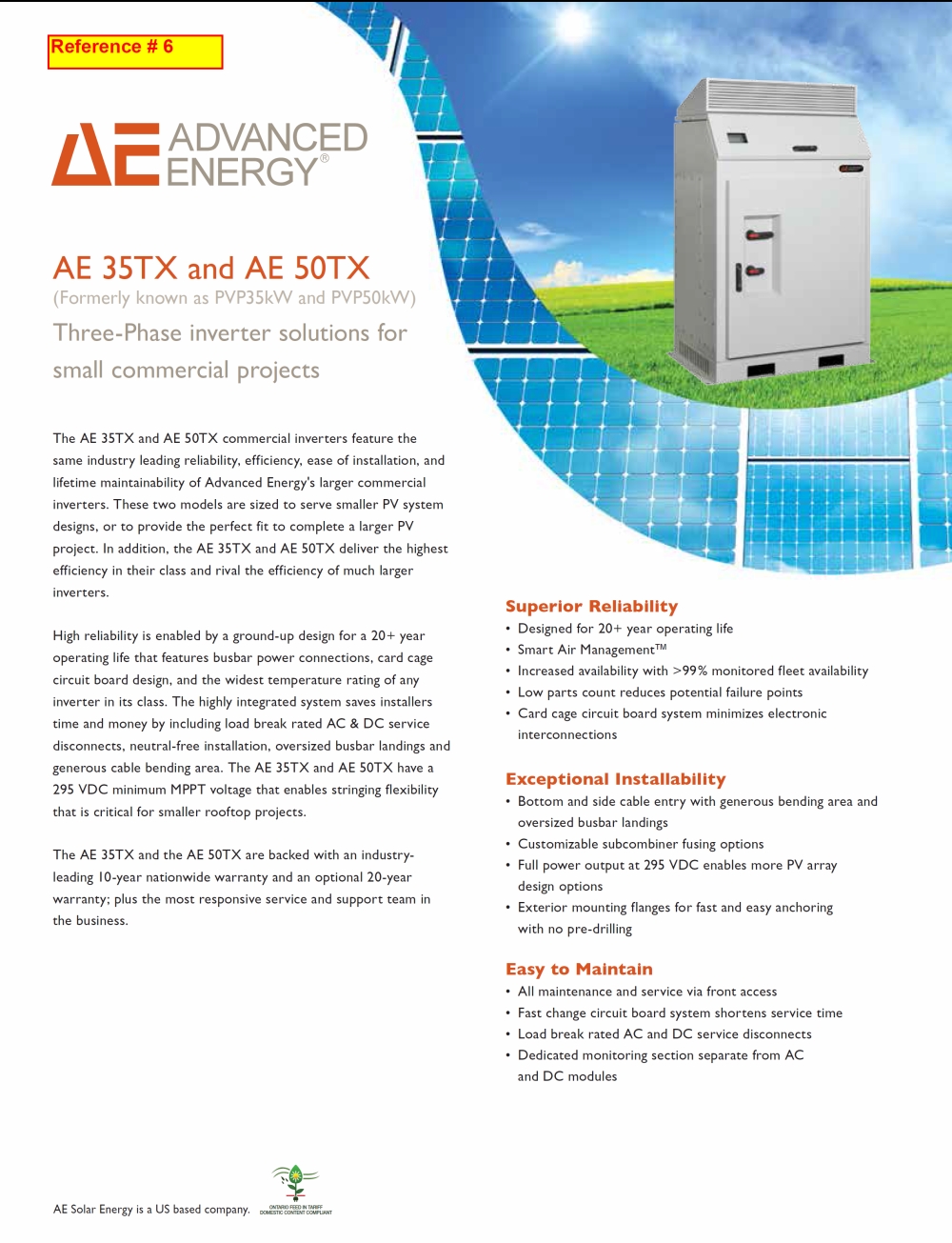

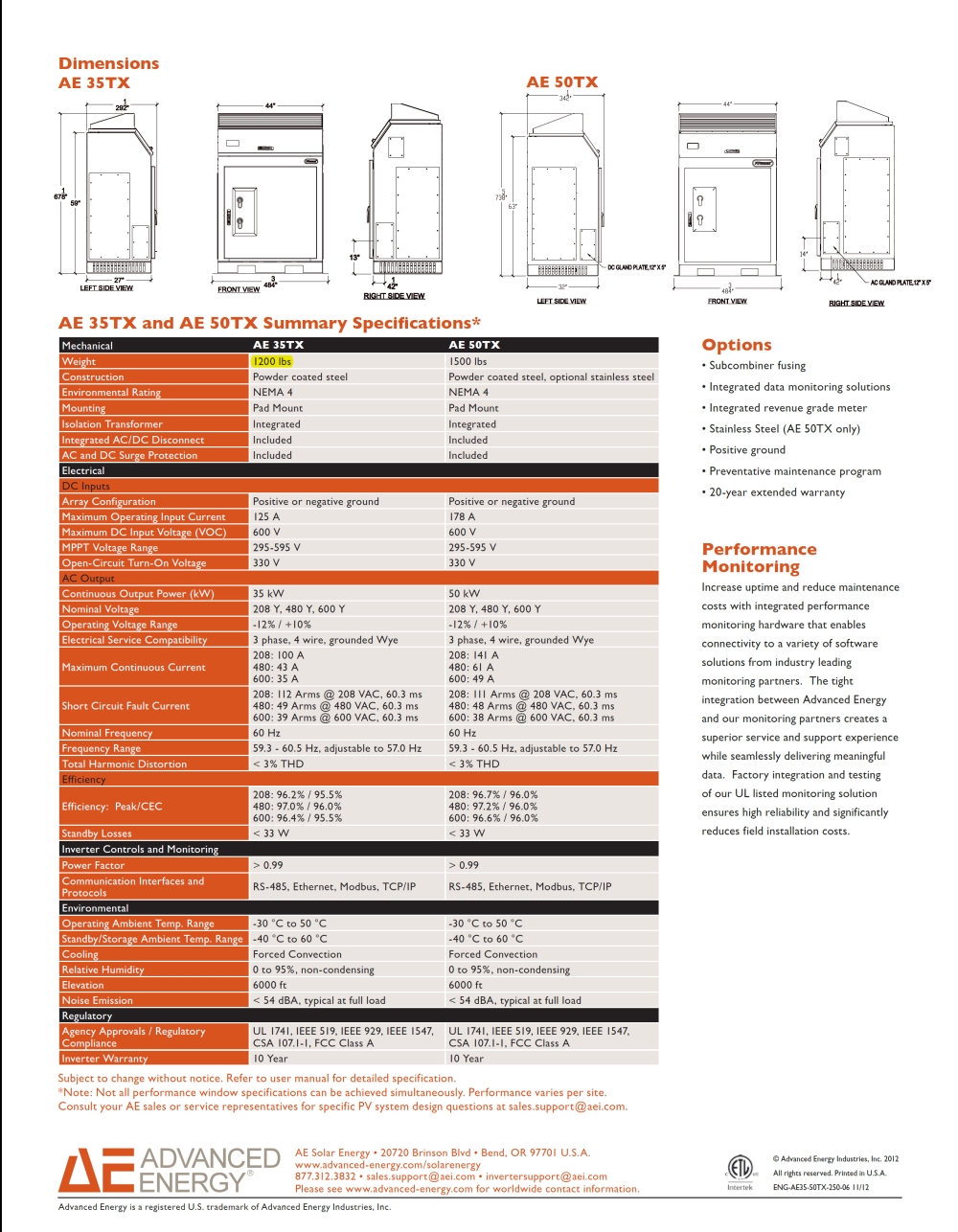

For example, Power One (one of the leaders in the power conversion space) currently offers a 27.6kW conventional transformer-less inverter that weighs 168 lbs., for a power-to-weight ratio of approximately 164 Watts/lbs. Conventional transformer-less inverters do not provide isolation; one of the key benefits they provide over traditional inverters is that they are smaller.

|

Reference #1: Power One datasheet for Trio-27.6-TL.

|

| |

3

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

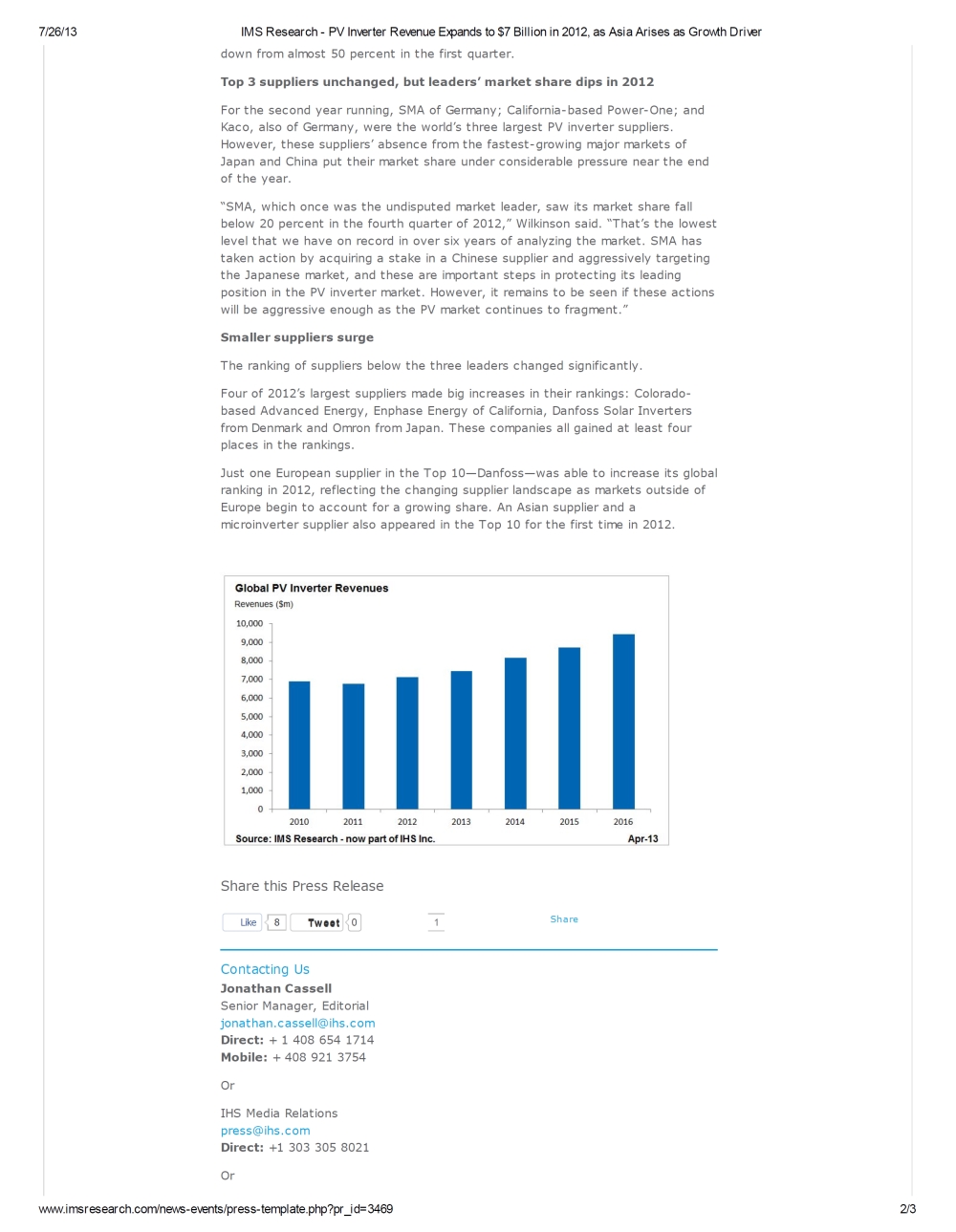

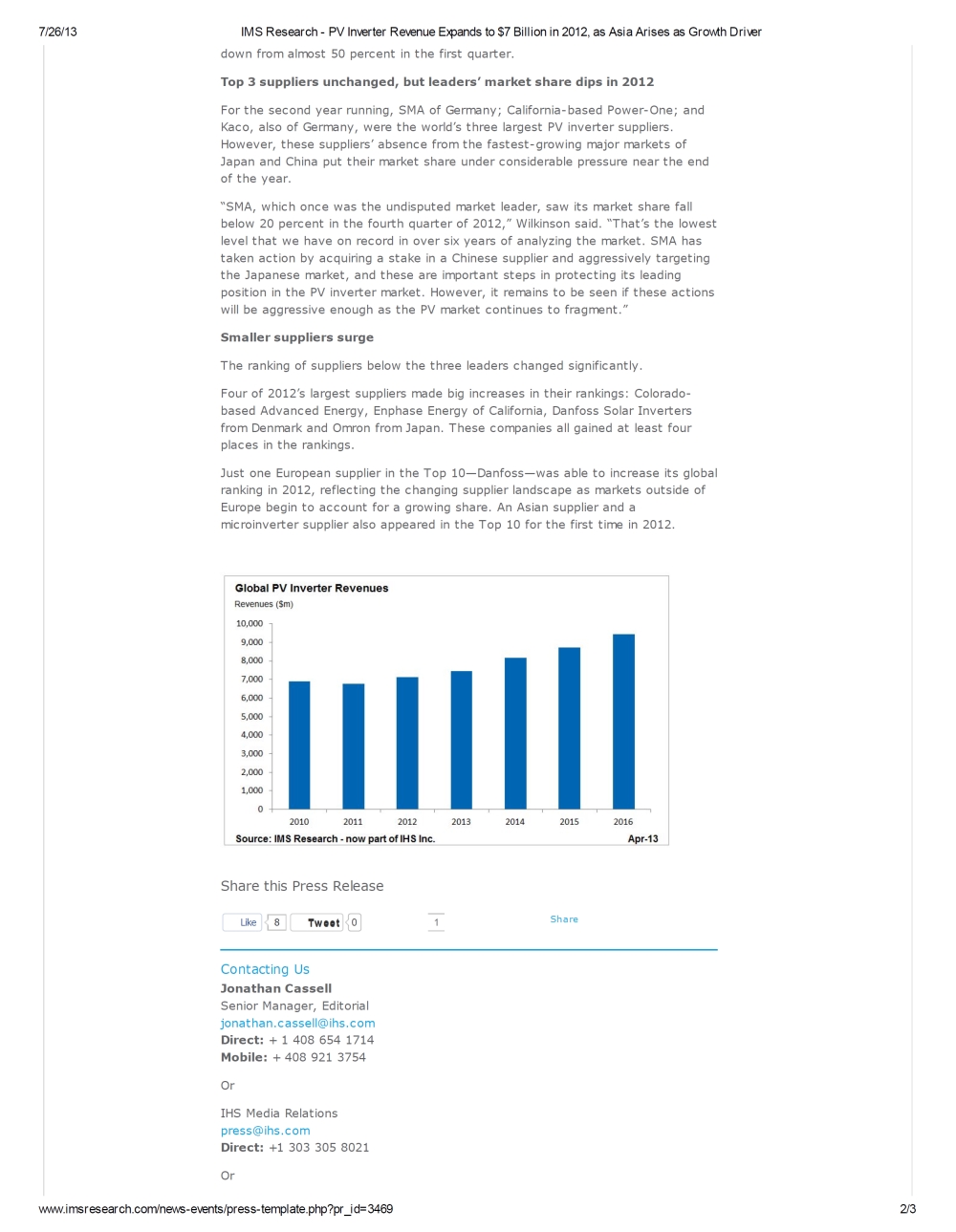

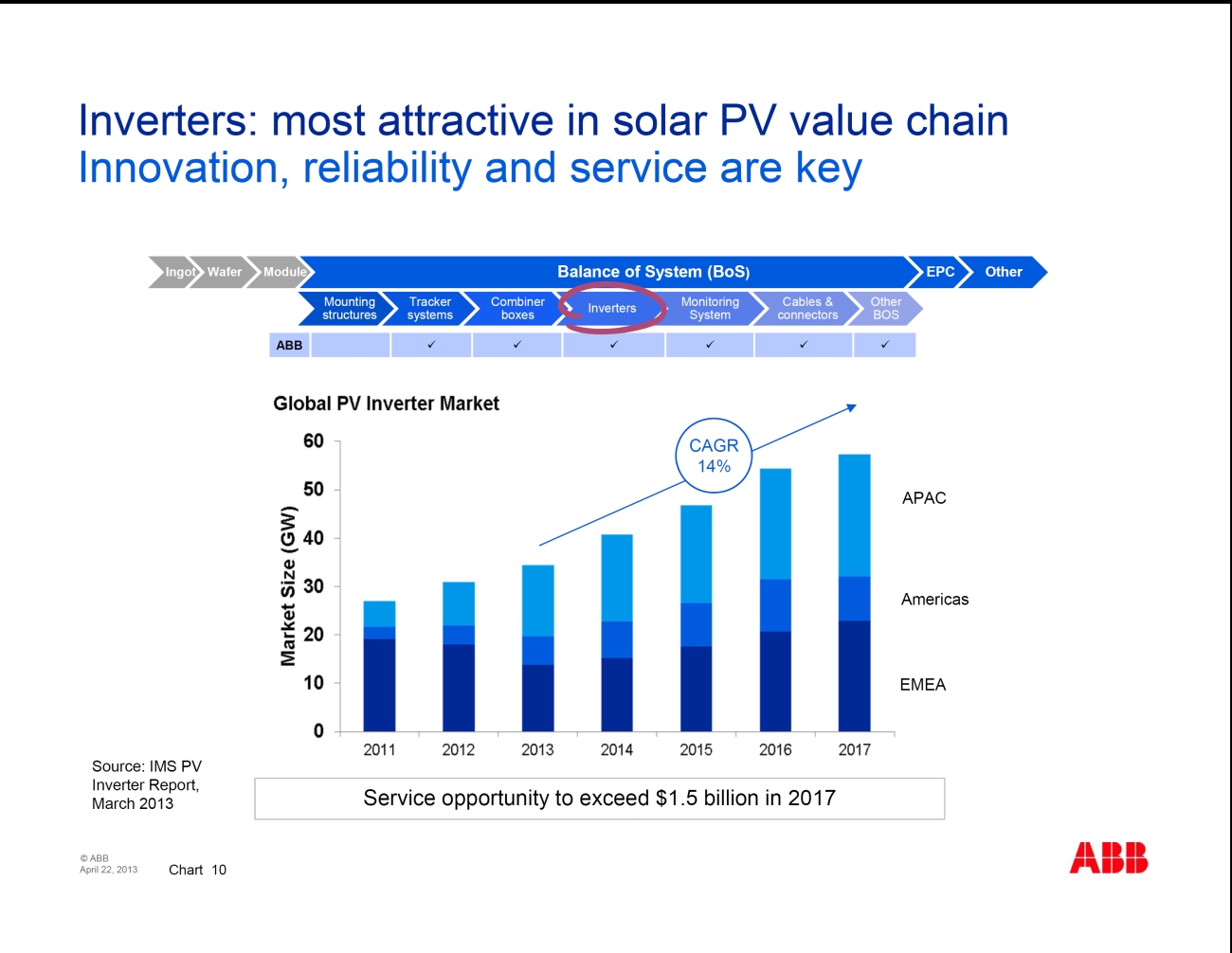

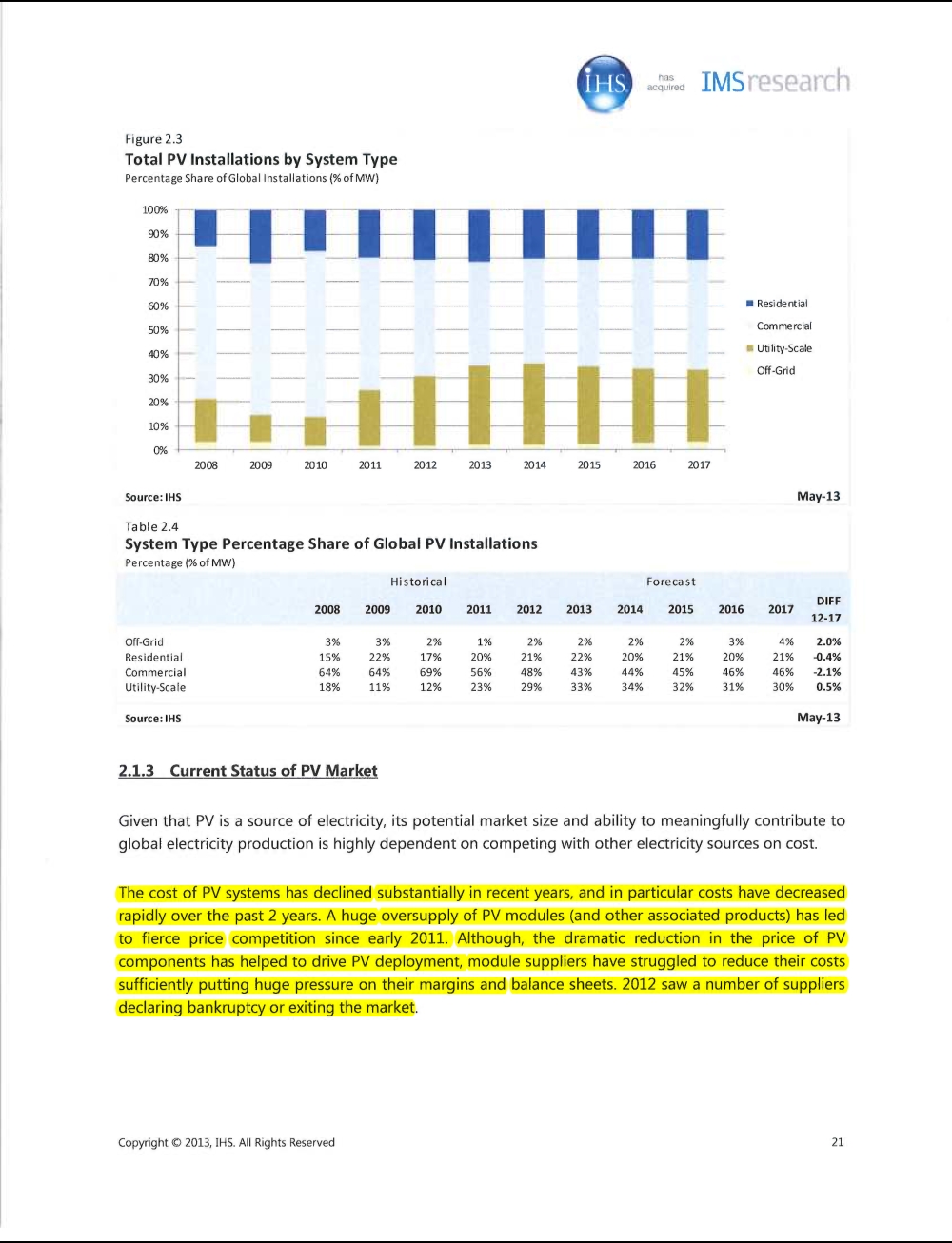

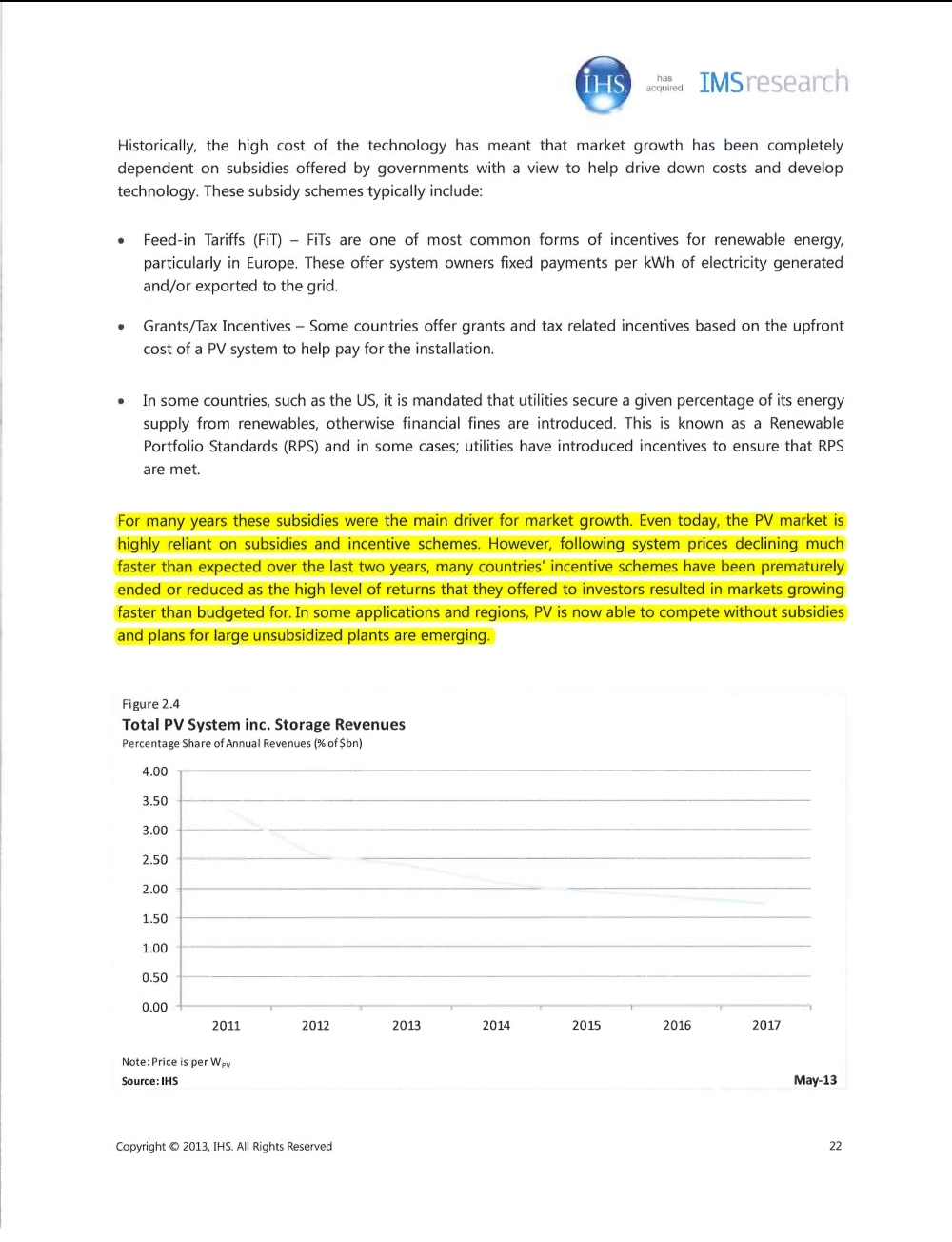

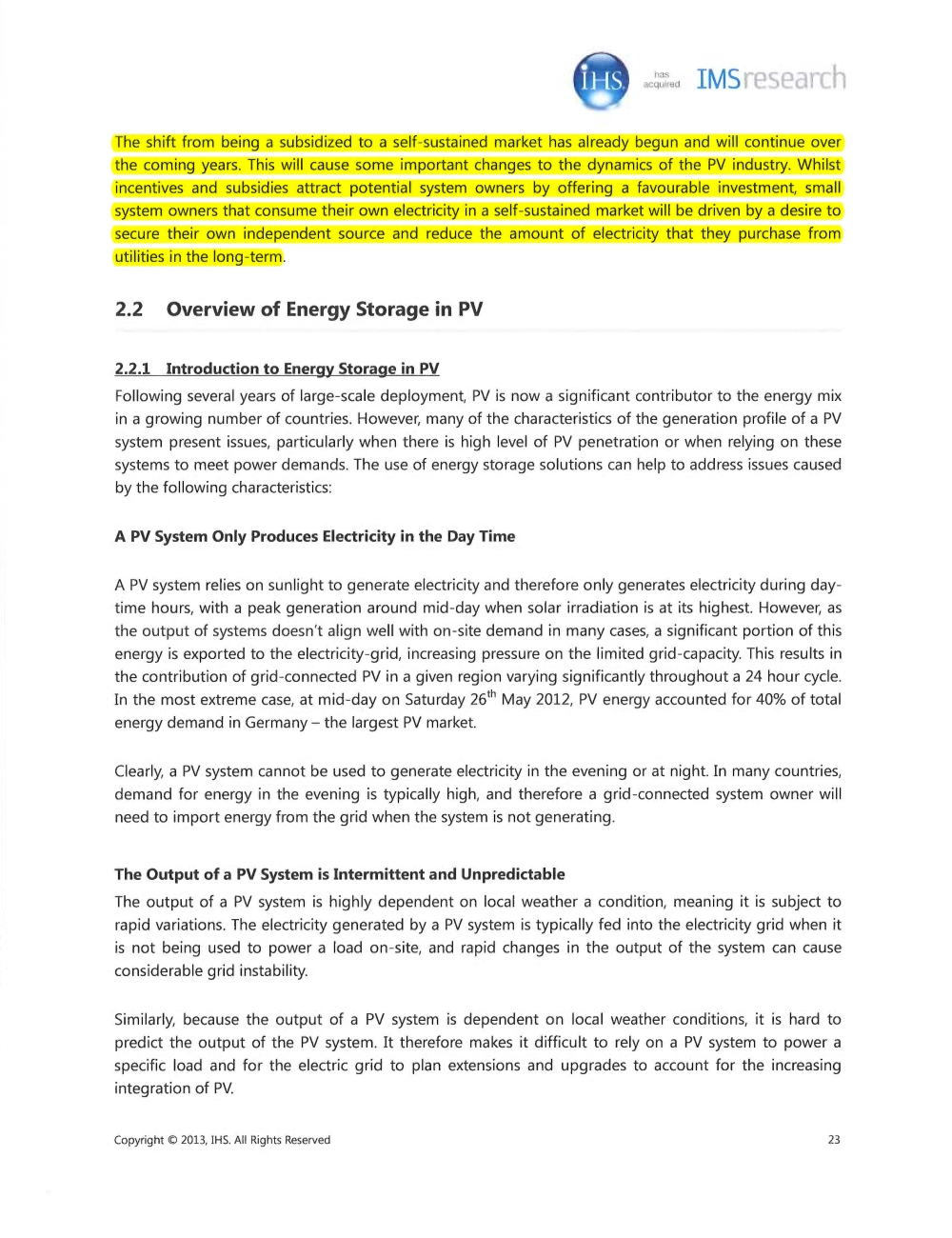

PV inverter market: The PV inverter market is already large and still growing; industry analysts estimate it at $7.1 billion in 2012, with growth in the installed base from 30 GW in 2012 to over 58 GW in 2017 (a CAGR of 13.8%). Due to the oversupply of PV modules, both module costs and installed PV system costs have declined sharply in the past few years. The decline in PV installation costs has increased demand for a number of installations and for other system components such as PV inverters. The declining system costs and increasing volume of PV installations have also reduced the need for government subsidies and incentive programs, and have prompted many countries to reduce or end their incentive programs faster than originally planned. In a growing number of applications and regions, PV is cost-effective with conventional generation without subsidies. This is particularly true for distributed power generation systems whose owners will consume the electricity they generate. In this case the demand for distributed PV is not only to reduce costs, but also to secure more independence from the power grid.

|

Reference #2: IHS Inc. (April 2013). PV Inverter Revenue Expands to $7 Billion in 2012, as Asia Arises as Growth Driver [Press release].

Reference #3: ABB Global PV Inverter Market (April 2013). Source: IMS PV Inverter Report, March 2013.

Reference #4: IHS (May 2013), “The Role of Energy Storage in the PV Industry: 2013 Edition,” pp. 21-23.

|

|

4

|

Our 30kW PV inverter weighs 97 pounds compared to 1200 pounds for a typical transformer-based PV inverter. It also weighs about half as much as typical transformer-less PV inverters, which do not provide isolation and therefore need additional safeguards to meet US regulatory guidelines. This reduced weight means that our 30kW PV inverter can be manufactured at lower costs as compared with our competition and it also means that it is cheaper to ship and install.

|

Reference #5: Comparison of PV inverter products.

Reference #6: Advanced Energy datasheet for AE35TX.

Reference #1: Power One datasheet for Trio-27.6-TL.

|

|

4

|

Distributed grid energy storage market: This market is also growing extremely fast; industry analysts estimate that the North American market will grow from 1.4 MW of PV systems with integrated storage in 2012 to 900 MW in 2017, a CAGR of 264%.

|

Reference #7: IHS (May 2013), “The Role of Energy Storage in the PV Industry: 2013 Edition,” p. 65.

|

| |

4

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

Electrified vehicle DC charging market: The DC charging market is sometimes called the fast-charging market, as it can reduce charge time for a standard electric vehicle from 8 hours to 30 minutes. This market is growing quickly, spurred on by EV manufacturers such as Tesla and Nissan; industry analysts estimate that EV DC or fast charger shipments will grow from 9,000 in 2012 to 98,000 in 2020

|

Reference #8: DC Fast Charging Equipment for Electric Vehicles, Navigant Research (2013).

|

|

Comment

|

S-1

Page #

|

S-1 Statement

|

Supporting Documentation

|

|

5. Please provide us support for your statements regarding your leadership throughout the prospectus, such as your statements about leadership in the first and last paragraphs on page 21 of the prospectus.

|

22

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

We believe we are a leader in the development of an innovative electronic power conversion technology called Power Packet Switching Architecture (PPSA), based on our 19 issued United States patents related to this technology.

|

Please see page 29 of Amendment No. 1 to the Original S-1 for a table of issued patents.

|

|

Comment

|

S-1

Page #

|

S-1 Statement

|

Supporting Documentation

|

|

Located in Proprietary Technology

|

|

6. Please provide us with support for your claims in the bullet points in this section about best-of-class safety, greater efficiency and greater reliability. In addition, where you provide statistics, please explain what they mean. For example, what does 96% efficiency mean?

|

2

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

Best-of-class safety without significant additional safeguards. The PPSA process provides electrical isolation between the input and the output without a transformer. This isolation means that PPSA systems can be grounded, so they achieve the same safety benefit as transformer-based inverters. Conventional transformer-less PV inverters generally cannot be grounded, and therefore must use other safeguards, increasing system expense. Note that it is only in the PV inverter space that we believe transformer-less inverters are even viable; in our other target markets (grid-storage battery converters and electrified vehicle DC charging), we believe that isolation will be a requirement. PPSA can provide this isolation without the size, weight, cost, and efficiency loss of using a transformer.

|

Reference #9: Power Electronics (October 2012), New Topology Cuts Size, Improves Performance of PV Inverters.

|

| |

2

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

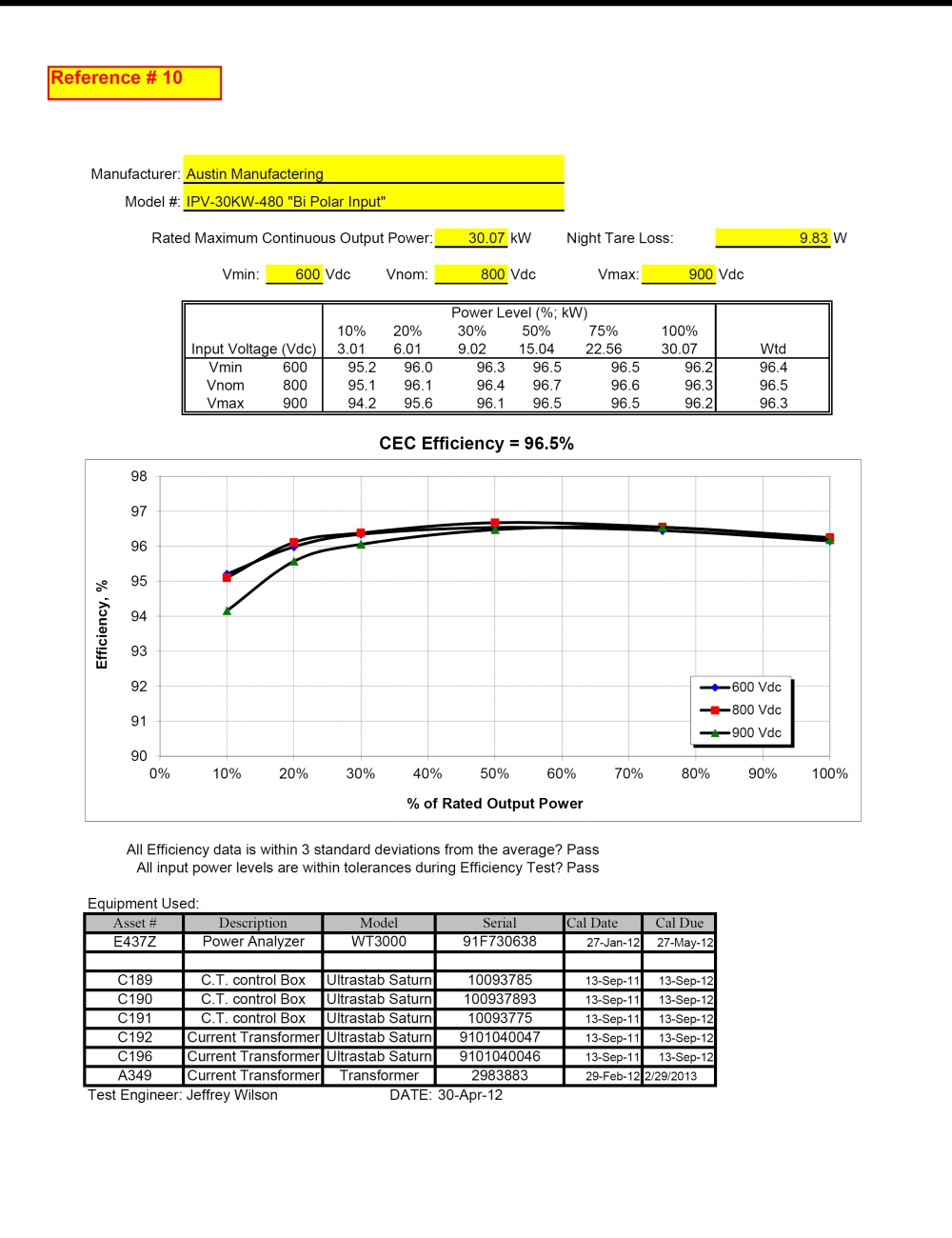

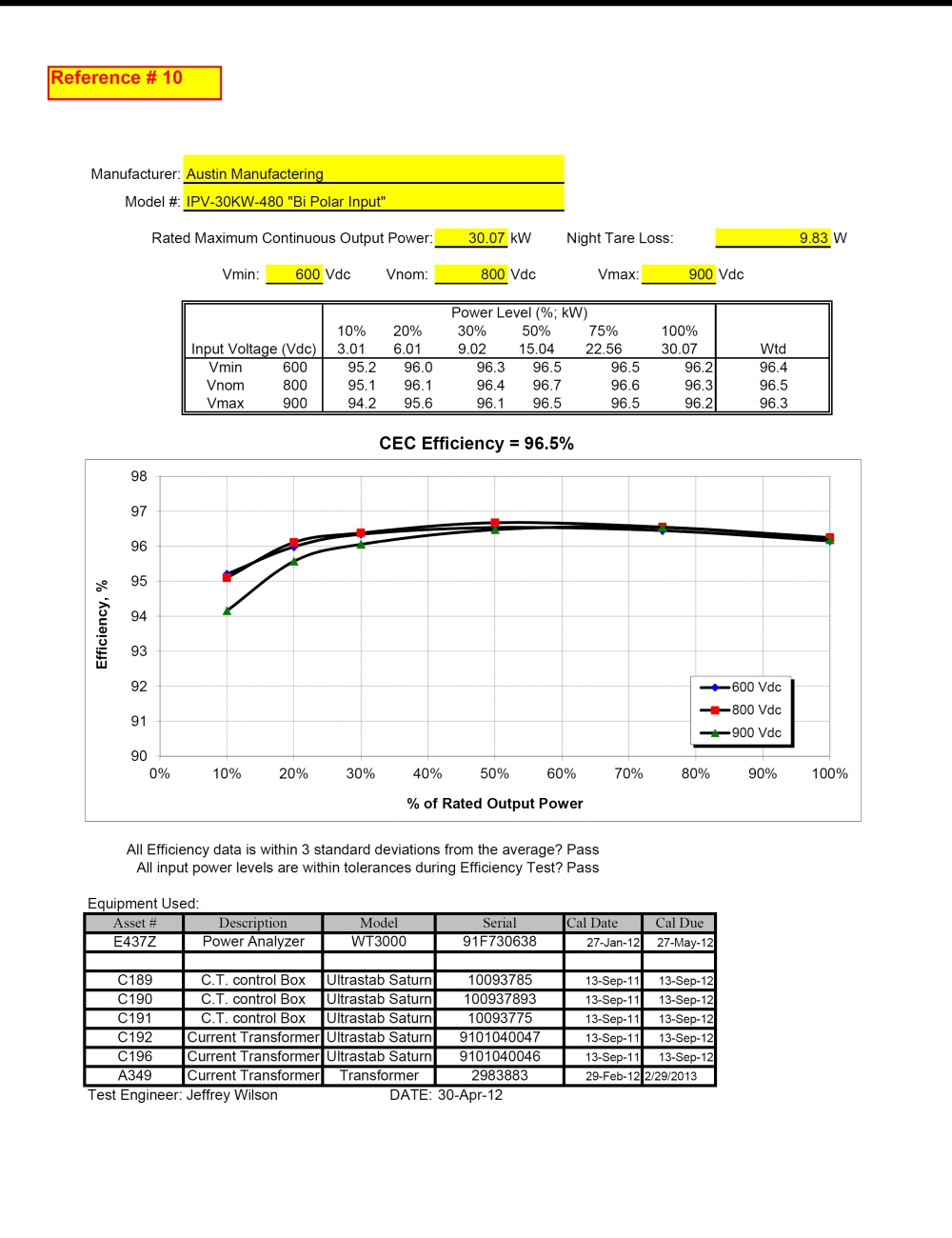

Greater efficiency. Efficiency is the measure of power out of the inverter as a percentage of the power into the inverter. Thus, high efficiency PV inverters use less power in the conversion process and supply more power for use. Our PPSA PV inverter was tested for efficiency by Intertek, a leading Nationally Recognized Testing Laboratory. Intertek’s results showed that our initial PV inverter product has a power conversion efficiency, defined as output power divided by input power, of 96.5% during normal operation. This ranks among the highest efficiencies of any PV inverter providing electrical isolation, based on published results from the California Energy Commission. In several of our emerging markets, such as electrified vehicle DC charging and grid-storage battery conversion, competing systems may have power conversion losses twice as high as our PPSA products.

|

Reference #10: California Energy Commission (CEC) Efficiency Test Results, Intertek Testing Services (May 2012).

Reference #11:

CEC website of approved PV inverters including CEC-weighted efficiency measurements

http://www.gosolarcalifornia.ca.gov/equipment/inverters.php

Reference #12:

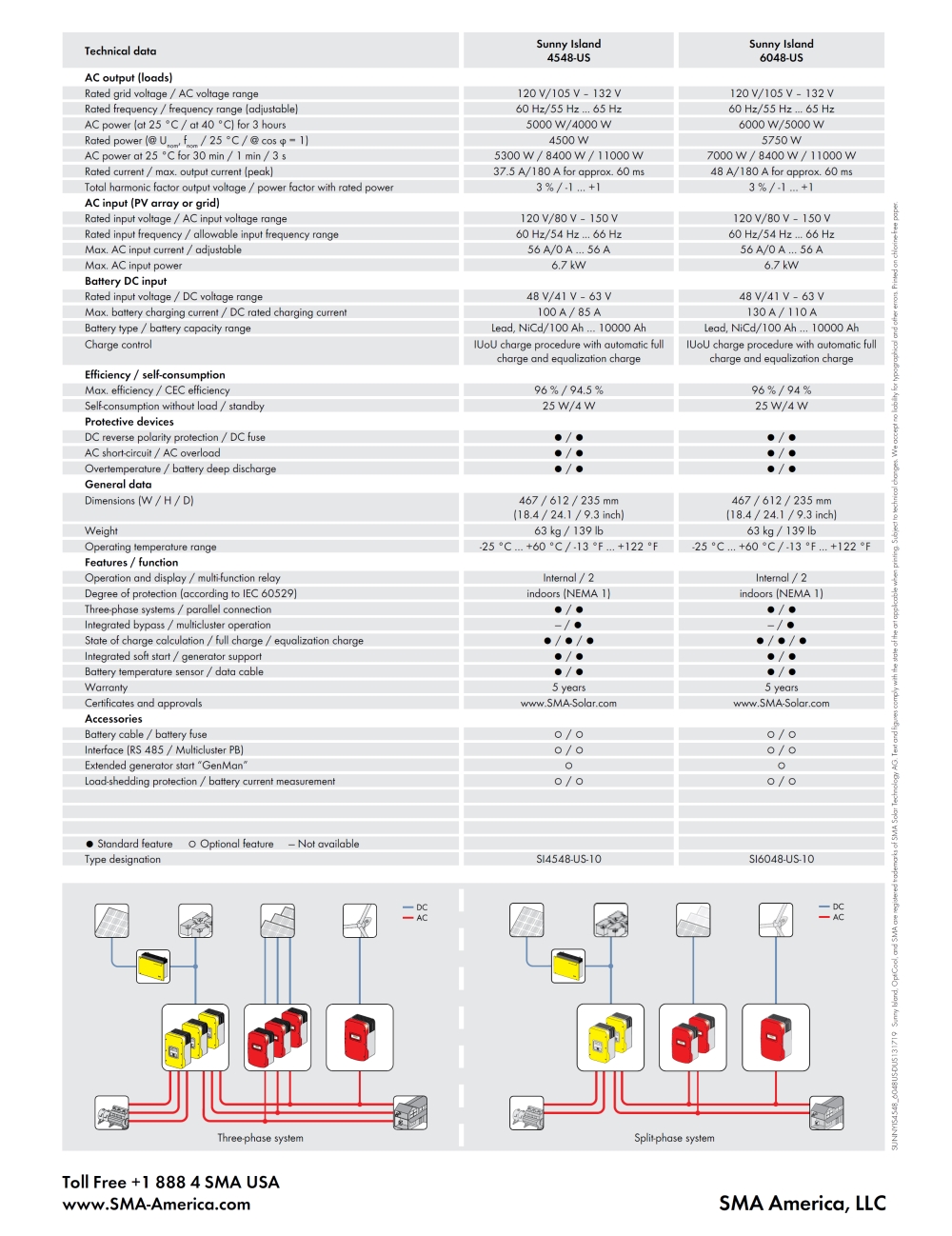

SMA SunnyIsland Battery Converter 94% CEC–weighted efficiency

Reference #13:

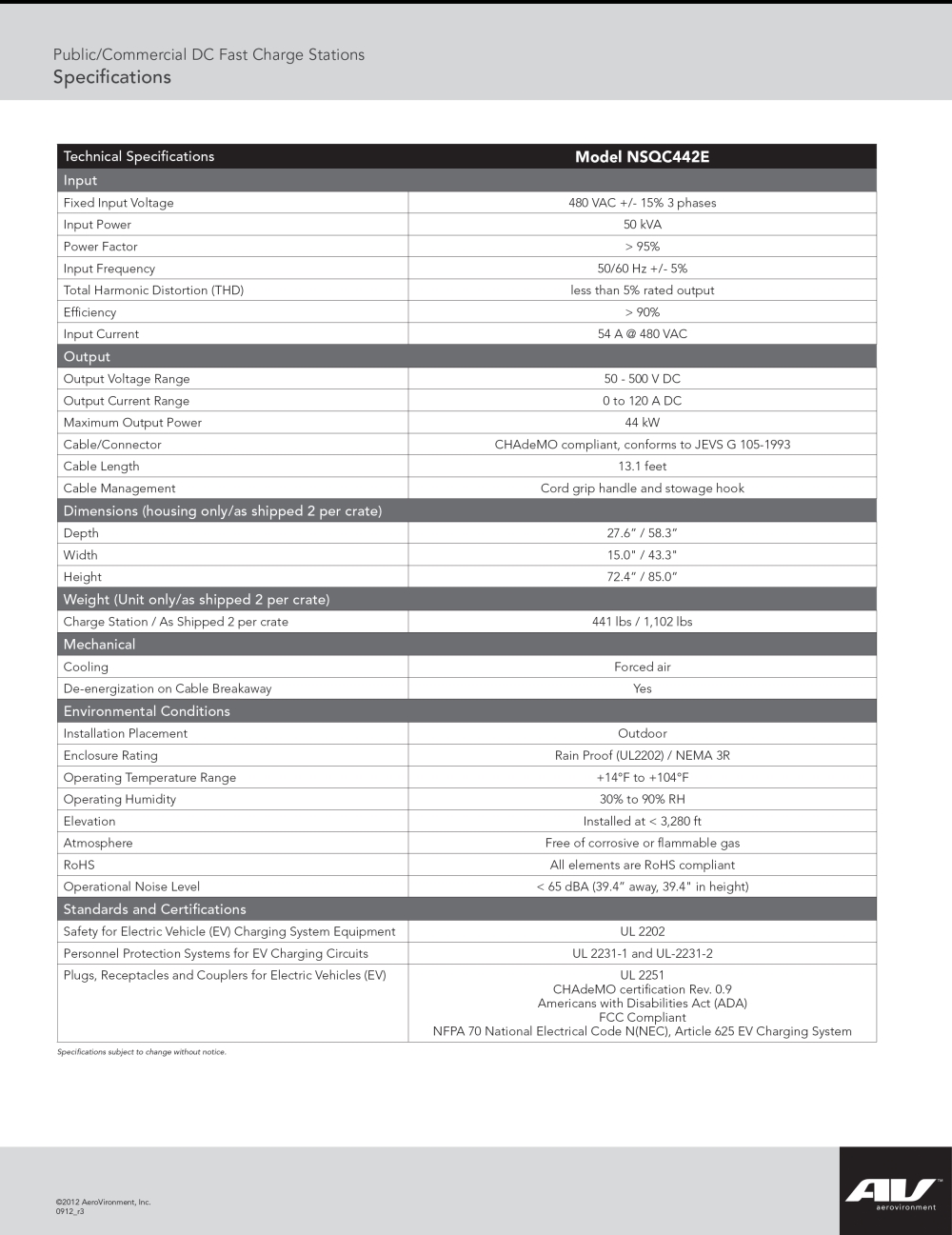

Nissan EV DC charger datasheet >90% efficiency

|

| |

3

|

The applicable disclosure from the Original S-1 has been revised to read as follows:

Greater reliability. Because PPSA uses no electrolytic capacitors, it eliminates that critical point of failure of conventional systems. We believe this and other design features will lead to increased product robustness and reliability. We are working with Intertek to subject our products with industry standard reliability tests. These tests are partly funded by the U.S. Navy.

|

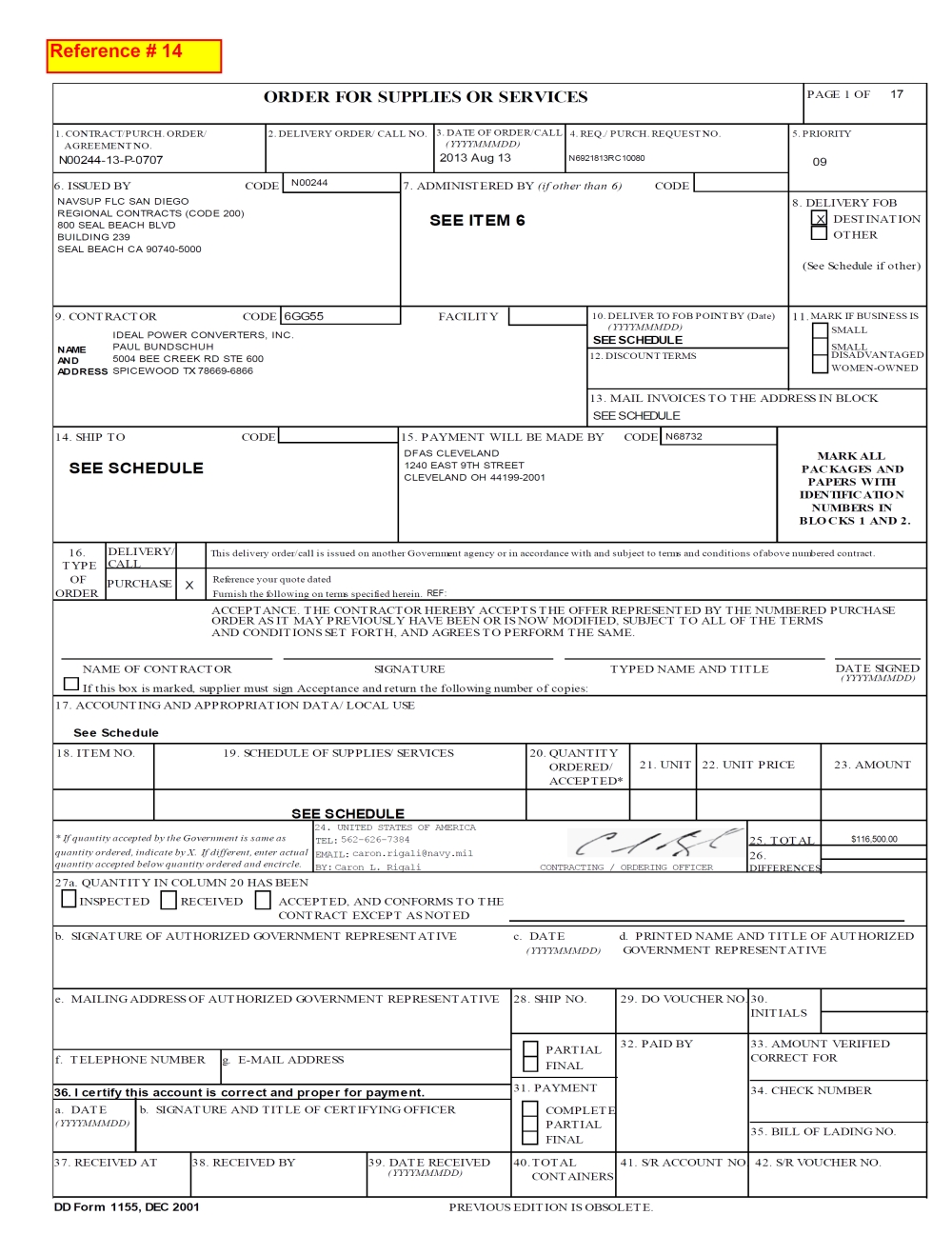

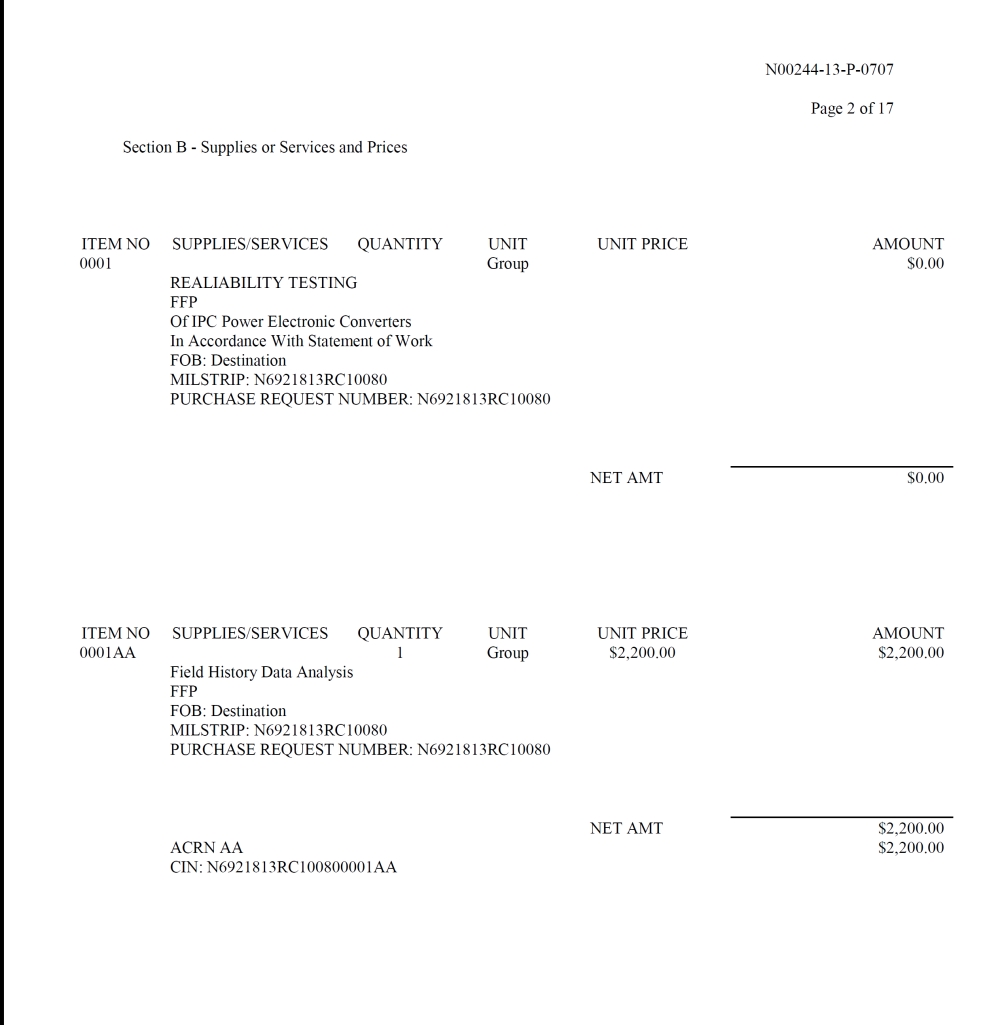

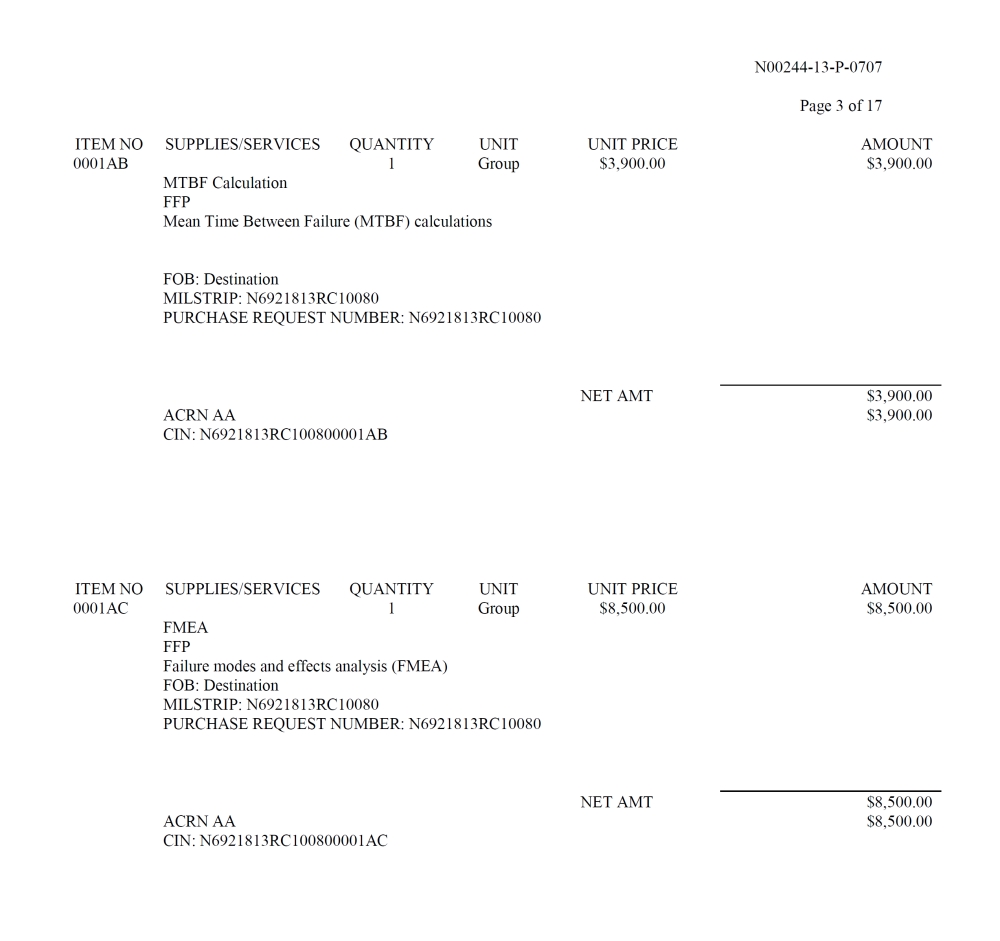

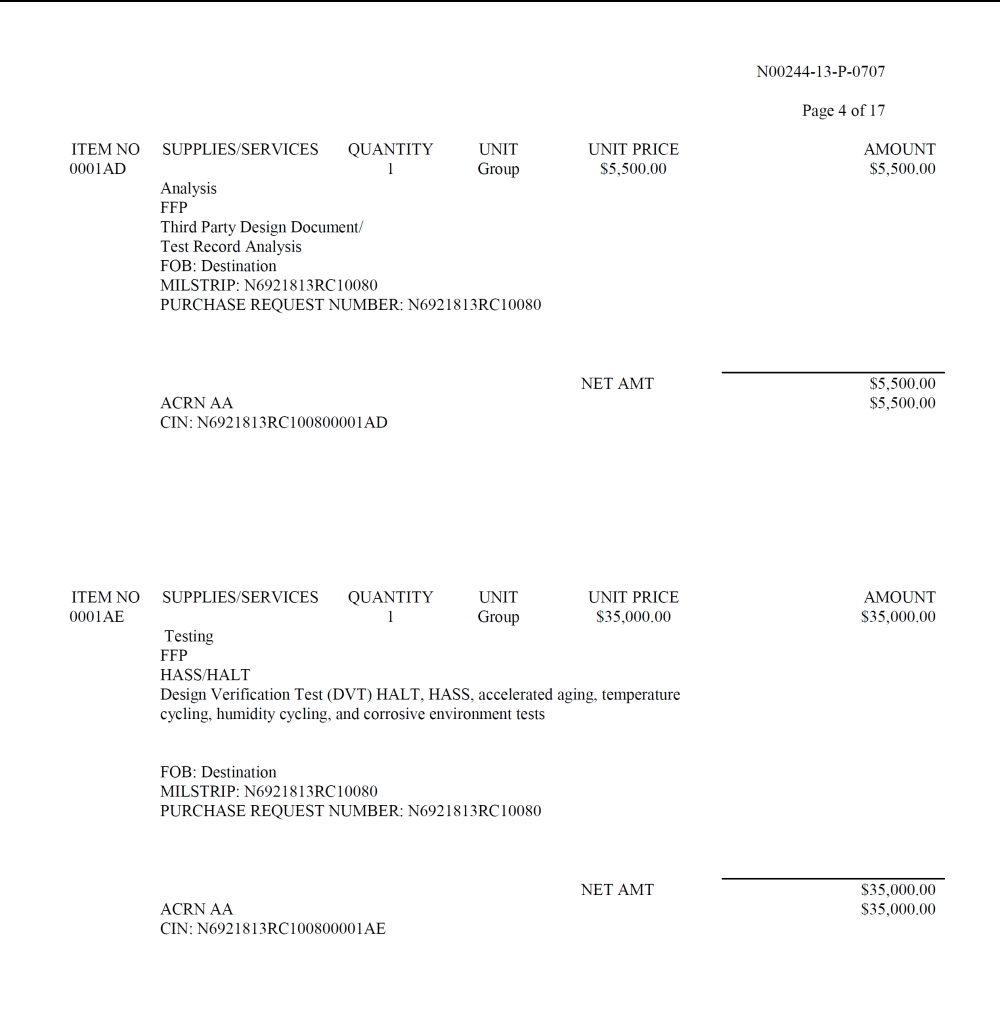

Reference #14: U.S. Navy purchase order to fund third party reliability testing in order to prove superior robustness and reliability of PPSA.

|