As filed with the Securities and Exchange Commission on November 12 , 2013

Registration No. 333-190414

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

IDEAL POWER INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

|

|

14-1999058

|

|

(State or other jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Classification Code Number)

|

|

Identification No.)

|

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

(512) 264-1542

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Paul Bundschuh

Chief Executive Officer

Ideal Power Inc.

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

(512) 264-1542

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Kevin Friedmann, Esq.

Richardson & Patel LLP

The Chrysler Building

405 Lexington Avenue, 49th Floor

New York, New York 10174

Telephone: (212) 561-5559

Fax: (917) 591-6898

|

Scott Bartel, Esq.

Eric Stiff, Esq.

Locke Lord LLP

500 Capitol Mall, Suite 1800

Sacramento, California 95814

Telephone: (916) 930-2500

Fax: (916) 930-2501

|

As soon as practicable after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. [ ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

|

Large accelerated filer [ ]

|

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

|

Smaller reporting company [X]

|

|

(Do not check if a smaller reporting company)

|

|

|

CALCULATION OF REGISTRATION FEE

| |

|

Amount to be

Registered

(1)

|

|

|

Proposed

Maximum

Offering

Price Per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee(5)

|

|

|

Title of Each Class of Securities to be Registered

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value per share(2)

|

|

|

2,875,000

|

|

|

$

|

5.00

|

|

|

$

|

14,375,000

|

|

|

$

|

1,960.75

|

|

|

Underwriter Warrant (3)(4)

|

|

|

|

|

|

$

|

|

|

|

$

|

1,000

|

|

|

$

|

0.14

|

|

|

Common Stock underlying Underwriter's Warrant

|

|

|

287,500

|

|

|

$

|

6.25

|

|

|

$

|

1,796,875

|

|

|

$

|

245.09

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

$

|

16,172,875

|

|

|

$

|

2,205.98

|

|

|

(1)

|

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933.

|

|

(2)

|

Includes 375,000 shares of common stock representing 15% of the shares offered to the public that the underwriter has the option to purchase to cover over-allotments, if any.

|

|

(3)

|

No registration fee required pursuant to Rule 457(g) under the Securities Act.

|

|

(4)

|

Represents a warrant granted to the underwriter to purchase shares of common stock in an amount up to 10% of the number of shares sold to the public in this offering.

|

|

(5)

|

The registration fee was paid on August 6, 2013.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment, which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND WE ARE NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED NOVEMBER 12 , 2013

PRELIMINARY PROSPECTUS

2,500,000 Shares of Common Stock

We are offering 2,500,000 shares of our common stock, $0.001 par value, in a firm commitment underwritten offering, which share number reflects our proposed one for 2.381 reverse stock split (the “reverse stock split”) described in this prospectus. After the effectiveness of the registration statement, of which this prospectus is a part, and concurrently with the pricing of the offering, we will effect the reverse stock split.

This is an initial public offering of our common stock. We expect the public offering price to be $5.00 per share (assuming the reverse stock split). There is presently no public market for our common stock. We have applied for listing of our common stock on the Nasdaq Capital Market under the symbol “IPWR,” which listing we expect to occur upon consummation of this offering. No assurance can be given that our application will be approved. If our application to the Nasdaq Capital Market is not approved, we will not complete the offering or effect the reverse stock split.

We are an “emerging growth company” under the federal securities laws and will have the option to use reduced public company reporting requirements. Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 11 for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

MDB Capital Group, LLC and Northland Capital Markets are the underwriters for our initial public offering. MDB Capital Group, LLC has rendered advisory services to us in the past and has acted as our placement agent in connection with the placement of our senior secured convertible promissory notes. In November of 2012, MDB Capital Group, LLC made an investment in our senior secured convertible promissory notes on the same terms and conditions as other investors as further described in the section of this prospectus titled “Underwriting.”

If we sell all of the common stock we are offering, we will pay to the underwriters $1,156,250, or 9.25%, of the gross proceeds of this offering and accountable and non-accountable expenses equal to $187,500. For a more complete discussion of the compensation we will pay to the underwriters, please see the section of this prospectus titled “Underwriting”. In connection with this offering, we have also agreed to issue to the underwriters warrants to purchase aggregate shares of our common stock in an amount up to 10% of the shares of common stock sold in the public offering, with an exercise price equal to 125% of the per-share public offering price.

| |

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

5.00

|

|

|

$

|

12,500,000.00

|

|

|

Underwriting discounts and commissions

|

|

$

|

0.4625

|

|

|

$

|

1,156,250.00

|

|

|

Proceeds to us (before expenses) (1)

|

|

$

|

4.5375

|

|

|

$

|

11,343,750.00

|

|

|

(1)

|

See “Underwriting” for a description of compensation payable to the underwriter.

|

The underwriters may also purchase an additional 375,000 shares of our common stock (assuming the reverse stock split) amounting to 15% of the number of shares offered to the public, within 45 days of the date of this prospectus, to cover over-allotments, if any, on the same terms set forth above.

The underwriters expect to deliver the shares on or about _____________________, 2013.

| MDB Capital Group, LLC |

|

Northland Capital Markets |

The date of this prospectus is _______________, 2013.

| |

|

Page

|

|

PROSPECTUS SUMMARY

|

|

1

|

|

SUMMARY SELECTED FINANCIAL INFORMATION

|

|

10

|

|

RISK FACTORS

|

|

11

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND OTHER INFORMATION CONTAINED IN THIS PROSPECTUS |

|

24 |

|

BUSINESS

|

|

25

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

40

|

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

|

49

|

|

EXECUTIVE COMPENSATION

|

|

52

|

|

DESCRIPTION OF CAPITAL STOCK

|

|

55

|

|

MARKET FOR OUR COMMON STOCK, DIVIDEND POLICY AND OTHER STOCKHOLDER MATTERS

|

|

59

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

59

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

|

61

|

| CHANGES IN ACCOUNTANTS |

|

66 |

|

UNDERWRITING

|

|

67

|

|

USE OF PROCEEDS

|

|

71

|

|

CAPITALIZATION

|

|

72

|

|

DILUTION

|

|

73

|

|

LEGAL MATTERS

|

|

73

|

|

EXPERTS

|

|

74

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

74

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

|

74

|

| INDEX TO FINANCIAL STATEMENTS |

|

F-1 |

Unless otherwise stated or the context otherwise requires, the terms “IPWR,” “we,” “us,” “our” and the “Company” refer to Ideal Power Inc.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with additional or different information. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

No dealer, salesperson or any other person is authorized in connection with this offering to give any information or make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than those contained in this prospectus and, if given or made, the information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any security other than the securities offered by this prospectus, or an offer to sell or a solicitation of an offer to buy any securities by anyone in any circumstance in which the offer or solicitation is not authorized or is unlawful.

Prospectus Summary

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire prospectus, as well as the information to which we refer you, before deciding whether to invest in our common stock. You should pay special attention to the “Risk Factors” section of this prospectus to determine whether an investment in our common stock is appropriate for you.

This registration statement, including the exhibits and schedules thereto, contains additional relevant information about us and our securities. With respect to the statements contained in this prospectus regarding the contents of any agreement or any other document, in each instance, the statement is qualified in all respects by the complete text of the agreement or document, a copy of which has been filed or incorporated by reference as an exhibit to the registration statement.

About Ideal Power Inc.

Ideal Power Inc. develops power converters. Power converters convert electricity from one form to another form that a user may find more useful. There are two forms of electricity. “AC” power uses alternating current, in which the current and voltage reverse direction many times per second. “DC” power uses direct current, which does not reverse direction. All electronics, such as computers, phones, video, and anything else that uses a transistor, use DC power internally. Batteries and solar cells only provide DC power output. However, electric utilities and power grid operators only sell AC power, so users often need to convert between AC and DC power. Power converters provide AC-to-DC and DC-to-AC conversion, as well as voltage conversion.

One important function of many power converters is to provide electrical isolation between the DC and AC sides of power converters. Without isolation, a fault or short on the DC side can cause an AC fault, negatively affecting the wider power grid. Typical power converters utilize transformers to achieve this isolation; these transformers tend to add size and weight to power conversion systems and sap system efficiency.

Power converters that use switching transistor operations rather than transformer voltage conversion are commonly referred to as “electronic” power converters. We design and develop technologies that aim to improve key performance characteristics of electronic power converters. Our initial target markets will be commercial and industrial applications for solar or photovoltaic (“PV”) inverters, electrified vehicle (“EV”) DC charging, and customer-sited power grid energy storage. A PV inverter is a type of electronic power converter that converts DC power from solar panels into AC power used by the power grid. EV DC chargers convert AC power from the power grid into DC power to rapidly charge on-board vehicle batteries. Grid energy storage applications use bi-directional battery converters; these convert AC power into DC power to store energy in a DC battery, and also convert DC power from the battery back into AC power to be used on the power grid.

Our Power Packet Switching Architecture™ (“PPSA”) is a novel, patented power conversion technology. With PPSA, all of the power flows into and is temporarily stored in an AC link magnetic storage component, thereby allowing PPSA-enabled products to provide isolation similar to transformer-based power conversion systems without the size, weight, cost, and efficiency loss of using transformers.

We believe that PPSA can allow owners and operators of systems with a wide variety of power conversion needs to benefit from reduced costs and increased efficiency, reliability and flexibility.

We were incorporated in Texas on May 17, 2007. We converted to a Delaware corporation on July 15, 2013. The address of our corporate headquarters is 5004 Bee Creek Road, Suite 600, Spicewood, Texas 78669 and our telephone number is (512) 264-1542. Our website can be accessed at www.idealpower.com. The information contained on, or that may be obtained from, our website is not, and shall not be deemed to be, a part of this prospectus.

The Industry

Recent trends in the sources and uses of energy are driving demand for electronic power converters. These trends include the migration toward intermittent renewable resources, an increased consumer demand for EVs, and a growing need to improve power grid resiliency and enable low cost off-grid renewable power systems in remote locations. However, the power electronics systems used in these markets have limitations in size, weight, cost, safety, efficiency, flexibility and reliability. We believe PPSA can improve upon existing technology in all of these product metrics.

The existing technology landscape primarily consists of two alternatives: transformer-based inverters and transformer-less inverters. Transformer-based inverters have large, heavy, magnetic components, which have a relatively high cost in terms of manufacturing, shipping and installation. However, these inverters provide electrical isolation, which is needed to ground an electrical system. Transformer-less inverters are lighter than transformer-based inverters, which means they cost less to manufacture, ship and install. However, they do not provide electrical isolation, so they require additional safeguards to achieve best-of-class safety.

Currently, power conversion requires several bulky, inflexible devices. These include bulk capacitors, power switches, line reactors and isolation transformers. These components are heavy and expensive. In addition, they are often custom-built for fixed functions, making them inflexible and not scalable. This process also imposes high electrical and thermal stresses, which can create safety and reliability issues.

Our Proprietary Technology

With PPSA, power flows through, and is temporarily stored in, an AC link magnetic storage component. The power therefore moves like a packet, and the switching of that packet through the stages of the PPSA process is what gives Power Packet Switching Architecture its name. This means that the entire process of isolated power conversion can take place in a single PPSA enabled device. A brief outline of the process is as follows:

Stage One: The AC Link is charged from the input

Stage Two: The AC Link stores electrical energy and switches (rotates) the input voltage/current to match the output voltage/current requirements

Stage Three: The AC Link releases power to the output

We believe PPSA provides several benefits, many of which stem from the fact that PPSA requires fewer hardware components than conventional designs:

|

●

|

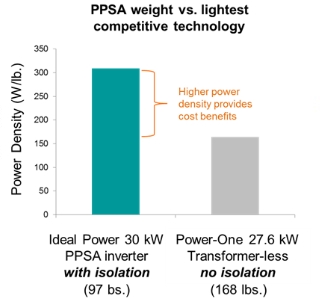

Improved power-to-weight ratio. This is another way of saying that PPSA can deliver the same power as a traditional inverter in a much smaller form factor and lower weight. Lower weight using standard materials can reduce material and manufacturing costs, as well as logistic costs of shipping, installation and maintenance. Our 30kW PPSA-enabled PV inverter has a power-to-weight ratio approximately 10 times higher than transformer-based PV inverters of similar power (which also provide isolation). It also has a power-to-weight ratio approximately two times higher than transformer-less PV inverters (which do not provide electrical isolation). Power One (one of the leaders in the power conversion space) currently offers a 27.6kW conventional transformer-less inverter that weighs 168 lbs., for a power-to-weight ratio of approximately 164 Watts/lb. Our 30 kW inverter weighs 97 lbs., for a power-to-weight ratio of approximately 309 Watts/lb. |

| |

|

|

●

|

Best-of-class safety without significant additional safeguards. The PPSA process provides electrical isolation between the input and the output without a transformer. This isolation means that PPSA systems can be grounded, so they achieve the same safety benefit as transformer-based inverters. Conventional transformer-less PV inverters generally cannot be grounded, and therefore must use other safeguards, increasing system expense. PPSA can provide this isolation without the size, weight, cost, and efficiency loss of using a transformer. |

| |

|

|

●

|

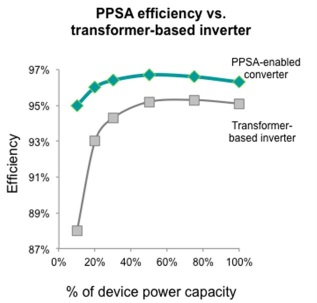

Greater efficiency. Efficiency is the measure of power out of the inverter as a percentage of the power into the inverter. High efficiency PV inverters use less power in the conversion process and supply more power for use. Our PPSA PV inverter was tested for efficiency by Intertek, a Nationally Recognized Testing Laboratory. Intertek’s results showed that our initial PV inverter product has a power conversion efficiency, defined as output power divided by input power, of 96.5% during normal operation. In several of our intended markets, competing systems may have power conversion losses twice as high as our PPSA products. |

| |

|

|

●

|

Greater scalability/flexibility. Based on our research and testing, we believe our PPSA technology can be scaled down to systems with power capacity as small as 10kW, which could be used in a home that requires conversion of DC power coming from a PV panel into AC current that is compatible with residential use and the utility grid power, or scaled up to utility-size systems of more than 1MW. Our current 30kW products are ideal for U.S. commercial and industrial applications, and are typically wall-mounted either indoors or outdoors. |

| |

|

|

●

|

Greater reliability. Because PPSA uses no electrolytic capacitors, it eliminates a critical point of failure of conventional systems. We believe this and other design features will lead to increased product robustness and reliability. We are working with Intertek to subject our products to industry standard reliability tests. These tests are partly funded by the U.S. Navy. |

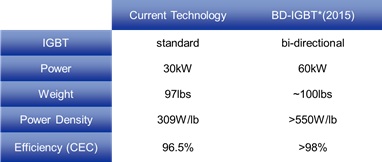

We are continuing to develop and extend the PPSA platform. This includes development work focused on bi-directional insulated gate bipolar transistors (“BD-IGBTs”) and other bi-directional power switches. We believe that using BD-IGBTs in our PPSA solution should yield further improvements in power density, manufacturing cost, and efficiency. The Department of Energy has awarded us a $2.5 million Advanced Research Projects Agency-Energy (“ARPA-E”) grant to develop and commercialize BD-IGBT power switches to improve the performance of our solutions. For a discussion of the economic terms and conditions of the ARPA-E grant, please see the discussion in the section of this prospectus titled “Management’s Discussion and Analysis of Results of Operations and Financial Condition – Critical Accounting Policies – Revenue Recognition”. We believe this funding will be sufficient to demonstrate the potential product improvements from this new power switch component technology. We have filed two provisional patent applications on a new technology approach to bi-directional switches optimized for PPSA.

In conjunction with the ARPA-E grant we received from the Department of Energy, we granted to the United States a license which:

| ● |

covers inventions that are related to the BD-IGBT and are made within the scope of the grant; |

| |

|

| ● |

is non-exclusive, nontransferable, irrevocable, and paid-up; and |

| |

|

| ● |

allows the United States to practice or have practiced (for or on behalf of the United States) such inventions. |

If we fail to disclose to the Department of Energy an invention made with grant funds that we disclose to patent counsel or for publication, or if we elect not to retain title to the invention, the United States may request that title to the subject invention be transferred to it. Any products that embody or use inventions conceived under the award must be manufactured substantially in the United States for any use or sale in the United States unless we can show, to the satisfaction of the Department of Energy, that it is not commercially feasible to do so. For a complete discussion of the rights reserved by the United States in this product, please see the discussion in the section of this prospectus titled, “Business-Rights of the United States”.

Our Business Model

Our business model is to license PPSA to original equipment manufacturers (“OEMs”). The types of OEMs that might be interested in using our products include subcontractors that would build our product designs for customers under license from us, as well as large commercial and industrial companies licensed by us to build the products to be sold under their own brands. Our goal is to share in the overall economic benefit with these OEMs; we expect this approach will allow us to save on staffing and working capital requirements.

We have designed and built our first two products: a 30kW PV inverter and a 30kW battery converter. These products demonstrate the capabilities of PPSA and can be licensed to OEMs. These products have met industry standards and, as of September 30, 2013, have been purchased by 24 commercial and government customers. Since our inception, our top ten customers measured by aggregate dollar value of purchase orders for our products have been Powin Energy, Ontility, Meridian Solar, Boulder Electric Vehicle, the U.S. Navy , Texas Solar Power Company, Lighthouse Solar, Saddleback Church, Global Energy Products, and Sharp. We are in the process of developing two more products that we plan to make available to OEMs: a 30kW 3-port hybrid converter and a 30kW micro-grid converter.

Our Target Markets

Our initial focus will be on three strategic markets: PV inverters, distributed grid energy storage using large batteries and EV DC charging. We have chosen these initial markets based on their size and growth and our time-to-market.

|

●

|

Solar PV inverter market: The PV inverter market is already large and still growing; industry analysts estimate it at $7.1 billion in 2012, with growth in the installed base from 30GW in 2012 to over 58GW in 2017 (a CAGR of 13.8%). Due to the oversupply of PV modules, both module costs and installed PV system costs have declined sharply in the past few years. In a growing number of applications and regions, PV is cost-effective when used in conjunction with conventional power generation even without government subsidies. This is particularly true for distributed power generation systems whose owners will also consume the electricity they generate. The decline in PV module and installation costs has increased demand for PV installations and other system components, such as PV inverters. |

| |

|

|

●

|

Our product for this market is our 30kW PV inverter. Our 30kW PV inverter weighs 97 pounds, compared to 1200 pounds for a typical transformer-based PV inverter. It also weighs about half as much as typical transformer-less PV inverters, which do not provide isolation and therefore need additional safeguards to meet US regulatory guidelines. This lighter weight reduces the manufacturing, shipping and installation cost of our 30kW PV inverter. As of September 30, 2013, we have sold this product to 14 different PV inverter installation companies. |

| |

|

|

●

|

Distributed grid energy storage market: This market is also growing extremely fast; industry analysts estimate that the North American market will grow from 1.4MW of PV systems with integrated storage in 2012 to 900MW in 2017, a CAGR of 264%. |

Our 30kW battery converter is our first product for this market. It is suitable for several emerging storage applications, including peak demand reduction. Our early customers for this application include Sharp and Powin Energy. We have also made commercial off the shelf sales to government customers including NREL and the U.S. Navy.

Our next product for this market will be our 3-port hybrid converter, which will integrate PV with grid energy storage. We also plan to develop a 3-port micro-grid converter (expected Q4 2014) that will require new embedded software supporting emergency power and off-grid power capabilities. Although these products are still in development, we expect they will allow our customers to use our systems to lower the cost of combined PV and batteries for emergency backup power or to operate them in remote off-grid installations.

|

●

|

EV DC charging market: The DC charging market is sometimes called the fast-charging market, as it can reduce charge time for a standard electric vehicle from 8 hours to 30 minutes. This market is growing quickly, spurred on by EV manufacturers such as Tesla and Nissan; industry analysts estimate that EV DC or fast charger shipments will grow from 9,000 in 2012 to 98,000 in 2020. |

Our 30kW battery converter is our first product for this market. NREL in Colorado, along with several early commercial customers in pilot installations, is using this product to buffer or reduce the intermittency of high power loads seen by the utility grid. We believe the efficiency, flexibility and cost benefits of PPSA will contribute to the spread of DC charging stations. Our next product for this market will be a 30kW hybrid converter, which we will design to exploit the multi-port capabilities of PPSA and to integrate DC charging with PV or stationary battery storage.

NRG Energy, Inc. (“NRG”) is the largest competitive generator of electricity in the U.S., with 47GW of generation assets. Through NRG’s agreement with the California Public Utilities Commission (“CPUC”), NRG anticipates investing $100 million over the next four years in the eVgo California charging network including 200 Freedom Stations with DC charging, and a Technology Demonstration Program. On July 3, 2013 NRG submitted a $1.9 million proposal for a Modular Micro-Grid DC Charging Technology Demonstration Program to the CPUC. This proposal contemplates developing and demonstrating a new EV DC charging solution using our 30kW 2-port battery converter and 3-port hybrid converter. After successful technical and economic demonstration, NRG intends to deploy these solutions, including our 3-port hybrid converter, into its broad EV charging station rollout.

We believe there is strong market demand to cost effectively integrate buffer batteries and distributed PV generation with EV charging infrastructure. NRG’s proposal to the CPUC states that the modular micro-grid platform using our 3-port hybrid converter and our micro-grid converter will save installation costs, operational costs and create new value streams for the host and power grid operator. According to NRG, the additional flexibility and functionality of this platform should lower total lifetime cost of ownership of EV DC charging infrastructure, thereby accelerating NRG’s deployment of charging infrastructure and customer adoption of EVs.

|

●

|

Other markets: We plan to continue to evaluate new markets for PPSA based on their size and growth and our time-to-market. We are studying PPSA’s applicability to markets such as variable frequency drives for AC motors, uninterruptible power supply, combined utility-scale PV and grid energy storage systems, and solid state transformers. |

Reverse Stock Split and Offering Requirements

We will close this offering only if our listing application is approved by the Nasdaq Capital Market. If we are unable to meet this requirement, we will terminate the offering.

On June 13, 2013, our board of directors, and on July 5, 2013, stockholders holding a majority of our outstanding voting power, approved resolutions authorizing our board of directors to effect a reverse split of our common stock at an exchange ratio of between one-for-two and one-for-ten, with our board of directors retaining the discretion as to whether to implement the reverse split and which exchange ratio to implement. The reverse stock split is intended to allow us to meet the minimum share price requirement of The Nasdaq Capital Market. During August 2013, our board of directors determined that following the effectiveness of the registration statement, of which this prospectus is a part, and prior to the closing of this offering, the board of directors will effect the reverse stock split at a ratio of 1 share for each 2.381 shares.

Except as otherwise indicated and except in our financial statements, all information regarding share amounts of common stock and prices per share of common stock contained in this prospectus assume the consummation of the reverse stock split to be effected following effectiveness of the registration statement, of which this prospectus is a part, and prior to the closing of this offering.

Status as an Emerging Growth Company

We are an “emerging growth company” as that term is defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Section 102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement declared effective under the Securities Act of 1933 or do not have a class of securities registered under the Securities Exchange Act of 1934) are required to comply with the new or revised financial accounting standard. The JOBS Act also provides that a company can elect to opt out of the extended transition period provided by Section 102(b)(1) of the JOBS Act and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. We have irrevocably elected to opt out of this extended transition period provided by Section 102(b)(1) of the JOBS Act, and we have not utilized any provisions of the JOBS Act to date. Even though we have elected to opt out of the extended transition period, we may still take advantage of all of the other provisions of the JOBS Act.

Ability to Continue our Operations

We experienced net losses of $4,647,219 and $1,750,939 for the years ended December 31, 2012 and 2011, respectively. At December 31, 2012, our net loss from inception was $7,200,514. Net loss for the nine month period ended September 30, 2013 was $ 5,976,729 , which increased our accumulated net losses from inception to $ 13,177,243 as of September 30, 2013.

We will need financing to continue our operations, particularly for the support of our research and development efforts. We have no committed sources of capital and do not know whether additional financing will be available when needed on terms that are acceptable, if at all. The failure to satisfy our capital requirements will adversely affect our business, financial condition, results of operations and prospects.

Unless we raise funds in this offering, we will not have sufficient capital to continue our operations for the next 12 months. Even if we raise funds in this offering, they may be insufficient to sustain our operations for the next 12 months if our costs are higher than projected or unforeseen expenses arise.

Convertible Promissory Notes

We have issued $750,000 in senior secured convertible promissory notes that must be paid or converted into shares of our common stock on or before July 29, 2014, $4 million in senior secured convertible promissory notes that must be paid or converted into shares of our common stock on or before January 6, 2014, and $1.355 million in convertible promissory notes that must be paid or converted into shares of our common stock on or before December 31, 2013. (The maturity date of $4 million in principal amount of our senior secured convertible promissory notes has been extended from November 21, 2013 to January 6, 2014 by action taken on October 25, 2013 by our board of directors and holders of a majority in interest in principal amount of the notes.) Collectively, we refer to these promissory notes as the “Convertible Notes” in this prospectus. Upon consummation of a public offering of our common stock yielding gross proceeds of at least $10 million in this offering, all of the Convertible Notes mandatorily will be converted in full into shares of our common stock, therefore, our disclosures in this prospectus assume full conversion of the Convertible Notes into 1,695,216 shares of our common stock.

Contentions with Respect to Patents

On October 4, 2013 we received a letter from a competitor alleging that the system architecture that appears on our website “appears” to infringe on patents licensed to or held by the competitor. We have investigated this claim and we have determined that the allegation is without merit. However, if we cannot resolve this matter, the cost to us of any litigation or other proceeding relating to intellectual property rights, even if resolved in our favor, could be substantial, and the litigation would divert management’s attention from our day-to-day operations.

Changes to Management

As a result of our change from a private company to a company reporting to the Securities and Exchange Commission, we intend to make certain changes in management. We are actively seeking a Chief Executive Officer with public company experience. Once we retain the services of the new Chief Executive Officer following the completion of this offering, we expect Paul Bundschuh to assume the positions of President and Vice-President of Business Development. We also expect Mr . Bundschuh to resign from the board at such time. On November 6, 2013 we entered into an agreement with Christopher Cobb, whereby he resigned as our President, Chief Operating Officer and director. Our board of directors plans to appoint our Chief Technology Officer, William Alexander, and our new Chief Executive Officer to fill the vacancies created by the resignations of Messrs. Bundschuh and Cobb. On October 21, 2013 we retained the services of Timothy W. Burns as our Chief Financial Officer. For a more complete discussion of the changes that we have made or expect to make to management, please see the discussion included in this prospectus titled “Directors, Executive Officers and Corporate Governance – Future Changes to Management”.

Risks Related to Our Business

Our business is subject to a number of risks. You should understand these risks before making an investment decision. If any of these risks actually occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. Below is a summary of some of the principal risks we face. The risks are discussed more fully in the section of this prospectus below titled “Risk Factors.”

|

·

|

We have a limited operating history and it is uncertain whether we will ever be profitable. We anticipate future losses and negative cash flow, which may limit or delay our ability to become profitable.

|

|

·

|

We may raise additional financing by issuing new securities that may have terms or rights superior to those of our shares of common stock, which could adversely affect the market price of our shares of common stock and our business.

|

|

·

|

If we do not receive additional financing when and as needed in the future, we may not be able to continue our research and development efforts or accelerate the commercialization of our technology and materials.

|

|

·

|

If we are unable to keep up with rapid technological changes, our technology may become obsolete.

|

|

·

|

We may be unable to protect our intellectual property.

|

|

·

|

We may not be able to reach production scales that are required to maintain manufacturing costs low enough to become profitable.

|

|

·

|

We may not be able to convince customers to buy or to license our products due to our limited history.

|

|

·

|

We may have significant reliability problems with our products, requiring extensive recalls and repair costs.

|

|

·

|

We will face extensive competition from better-established power converter manufacturers.

|

THE OFFERING

The following summary contains basic information about our initial public offering and our common stock and is not intended to be complete. It does not contain all of the information that may be important to you. For a more complete understanding of our common stock, please refer to the section of this prospectus titled “Description of Capital Stock.”

|

Issuer

|

|

Ideal Power Inc., a Delaware corporation.

|

| |

|

|

|

Common Stock Offered By Us

|

|

2,500,000 shares of common stock, par value $0.001 per share.

|

| |

|

|

|

Over-allotment Option

|

|

We have granted an option to our underwriter to purchase up to an additional 375,000 shares of common stock within 45 days of the date of this prospectus in order to cover over-allotments, if any.

|

| |

|

|

|

Common Stock Outstanding Prior To This Offering

|

|

1,480,262 shares of common stock (1)

|

| |

|

|

|

Common Stock Outstanding After This Offering

|

|

5,700,357 shares of common stock (1)(2)(3)

|

| |

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from our sale of common stock in this offering as follows: approximately $4.5 million will be used for new product research and development, approximately $2 million will be used for existing product development and commercialization, approximately $1 million will be used for the protection of our intellectual property, approximately $1 million will be used for the purchase of equipment and software, and the balance of the funds will be used for general corporate purposes. See “Use of Proceeds” and “Plan of Operation” in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional information.

|

| |

|

|

|

Market And Trading Symbol For The Common Stock

|

|

There is currently no market for our common stock. We have applied for listing of our common stock on the Nasdaq Capital Market under the symbol “IPWR”.

|

| |

|

|

|

Underwriter Common Stock Purchase Warrant

|

|

In connection with this offering, we have also agreed to sell to MDB Capital Group, LLC and its designees a warrant to purchase up to 10% of the shares of common stock sold in this offering. If this warrant is exercised, each share may be purchased by MDB Capital Group, LLC at $6.25 per share (125% of the price of the shares sold in this offering.) This warrant will have a five-year term and be subject to a six-month lock-up. See “Underwriting - Managing Underwriter Warrant” for additional information.

|

|

Lock-Up Agreements

|

|

Excluding holders of our senior secured convertible promissory notes, our officers, directors and employees, and 5% or greater holders of our equity securities as determined pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended, will have the securities they own locked up until the first anniversary of the Underwriting Agreement we will enter into with MDB Capital Group, LLC in conjunction with this offering (the “One Year Lock-Up”). The purchasers of our senior secured convertible promissory notes, including MDB Capital Group, LLC, are subject to lock-up requirements for periods that may last no more than 180 days following the date of this prospectus (the “180 Days Lock-Up”). The number of currently outstanding shares of common stock subject to the One Year Lock-Up totals 1,249,012 shares and the number of shares underlying options, warrants, and convertible promissory notes subject to the One Year Lock-Up as of September 30, 2013, totals 721,795 shares. The number of shares of common stock to be issued to, or that may be acquired by, the holders of our senior secured convertible promissory notes and MDB Capital Group, LLC that will be subject to the 180 Days Lock-Up totals 2,167,472 shares. For more information about the lock-up agreements and requirements, see the section titled “Underwriting - Lock-Up Agreements” in this prospectus.

|

|

Offering Termination

|

|

If we fail to obtain approval from The Nasdaq Stock Market to list our common stock on the Nasdaq Capital Market, we will not complete the offering.

|

| |

|

|

|

(1)

|

The number of shares of our common stock to be outstanding both before and after this offering is based on the number of shares outstanding as of September 30, 2013 and excludes:

|

| |

|

| |

●

|

504,919 shares of our common stock reserved for issuance under outstanding option agreements;

|

| |

●

●

|

493,172 shares of our common stock reserved for future issuance under our 2013 Equity Incentive Plan;

1,529,095 shares of our common stock reserved for issuance under outstanding warrant agreements; and

|

| |

●

|

250,000 shares of our common stock issuable upon exercise of the warrant issued to MDB Capital Group, LLC.

|

| (1) |

Unless otherwise specifically stated, information throughout this prospectus assumes that none of the outstanding options or warrants to purchase shares of our common stock are exercised.

|

|

(2)

|

Unless otherwise indicated, the number of shares of common stock presented in this prospectus excludes shares issuable pursuant to the exercise of the underwriter’s over-allotment option.

|

|

(3)

|

This number includes 2,500,000 shares of common stock that will be issued in this offering, 1,695,216 shares of common stock that will be issued to the holders of the Convertible Notes upon the completion of this offering, and 24,879 shares of common stock to be issued to our independent directors as compensation for their services.

|

SUMMARY SELECTED FINANCIAL INFORMATION

The table below includes historical selected financial data for each of the years ended December 31, 2012 and 2011, derived from our audited financial statements included elsewhere in this prospectus. The table below also includes historical financial data for the nine-month periods ended September 30, 2013 and 2012, derived from our unaudited financial statements included elsewhere in this prospectus.

You should read the historical selected financial information presented below in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and our financial statements and the notes to those financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period.

| |

|

For the Years Ended December 31,

|

|

|

For the Nine Months Ended September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2013

|

|

|

2012

|

|

| |

|

|

|

|

|

|

|

unaudited

|

|

unaudited

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

STATEMENT OF OPERATIONS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$ |

1,126,907 |

|

|

$ |

860,771 |

|

|

$ |

1,638,586 |

|

|

$ |

611,863 |

|

|

Costs of revenues

|

|

|

957,641 |

|

|

|

757,393 |

|

|

|

1,545,299 |

|

|

|

509,369 |

|

|

Gross Profit

|

|

|

169,266 |

|

|

|

103,378 |

|

|

|

93,287 |

|

|

|

102,494 |

|

|

Operating expenses

|

|

|

3,207,573 |

|

|

|

1,616,060 |

|

|

|

2,582,214 |

|

|

|

1,745,329 |

|

|

Loss from operations

|

|

|

(3,038,307 |

) |

|

|

(1,512,682 |

) |

|

|

(2,488,927 |

) |

|

|

(1,642,835 |

) |

|

Interest expense, net

|

|

|

(1,608,912 |

) |

|

|

(238,257 |

) |

|

|

(3,487,802 |

) |

|

|

(635,593 |

) |

|

Net loss

|

|

$ |

(4,647,219 |

) |

|

$ |

(1,750,939 |

) |

|

$ |

(5,976,729 |

) |

|

$ |

(2,278,428 |

) |

|

Basic and diluted net loss per share

|

|

$ |

(1.33 |

) |

|

$ |

(0.53 |

) |

|

$ |

(1.70 |

) |

|

$ |

(0.65 |

) |

|

Weighted average number of basic and diluted common shares outstanding

|

|

|

3,489,963 |

|

|

|

3,282,520 |

|

|

|

3,524,505 |

|

|

|

3,484,960 |

|

|

Pro forma basic and diluted net loss per share - after reverse stock split

|

|

$ |

(3.17 |

) |

|

$ |

(1.27 |

) |

|

$ |

(4.04 |

) |

|

$ |

(1.56 |

) |

|

Pro forma weighted average number of basic and diluted common shares outstanding - after reverse stock split

|

|

|

1,465,755 |

|

|

|

1,378,631 |

|

|

|

1,480,262 |

|

|

|

1,463,654 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, 2012

|

|

|

December 31, 2011

|

|

|

September 30, 2013 (unaudited) |

|

|

|

BALANCE SHEET DATA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,972,301 |

|

|

$ |

100,675 |

|

|

$ |

278,784 |

|

|

|

|

|

|

Working capital (deficit)

|

|

|

528,603 |

|

|

|

(61,437 |

) |

|

|

(4,462,607 |

) |

|

|

|

|

|

Total assets

|

|

|

3,207,003 |

|

|

|

579,853 |

|

|

|

2,750,735 |

|

|

|

|

|

|

Total liabilities

|

|

|

3,308,397 |

|

|

|

1,750,750 |

|

|

|

7,752,827 |

|

|

|

|

|

|

Total stockholders’ deficit

|

|

|

(101,394 |

) |

|

|

(1,170,897 |

) |

|

|

(5,002,092 |

) |

|

|

|

|

RISK FACTORS

We are subject to various risks that may materially harm our business, prospects, financial condition and results of operations. An investment in our common stock is speculative and involves a high degree of risk. In evaluating an investment in shares of our common stock, you should carefully consider the risks described below, together with the other information included in this prospectus.

If any of the events described in the following risk factors actually occurs, or if additional risks and uncertainties that are not presently known to us or that we currently deem immaterial later materialize, then our business, prospects, results of operations and financial condition could be materially adversely affected. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment in our shares. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risks Related to Our Business

We lack an established operating history on which to evaluate our business and determine if we will be able to execute our business plan, and we can give no assurance that our operations will result in profits.

We were formed in Texas on May 17, 2007 and converted to a Delaware corporation on July 15, 2013; therefore, we have a limited operating history that makes it difficult to evaluate our business. We have been granted patents by the United States of America and we have currently pending patent applications with the United States Patent and Trademark Office and equivalent offices in the European Union, India, Malaysia, Singapore, the Philippines, South Korea, China, Brazil and Canada for a power converter technology and our methods of operation, as well as various improvements on and applications of our basic power converter design. We have also had our designs validated by UL certifications from Intertek, the California Energy Commission, and several photovoltaic (“PV”) inverter installations. However, we have only recently begun sales of our products, and we cannot say with certainty when we will begin to achieve profitability. No assurance can be made that we will ever become profitable.

We have incurred losses in prior periods and expect to incur losses in the future. We may never be profitable.

Our independent registered public accounting firm has issued an unqualified opinion with an explanatory paragraph to the effect that there is substantial doubt about our ability to continue as a going concern. This unqualified opinion with an explanatory paragraph could have a material adverse effect on our business, financial condition, results of operations and cash flows. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources” and Note 2 to our financial statements included elsewhere in this prospectus.

Since our inception on May 17, 2007 through December 31, 2012, we sustained $7,200,514 in net losses and we had net losses at December 31, 2012 and 2011 of $4,647,219 and $1,750,939, respectively. We expect to continue to sustain losses for the foreseeable future. Net loss for the nine months ended September 30, 2013 was $5,976,729 , which increased the accumulated net losses to $13,177,243 as of September 30, 2013.

We began product sales in 2011 and shipped 14 units for $165,000. In 2012 we shipped 25 units for $266,000. During the first nine months of 2013, we shipped 36 units for $348,000 . We also sold $ 23,000 in PV combiners. As sales of our products have generated minimal operating revenues, we have relied on sales of our debt securities to continue our operations. If we are unable to raise funds through sales of our securities, there can be no assurance that we will be able to implement our business plan, generate sustainable revenue or ever achieve profitable operations. We expect to have operating losses until such time as we develop a substantial and stable revenue base. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future.

To date we have had a limited number of customers. We cannot assure you that our customer base will increase.

Two customers, the Department of Energy and Lockheed Martin Corporation (“LMC”), from which we have received, since inception, approximately $ 1,861,000 and $ 1,276,000 , respectively, in revenues, and in 2012 $694,000 and $153,900, respectively, accounted for 75% of net revenue for the year ended December 31, 2012. Two customers, LMC and Meridian Solar, from which we received $669,000 and $82,250, respectively, in net revenues, accounted for 87% of net revenues for the year ended December 31, 2011. The contract revenue from LMC declined in 2012, since the project required lower levels of our services. We had five contracts with LMC pursuant to which we provided technical support and test products to its staff. We completed the last of the contracts in the first half of 2012; no additional contract work from LMC is anticipated. Separate from the work for the Department of Energy and LMC, the Company sold its products to eleven customers in 2012.

We may not be able to meet our product development and commercialization milestones.

Product development and testing are subject to unanticipated and significant delays, expenses and technical or other problems. We cannot guarantee that we will successfully achieve our milestones within our planned timeframe or ever. Our plans and ability to achieve profitability depend on acceptance of our technology and our products by key market participants, such as vendors and marketing partners, and potential end-users of our products. We continue to educate designers and manufacturers about our solar PV inverters, grid-battery converters, and electrified vehicle (“EV”) charging infrastructure. More generally, the commercialization of our products may also be adversely affected by many factors not within our control, including:

|

·

|

the willingness of market participants to try a new product and the perceptions of these market participants of the safety, reliability, functionality and cost effectiveness of our products;

|

|

·

|

the emergence of newer, possibly more effective technologies;

|

|

·

|

the future cost and availability of the raw materials and components needed to manufacture and use our products; and

|

|

·

|

the adoption of new regulatory or industry standards that may adversely affect the use or cost of our products.

|

Accordingly, we cannot predict that our products will be accepted on a scale sufficient to support development of mass markets for them.

We must achieve design wins to retain our existing customers and to obtain new customers, although design wins achieved do not necessarily result in substantial sales.

The constantly changing nature of technology in the markets we serve causes equipment manufacturers to continually design new systems. We must work with these manufacturers early in their design cycles to modify our equipment or design new equipment to meet the requirements of their new systems. Manufacturers typically choose one or two vendors to provide the components for use with the early system shipments. Selection as one of these vendors is called a design win. It is critical that we achieve these design wins in order to retain existing customers and to obtain new customers.

We believe that equipment manufacturers often select their suppliers based on factors including long-term relationships and end user demand. Accordingly, we may have difficulty achieving design wins from equipment manufacturers who are not currently our customers. In addition, we must compete for design wins for new systems and products of our existing customers, including those with whom we have had long-term relationships. Our efforts to achieve design wins are time consuming, expensive, and may not be successful. If we are not successful in achieving design wins, or if we do achieve design wins but our customers’ systems that utilize our products are not successful, our business, financial condition, and results of operations could be materially and adversely impacted.

Once a manufacturer chooses a component for use in a particular product, it is likely to retain that component for the life of that product. Our sales and growth could experience material and prolonged adverse effects if we fail to achieve design wins. However, design wins do not always result in substantial sales, as sales of our products are dependent upon our customers’ sales of their products.

The prototype of our new 3-port hybrid converter may not provide the results we expect, may prove to be too expensive to produce and market, or may uncover problems of which we are currently not aware, any of which could harm our business and prospects.

We are currently developing our prototype of a 3-port hybrid converter, which is an integrated solar PV inverter and battery charger/inverter, based on improvements to our current PV inverter products. We do not yet know if the prototype will produce positive results consistent with our expectations. The prototype may also cost significantly more than expected, and the prototype design and construction process may uncover problems of which we are currently not aware. These and other prototypes of emerging products are a material part of our business plan, and if they are not proven to be successful, our business and prospects could be harmed.

We have received grant funds from the United States for the development of a bidirectional insulated gate bipolar transistor (“BD-IGBT”). In certain instances, the United States may obtain title to the invention. If we were to lose title to the BD-IGBT, we may have to pay to license it from the United States in order to use it in future products. If we were unable to license the BD-IGBT from the United States, it could slow down our product development.

In conjunction with the Advanced Research Projects Agency-Energy (“ARPA-E”) grant we received from the Department of Energy, we granted to the United States a non-exclusive, nontransferable, irrevocable, paid-up license to practice or have practiced for or on behalf of the United States inventions related to the BD-IGBT and made within the scope of the grant. If we fail to disclose to the Department of Energy an invention made with grant funds that we disclose to patent counsel or for publication, or if we elect not to retain title to the invention, the United States may request that title to the subject invention be transferred to it.

We also granted “march-in-rights” to the United States in connection with any BD-IGBT inventions in which we choose not to retain title, if those inventions are made under the ARPA-E grant. Pursuant to the march-in-rights, the United States has the right to require us, any person to whom we have assigned our rights, or any exclusive licensee to grant a non-exclusive, partially exclusive, or exclusive license in any field of use to a responsible applicant upon terms that are reasonable. If the license is not granted as requested, the United States has the right to grant the license if it determines that we have not achieved practical application of the invention in the field of use, the action is necessary to alleviate health or safety needs, the action is necessary to meet requirements for public use specified by Federal regulations and such requirements have not been satisfied, or the action is necessary because an agreement to manufacture the invention in the United States has not been obtained or waived or because any such agreement has been breached.

If we lost title to the United States as a result of any of these events, we would have to pay to license the BD-IGBT from the United States. If we were unable to license the BD-IGBT from the United States, it could slow down our product development.

We have entered into a Cooperative Research and Development Agreement with the National Renewable Energy Lab (“NREL”). Under that agreement, the United States Government and NREL will have licenses to inventions made under that contract.

As we announced in May 2013, we have entered into a Cooperative Research and Development Agreement (“CRADA”) with NREL. The CRADA provides that NREL and the Company will jointly develop and demonstrate a hybrid power converter system which includes bi-directional electric vehicle charging, photovoltaic generation, and stationary battery storage using our 3-port hybrid converter. Together with NREL, we will also jointly investigate synergies in tightly integrating these separate power conversion systems.

The United States retains a nonexclusive, nontransferable, irrevocable, paid-up license to practice or to have practiced for or on behalf of the United States every invention made under this CRADA. The same licensing terms may apply to NREL’s operator, the Alliance for Sustainable Energy LLC.

This agreement also grants “march-in-rights” to the United States in connection with any inventions made under this contract in which we choose not to retain title, if those inventions are made under the CRADA contract. Pursuant to the march-in-rights, the United States has the right to require us, any person to whom we have assigned our rights, or any exclusive licensee to grant a non-exclusive, partially exclusive, or exclusive license in any field of use to a responsible applicant upon terms that are reasonable. If the license is not granted as requested, the United States has the right to grant the license if it determines that we have not achieved practical application of the invention in the field of use, the action is necessary to alleviate health or safety needs, the action is necessary to meet requirements for public use specified by Federal regulations and such requirements have not been satisfied, or the action is necessary because an agreement to manufacture the invention in the United States has not been obtained or waived or because any such agreement has been breached.

We do not expect to make any inventions under the CRADA.

As we continue to grow and to develop our intellectual property, we expect to attract threats from patent monetization firms or competitors alleging infringement. We may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual property rights.

As we continue to grow and to develop our intellectual property, we expect to attract threats from patent monetization firms or competitors alleging infringement of intellectual property rights. For example, on October 4, 2013 we received a letter from a competitor alleging that the system architecture that appears on our website “appears” to infringe on patents licensed to or held by the competitor. We have investigated this claim and we have determined that the allegation is without merit. However, if we cannot resolve this matter, the cost to us of any litigation or other proceeding relating to intellectual property rights, even if resolved in our favor, could be substantial, and the litigation would divert management’s attention from our day-to-day operations. Some of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources. If we do not prevail in this type of litigation, we may be required to: pay monetary damages; stop commercial activities relating to our product; obtain one or more licenses in order to secure the rights to continue manufacturing or marketing certain products; or attempt to compete in the market with substantially similar products. Uncertainties resulting from the initiation and continuation of any litigation could limit our ability to continue some of our operations. In addition, a court may require that we pay expenses or damages, and litigation could disrupt our commercial activities.

We expect to license our technology in the future; however the terms of these agreements may not prove to be advantageous to us. If the license agreements we enter into do not prove to be advantageous to us, our business and results of operations will be adversely affected.

Our goal is to license our technology to our customers. However, we may not be able to secure license agreements with customers on terms that are advantageous to us. Furthermore, the timing and volume of revenue earned from license agreements will be outside of our control. If the license agreements we enter into do not prove to be advantageous to us, our business and results of operations will be adversely affected.

We have not devoted significant resources towards the marketing and sale of our products and we continue to rely on the marketing and sales efforts of third parties whom we do not control.

To date, we have sold low volumes of our solar PV inverter and battery converter products and, even after adding industry veterans to our staff, we continue to experience a learning curve in the marketing and sale of products on a commercial basis. We expect that the marketing and sale of these products will continue to be conducted by a combination of independent manufacturers’ representatives, third-party strategic partners, distributors, or original equipment manufacturers (“OEMs”). Consequently, commercial success of our products will depend to a great extent on the efforts of others. We intend to enter into strategic marketing and distribution agreements or other collaborative relationships to market and sell our solar PV inverter, battery converter and other value added products. However, we have not entered into any strategic marketing or material distribution agreements at this time. We have entered into one distribution agreement with a large electrical equipment distributor, but have not sold any products through that distributor thus far. We may not be able to identify or establish appropriate relationships in the near term or in the future. We can give no assurance that these distributors or OEMs will focus adequate resources on selling our products or will be successful in selling them. In addition, third-party distributors or OEMs have or may require us to provide volume price discounts and other allowances, customize our products or provide other concessions that could reduce the potential profitability of these relationships. Failure to develop sufficient distribution and marketing relationships in our target markets will adversely affect our commercialization schedule and to the extent we have entered or enter into such relationships, the failure of our distributors and other third parties to assist us with the marketing and distribution of our products, or to meet their monetary obligations to us, may adversely affect our financial condition and results of operations.

A material part of our success depends on our ability to manage our suppliers and manufacturers. Our failure to manage our suppliers and manufacturers could materially and adversely affect our results of operations and relations with our customers.

We rely upon suppliers to provide the components necessary to build our products and on contract manufacturers to produce our products. There can be no assurance that key suppliers and manufacturers will provide components or products in a timely and cost efficient manner or otherwise meet our needs and expectations. Our ability to manage such relationships and timely replace suppliers and manufacturers, if necessary, is critical to our success. Our failure to timely replace our contract manufacturers and suppliers, should that become necessary, could materially and adversely affect our results of operations and relations with our customers.

We may in the future add production capabilities that would subject us to numerous additional risks and could adversely affect our business, financial condition, results of operations and prospects.

We currently rely on third parties to produce our products, but we may in the future add production capabilities and produce products ourselves. Adding production to our operations would subject us to numerous additional risks, including:

|

·

|

the need to use significant capital resources for equipment purchases;

|

|

·

|

increases to our operating expenses to add personnel and expertise to effectively and efficiently manufacture products;

|

|

·

|

inaccurate estimates of customer demand for our products and the resources needed to meet customer demand; and

|

|

·

|

diversion of management’s attention from other aspects of our business.

|

If we expand our business to produce our own products, we cannot assure you that we will be able to produce our products in a profitable manner or at all. If we add production capabilities and any of the risks above are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Our business is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flows in the future. We will require additional financing in order to sell our current products and to continue the research and development required to produce our next generation of products. We anticipate that we will need approximately $5 million during the next 12 months to sustain our business operations, including our research and development activities. We may not be able to obtain financing on commercially reasonable terms or at all. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

In conjunction with an award we received through the State of Texas, we have granted the Office of the Governor, Economic Development and Tourism (“OOGEDT”), a security interest in all of our assets. If we breach the award agreement and do not repay the award funds, the OOGEDT will be entitled to exercise its right to foreclose on our assets. If that were to happen, your investment would become worthless.

On October 1, 2010, we received a Texas Emerging Technology Fund Award in the amount of $1 million through the OOGEDT. If we are in breach of the terms of the award because, for example, we move our operations to a jurisdiction other than Texas, we fail to continue our business, or because the Office of the Governor finds that we made false or misleading statements to the OOGEDT to induce that office to make the award, the OOGEDT may demand repayment of the award funds that have been disbursed, which currently total $ 1,192,690 as of September 30, 2013. The OOGEDT has taken a security interest in our assets to secure the repayment of the funds in the event that we breach the terms of the award. If we breach the terms of the award and fail to repay the award funds, the OOGEDT would be entitled to exercise its right to foreclose on our assets. If that were to happen, your investment would become worthless.

The economic downturn in the United States has adversely affected, and is likely to continue affecting, our ability to raise capital, which may potentially impact our ability to continue our operations.

As a company that is still in the process of developing its technology, we must rely on raising funds from investors to support our research and development activities and our operations. The economic downturn in the United States has resulted in a tightening of the credit markets, which has made it more difficult to raise capital. If we are unable to raise funds as and when we need them, we may be forced to curtail our operations or even cease operating altogether.

We are subject to credit risks.