Exhibit 10.1

SEPARATION AND RELEASE AGREEMENT

This Separation and Release Agreement (this “Agreement”) is made and entered into as of November 27, 2013, by and between Charles De Tarr (“you” or “your”) and Ideal Power Inc., a Delaware corporation (the “Company”). You and the Company are sometimes each referred to herein as a “Party” and collectively, as the “Parties”.

RECITALS

WHEREAS, you and the Company desire to separate from their business relationship as provided herein.

NOW, THEREFORE, in consideration of the premises and mutual promises herein contained, it is agreed as follows:

AGREEMENT

1. You and the Company understand and agree that neither the making of this Agreement nor the fulfillment of any condition or obligation of this Agreement constitutes an admission of any liability or wrongdoing by the Company, you, any Company Releasee (as defined below) or any Employee Releasee (as defined below).

2. You and the Company expressly acknowledge and agree that this Agreement, including all exhibits attached to it: (i) is the final, complete and exclusive statement of the agreement of the Parties with respect to the your separation from the Company; (ii) supersedes any prior or contemporaneous agreements, promises, representations, understandings, course of dealing, or terms of any kind, oral or written, with respect to your separation from the Company, including, without limitation, any representations made to you by any executive officer or director of the Company (collectively and severally, the “Prior Agreements”), and that any such Prior Agreements are of no force or effect except as expressly set forth herein; and (iii) may not be varied, supplemented or contradicted by evidence of Prior Agreements, or by evidence of subsequent oral agreements. Any agreement hereafter made shall be ineffective to modify, supplement or discharge the terms of this Agreement, in whole or in part, unless such agreement is in writing and signed by the Party against whom enforcement of the modification or supplement is sought.

3. As of November 27, 2013 (the “Separation Date”) your employment with the Company, including any and all offices you hold with the Company (including without limitation your office of Vice-President, Finance) will be terminated.

4. You acknowledge that:

(a) You have been advised by the Company to consult with the attorney of your choice prior to signing this Agreement.

(b) You have been given a period of at least twenty-one days within which to consider this Agreement.

(c) You would not be entitled to receive the consideration offered to you in Section 7 and Section 10 below but for your signing this Agreement.

(d) You may revoke this Agreement within seven days after the date you sign it by providing written notice of the revocation to the Company no later than the seventh day after you sign it. It is understood and agreed that any notice of revocation received by the Company after the expiration of this seven day period shall be null and void.

5. It is further expressly agreed by you and the Company that this Agreement shall not become effective or enforceable and the consideration referred to in Section 7 below and elsewhere herein will not be paid until the seven day revocation period described in Section 4(d) above has expired. Therefore, it is expressly agreed by the Parties that the “Effective Date” of this Agreement is the first day after the date the seven day revocation period has expired.

6. You represent that you have consulted or have had sufficient opportunity to discuss with any person, including the attorney of your choice, all provisions of this Agreement, that you have carefully read and fully understand all the provisions of this Agreement, that you are competent to execute this Agreement, and that you are voluntarily entering into this Agreement of your own free will and accord, without reliance upon any statement or representation of the Company or its representatives.

7. For the purpose of the following discussion, the number of shares and the per share exercise prices do not reflect the proposed reverse stock split that the Company will effect prior to the consummation of the initial public offering of its common stock (the “IPO”). Provided that you do not revoke this Agreement and that you comply with your obligations hereunder, the Company agrees to:

allow you to purchase 7,000 shares of the Company’s common stock, at a per share exercise price of $5.00 (the “July 2013 Option”), covered by the stock option grant for the purchase of 21,000 shares of common stock made pursuant to that certain Notice of Grant of Stock Option dated July 19, 2013.

allow you to purchase 26,743 shares of the Company’s common stock, at a per share exercise price of $0.416675, covered by the stock option grant issued on January 31, 2009 (the “January 2009 Option”). Collectively, the right to purchase the 7,000 shares and the right to purchase the 26,743 shares shall be referred to as the “Post Separation Option”.

The Post-Separation Option will have a term of 24 months, as to the July 2013 Option, and a term that ends on January 31, 2022 as to the January 2009 Option. The term will start on the earlier of the date of the consummation of the IPO or January 1, 2014 (the “Term Start Date”). You agree that you will not exercise the Post-Separation Option for a period of 12 months following the Term Start Date (the “Lock-Up Period”). Following the expiration of the Lock-Up Period, you will have a period of 12 months to exercise the July 2013 Option and until January 31, 2022 to exercise the January 2009 Option. With the exception of the Post-Separation Option, any option that you hold, including the option grant made to you on July 19, 2013, will immediately terminate and be of no further force and effect as of the Effective Date. An agreement memorializing the Post-Separation Option (the “Post-Separation Option Agreement”), substantially in the form attached to this Agreement as Exhibit 1, will be issued to you on the Effective Date.

8. On the Separation Date, your Company-provided health insurance and all other Company benefits will terminate according to the terms of the plans. This provision is not, however, intended to waive your rights under COBRA. You acknowledge that the Company will provide the COBRA notice, in accordance with federal guidelines, under which you may elect continuation of coverage.

9. Effective as of the Separation Date, you will be deemed to have resigned as the Vice-President, Finance of the Company, it being agreed and understood that this Agreement shall serve as irrevocable written notice of such resignation; and furthermore on the Separation Date, you will deliver to the Company an executed Resignation Letter, in substantially the form attached hereto as Exhibit 2.

10. You agree to make yourself available to consult with the Chief Executive Officer of the Company (the “CEO”) or persons designated by the CEO as reasonably requested by the CEO from time to time for a period of six months from the Effective Date (the “Consulting Period”). As compensation for your services, you will be paid a consulting fee of $14,583 per month (the “Consulting Fee”) during the Consulting Period. The consulting fee will be paid in accordance with the Company’s ordinary and normal payroll practices. You and the Company agree that, during the Consulting Period, you will provide services on a full-time basis (no less than 8 hours per day and 40 hours per week) and that your services as a consultant may be terminated by the Company at any time during the Consulting Period upon 60 days written notice (the “Notice Period”). During the Notice Period, unless you and the Company agree to another arrangement in writing, you will not be required to provide consulting services for more than 15 hours per week. Upon the effective date of your termination as a consultant, the Company will no longer be required to pay the Consulting Fee. The Parties hereto acknowledge that, but for this Agreement, you would not be required to render the services described in this Section 10.

11. As a material inducement to enter into this Agreement, in addition to the restrictions on transfer relating to the Post-Separation Option, the Company is requiring you to restrict the sale and transfer of securities of the Company held by you in accordance with the terms of that certain lock-up agreement signed by you in connection with the IPO (the “Lock-Up Agreement”), a copy of which is attached to this Agreement as Exhibit 3, and you are agreeable to such restrictions.

12. You represent and acknowledge that in executing this Agreement, you do not rely and have not relied upon any representation or statement made by the Company or any of its agents, representatives or attorneys with regard to the subject matter, basis or effect of this Agreement or otherwise other than the representations contained in this Agreement.

13. You agree as follows:

(a) As a material inducement to the Company to enter into this Agreement and subject to the terms of this Section 13, you hereby irrevocably and unconditionally release, acquit and forever discharge the Company and each of its parent, owners, stockholders, predecessors, successors, assigns, agents, directors, officers, employees, representatives, attorneys, divisions, subsidiaries, affiliates and all persons acting by, through, under or in concert with any of them, (collectively the “Company Releasees”), from any and all charges, complaints, claims, liabilities, obligations, promises, agreements, controversies, damages, actions, causes of action, suits, rights, demands, costs, losses, debts and expenses (including attorneys’ fees and costs actually incurred), of any nature whatsoever, known or unknown (singularly referred to in this Section as a “Claim” or collectively, as “Claims”) which you now have, own, hold, or which you at any time heretofore had, owned, or held against each of the Company Releasees, including, but not limited to: (i) all Claims under the Age Discrimination in Employment Act of 1967, as amended; (ii) all Claims under Title VII of the Civil Rights Act of 1964, as amended; (iii) all Claims under the Employee Retirement Income Security Act of 1974, as amended; (iv) all Claims arising under the Americans With Disabilities Act of 1990, as amended; (v) all Claims arising under the Family and Medical Leave Act of 1993, as amended; (vi) all Claims related to your employment with the Company; (vii) all Claims of unlawful discrimination based on age, sex, race, religion, national origin, handicap, disability, equal pay, sexual orientation or otherwise; (viii) all Claims of wrongful discharge, breach of an implied or express employment contract, negligent or intentional infliction of emotional distress, libel, defamation, breach of privacy, fraud, breach of any implied covenant of good faith and fair dealing and any other federal, state, or local common law or statutory Claims, whether in tort or in contract; (ix) subject to the payment of the Termination Compensation as described in Section 14(d) below, all Claims related to unpaid wages, salary, overtime compensation, bonuses, severance pay, vacation pay, paid-time-off, expenses or other compensation or benefits arising out of your employment with the Company; (x) all Claims arising under any federal, state or local regulation, law, code or statute; (xi) all Claims of discrimination arising under any state or local law or ordinance; and (xii) all Claims relating to any agreement, arrangement or understanding that you have, or may have, with the Company but specifically excluding this Agreement and the Post-Separation Options Agreement. Nothing in this Agreement shall release any claims based on any actions or omissions occurring after the execution of this Agreement.

(b) You covenant and promise not to sue or otherwise pursue legal action against the Company, other than for breach of this Agreement and the Post-Separation Options Agreement, and further covenant and promise to indemnify and defend the Company from any and all such claims, demands and causes of action, including the payment of reasonable costs and attorneys’ fees relating to any claim, demand, or causes of action brought by you. You agree that should any legal action be pursued on your behalf, with your consent, by any person or other entity against the Company regarding the claims released by you in this Agreement, you will not accept recovery from such action, but will assign such recovery to the Company and agree to indemnify the Company against such claims and assessment of damages. You further represent that you have filed no lawsuits against the Company. Nothing in this Agreement shall limit the ability of you to sue or otherwise pursue legal action against the Company on the basis of any acts or omissions occurring after this Agreement is executed by you.

(c) You further promise and agree that you will not at any time disparage the Company or any of its directors, officers, employees, products, operations, policies, decisions, advertising or marketing programs, if the effect of such disparagement reasonably could be anticipated to cause material harm to the Company’s reputation, business, interests or to the morale among its work force, or the reputation of any Company employee. Additionally, you will refer all inquiries that you receive (whether written or oral) regarding the business or operations of the Company to the CEO (or his successor or designee).

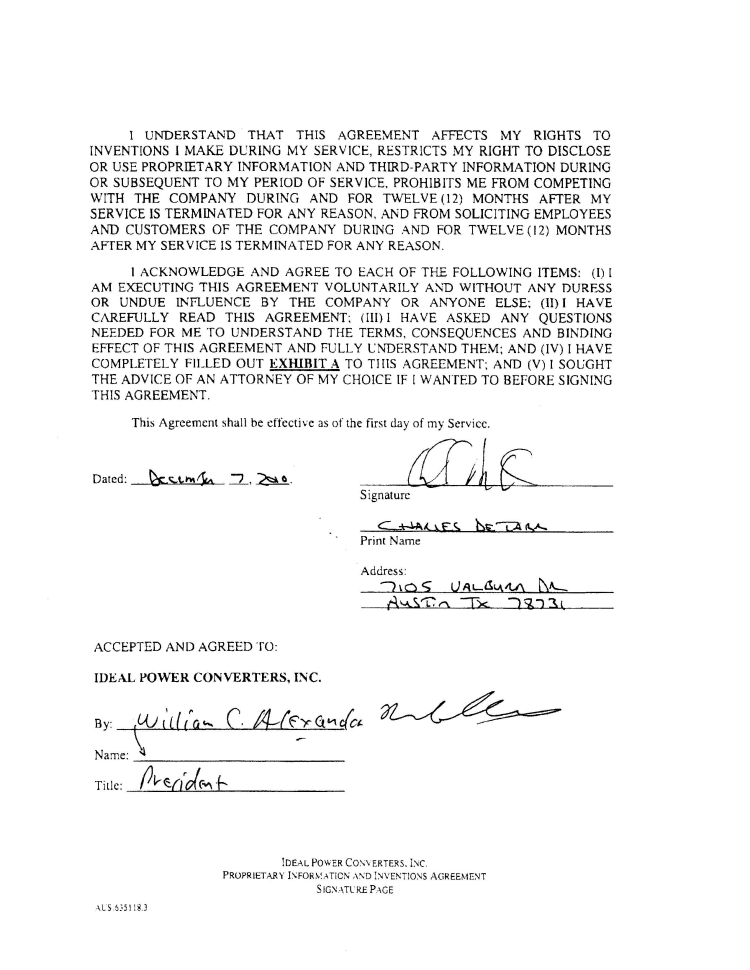

(d) You acknowledge that you will continue to be bound by the terms of that certain Ideal Power Converters, Inc. Proprietary Information and Inventions Agreement that you executed on December 7, 2010 (the “Proprietary Information and Inventions Agreement”), a copy of which is attached to this Agreement as Exhibit 4. In accordance with the Proprietary Information and Inventions Agreement and this Agreement, you will immediately transfer to the Company all accounting or other Company records held by you, irrespective of the medium in which they are held, and you will provide to Timothy Burns or his designee all user names and passwords for the Company’s accounting software and for any computer that stores the Company’s accounting files and records.

14. The Company agrees as follows:

(a) As a material inducement to you to enter into this Agreement and subject to the terms of this Section, the Company, on its own behalf and on behalf of each of the Company Releasees, hereby irrevocably and unconditionally releases, acquits and forever discharges you, and your heirs, representatives, successors and assigns and all persons acting by, through, under or in concert with any of them (collectively, the “Employee Releasees”), from any and all Claims which any Company Releasee now has, owns, holds, or which any Company Releasee at any time heretofore had, owned, or held against any of the Employee Releasees (including, without limitation, any Claims arising out of, in connection with, or related to your involvement as an officer or director of the Company).

(b) The Company covenants and promises not to sue or otherwise pursue legal action against you, other than for breach of this Agreement, the Proprietary Information and Inventions Agreement, the Post-Separation Options Agreement and the Lock-Up Agreement, and further covenants and promises to indemnify and defend you from any and all such claims, demands and causes of action, including the payment of reasonable costs and attorneys’ fees relating to any claim, demand, or causes of action brought by the Company. The Company agrees that should any legal action be pursued on its behalf by any person or other entity against you regarding the claims released in this Agreement, the Company will not accept recovery from such action, but will assign such recovery to you and agrees to indemnify you against such claims and assessment of damages. The Company further represents that it has filed no lawsuits against you.

(c) The Company further promises and agrees that it will not at any time disparage you, if the effect of such disparagement reasonably could be anticipated to cause material harm to your reputation.

(d) Within six days of the Separation Date, the Company further promises and agrees that accrued but unpaid compensation owed to you in the amount of $27,932.82 (the “Termination Compensation”) will be paid, net of any required employee withholdings. If the Company does not have the funds to pay all of the Termination Compensation to you within six days of the Separation Date, the Company will pay you the additional sum of $50 for every day after the sixth day following the Separation Date that any portion of the Termination Compensation is not paid.

15. If you or the Company determine that the other has breached this Agreement, the non-breaching Party will notify the Party in breach of that fact in writing and the Party in breach will be afforded ten days to cure the breach.

16. No waiver of any of the terms of this Agreement shall be valid unless in writing and signed by both Parties. No waiver of a breach or default of any term of this Agreement shall be deemed a waiver of any subsequent breach or default of the same or similar nature. This Agreement may not be changed except by a writing signed by both Parties.

17. This Agreement shall be binding upon you and upon your heirs, administrators, representatives, executors, trustees, successors and assigns, and shall inure to the benefit of the Company, the Company Releasees and the Employee Releasees and each of them, and to their heirs, administrators, representatives, executors, trustees, successors, and assigns.

18. For the same aforesaid consideration, it is further expressly agreed and understood that the Parties will promptly execute any and all documents that are necessary and appropriate to effectuate the terms of this Agreement.

19. For the same aforesaid consideration, it is expressly agreed and understood that the contents of this Agreement, including its terms, any consideration paid herein, and the parties thereto, shall not be disclosed, released or communicated to any person (except their attorneys, spouses, and tax consultants), including natural persons, corporations, partnerships, limited partnerships, joint ventures, sole proprietorships or other business entities, except for the purpose of enforcing this Agreement or any provision therein or pursuant to a lawful subpoena or except as otherwise required by applicable law (including, without limitation, Federal securities laws). Each Party agrees to give reasonable notice to the other in the event disclosure of this Agreement is sought by subpoena or otherwise.

20. This Agreement is entered into and shall be interpreted, enforced and governed by the law of the State of Texas. Any action regarding this Agreement shall be brought in a court in Austin, Texas. In any proceeding to enforce this Agreement, the prevailing Party shall be entitled to costs and reasonable attorneys’ fees.

21. All notices and other communications hereunder shall be in writing and shall be given by personal delivery, mailed by registered or certified mail (postage prepaid, return receipt requested), sent by facsimile transmission or sent by a nationally recognized overnight courier service to the Parties at the following addresses (or at such other address for a party as is specified by like change of address):

If to the Company:

Chief Executive Officer

c/o Ideal Power Inc.

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

Facsimile: _________________

If to you:

Charles De Tarr

Facsimile: ________________

22. The Parties agree that the Agreement may be executed in multiple copies, each of which will be considered an original.

WHEREFORE, the Parties have executed this Agreement in Spicewood, Texas on the date set forth above.

IDEAL POWER INC.

By:/s/ Paul Bundschuh

CHARLES DE TARR

/s/ Charles De Tarr

Charles De Tarr

Exhibit 1

POST-SEPARATION OPTION AGREEMENT

IDEAL POWER INC.

STOCK OPTION AGREEMENT

THIS STOCK OPTION AGREEMENT is made as of December 5, 2013, by and between IDEAL POWER INC., a Delaware corporation (the “Company”), and CHARLES DE TARR (the “Optionee”).

W I T N E S S E T H:

WHEREAS, the Company desires to grant to the Optionee an option to purchase shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), in consideration for the Optionee’s execution of that certain Separation and Release Agreement dated November 27, 2013.

NOW, THEREFORE, the parties hereto, intending to be legally bound, do agree as follows:

1. Grant of Option. Subject to the terms and conditions of this Agreement, the Company hereby grants to Optionee the right and option to purchase from the Company all or part of an aggregate of 33,743 shares of Common Stock (the “Shares”). This option is not intended to constitute an incentive stock option within the meaning of Section 422A of the Internal Revenue Code of 1986, as amended (the “Code”).

2. Exercise Price, Term and Time of Exercise.

(i) Exercise Price. The per-share price at which 26,743 of the Shares subject to this option (the “January 2009 Shares”) may be purchased by Optionee pursuant to his exercise of this option shall be $0.416675; the per-share price at which 7,000 of the Shares subject to this option (the “July 2013 Shares”) may be purchased by Optionee pursuant to his exercise of this option shall be $5.00. At the election of the Optionee, the exercise price may be paid in cash (including check or bank draft payable to the order of the Company) or, assuming that a public market for the Common Stock exists, in accordance with the following formula, which shall be referred to as a “Cashless Exercise”:

Where, X = the number of Shares to be issued to the Optionee;

Y = the number of Shares for which the option is being exercised;

A = the fair market value of one Share; and

B = the exercise price.

For purposes of the foregoing, the “fair market value of one Share” will be the closing price of one share of Common Stock on the day that the Optionee delivers notice to the Company of his election to make a Cashless Exercise.

(ii) Option Term. As to the July 2013 Shares, the term of the option shall begin on the closing of the initial public offering of the Company’s Common Stock (the “Closing Date”) and shall last until the close of business on the day immediately preceding the second anniversary of the Closing Date. As to the January 2009 Shares, the term of the option shall begin on the earlier of the Closing Date or January 1, 2014 and shall last until the close of business on January 31, 2022.

(iii) Time to Exercise. Optionee’s right to exercise this option shall vest on the first anniversary of the Closing Date and shall expire, as to the July 2013 Shares, on the close of business on the day immediately preceding the second anniversary of the Closing Date. Optionee’s right to exercise this option as to the January 2009 Shares shall vest on the first anniversary of the Closing Date and shall expire, as to the January 2009 Shares, on the close of business on January 31, 2022. The definition of “close of business” means 5:00 p.m. Central Time.

3. Method of Exercise and Payment for Shares; No Rights as a Shareholder. This option shall be exercised by written notice delivered to the Company at its principal office, specifying the number of Shares to be acquired upon such exercise, and accompanied by cash payment of the exercise price. The Optionee shall not have any shareholder rights with respect to the Shares until the Optionee shall have exercised the option, paid the Exercise Price and become a holder of record of the purchased Shares.

4. Non-transferability. This option is not transferable by Optionee except as otherwise provided in Section 5 below, and during Optionee’s lifetime is exercisable only by him.

5. Exercise After Death. In the event Optionee dies before the expiration of the Term, Optionee’s estate, or the person or persons to whom his rights under this option shall pass by will or the laws of descent and distribution, may exercise this option, to the extent exercisable at the date of death, at any time within six months following Optionee’s death (but in any event before the expiration of the Term).

6. Adjustments.

(i) Adjustments by Stock Split, Stock Dividend, Etc. If the Company shall at any time increase or decrease the number of its outstanding shares of Common Stock, or change in any way the rights and privileges of such shares, by means of the payment of a Common Stock dividend or the making of any other distribution upon such shares payable in Common Stock, or through a Common Stock split or subdivision of shares, or a consolidation or combination of shares, or through a reclassification or recapitalization involving the Common Stock, then the numbers, rights and privileges of the shares of Common Stock underlying the option granted hereunder shall be increased, decreased or changed in like manner as if they had been issued and outstanding, fully paid and non-assessable at the time of such occurrence.

(ii) Apportionment of Price. Upon any occurrence described in the preceding subsection (i) of this Section 6, the total option price hereunder shall remain unchanged but shall be apportioned ratably over the increased or decreased number or changed kinds of securities or other property subject to this option.

(iii) Determination by the Company. Adjustments under this Section 6 shall be made by the Company, whose determinations with regard thereto shall be final and binding. No fractional shares of Common Stock shall be issued on account of any such adjustment.

7. Merger, Consolidation, Etc.

(i) Effect of Transaction. Upon the occurrence of any of the following events, if the notice required by Section 7(ii) hereof shall have first been given, the option granted hereunder shall automatically terminate and be of no further force and effect whatsoever, without the necessity for any additional notice or other action by the Company: (a) the merger, consolidation or liquidation of the Company or the acquisition of its assets or stock pursuant to a nontaxable reorganization, unless the surviving or acquiring corporation, as the case may be, shall assume all outstanding options of the Company or substitute new options for them pursuant to Section 425(a) of the Code; (b) the dissolution or liquidation of the Company; (c) the appointment of a receiver for all or substantially all of the Company’s assets or business; (d) the appointment of a trustee for the Company after a petition has been filed for the Company’s reorganization under applicable statutes; or (e) the sale, lease or exchange of all or substantially all of the Company’s assets and business.

(ii) Notice of Such Occurrences. At least 30 days’ prior written notice of any event described in Section 7(i) hereof, except the transactions described in subsections 7(i)(c) and (d) as to which no notice shall be required, shall be given by the Company to the Optionee. If the Optionee is so notified, he may exercise all or a portion of the entire unexercised portion of this option at any time before the occurrence of the event requiring the giving of notice. Such notice shall be deemed to have been given when delivered personally to the Optionee or when mailed to the Optionee by registered or certified mail, postage prepaid, at the Optionee’s address included in Section 9 below.

8. Binding Effect, Entire Agreement. Subject to the limitations stated above, this Agreement shall be binding upon and inure to the benefit of the personal representatives of Optionee and the successors of the Company. This Agreement constitutes the entire agreement between the parties and cannot be altered, modified, or changed in any way unless made in writing and signed by the party against whom such alteration, modification, or change is asserted.

9. Notices. With the exception of the notice required by Section 7 above, any notice required to be given or delivered to the Company under the terms of this Agreement shall be in writing and addressed to the Company at its principal corporate offices. Any notice required to be given or delivered to Optionee shall be in writing and addressed to Optionee at the address indicated below. All notices shall be deemed effective upon personal delivery, or if sent by a nationally recognized overnight courier service or upon deposit in the U.S. mail, postage prepaid and properly addressed to the party to be notified, as follows:

If to the Company:

Chief Executive Officer

c/o Ideal Power Inc.

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

If to the Optionee:

Charles De Tarr

7105 Valburn Drive

Austin, Texas 78731

Notice of a Cashless Exercise may be given to the Company via electronic mail to tim.burns@idealpower.com.

IN WITNESS WHEREOF, the Company has caused this Agreement to be signed by its Chief Executive Officer and the Optionee has signed this Agreement.

IDEAL POWER INC.

By:_____________________________

Paul Bundschuh

Chief Executive Officer

OPTIONEE

________________________________

Charles De Tarr

Optionee

Exhibit 2

LETTER OF RESIGNATION

November 27, 2013

VIA ELECTRONIC MAIL

paul.bundschuh@idealpowerconverters.com

Paul Bundschuh, Chairman

Board of Directors

Ideal Power Inc.

5004 Bee Creek Road, Suite 600

Spicewood, Texas 78669

Dear Paul:

I hereby resign as the Vice-President, Finance of Ideal Power Inc. and from any other office I hold, effective immediately.

Very truly yours,

/s/ Charles De Tarr

Charles De Tarr

Exhibit 3

LOCK-UP AGREEMENT

(Exhibit starts on next page.)

Exhibit 4

PROPRIETARY INFORMATION AND INVENTIONS AGREEMENT

(Exhibit starts on next page.)

AMENDMENT TO SEPARATION AND RELEASE AGREEMENT

This Amendment to Separation and Release Agreement (this “Amendment”) is made and entered into as of December 5, 2013, by and between Charles De Tarr (“you” or “your”) and Ideal Power Inc., a Delaware corporation (the “Company”) in relation to the following:

RECITALS

A. On November 27, 2013, you and the Company entered into that certain Separation and Release Agreement (the “Original Agreement”).

B. The first sentence of the first paragraph of Section 7 of the Original Agreement states:

7. For the purpose of the following discussion, the number of shares and the per share exercise prices do not reflect the proposed reverse stock split that the Company will effect prior to the consummation of the initial public offering of its common stock (the “IPO”).

C. On November 21, 2013 the Company effected a reverse split of its common stock in the ratio of 1 share of common stock for every 2.381 shares of common stock (the “Reverse Split”).

D. You and the Company agree that the first sentence of the first paragraph of Section 7 of the Original Agreement is incorrect, and that the number of shares of common stock covered by the Post-Separation Option reflects the Reverse Split.

THEREFORE, you and the Company agree as follows:

1. Edit to Section 7. The first sentence of the first paragraph of Section 7 of the Original Agreement shall be deleted.

2. Remaining Terms to Remain the Same. All other terms and conditions of the Original Agreement shall remain the same.

[SIGNATURES APPEAR ON NEXT PAGE]

WHEREFORE, you and the Company have executed this Amendment in Spicewood, Texas on the date set forth above.

IDEAL POWER INC.

By:/s/ Paul Bundschuh

Paul Bundschuh, Chief Executive Officer

CHARLES DE TARR

/s/ Charles De Tarr

Charles De Tarr