UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

IDEAL POWER INC.

(Name of Registrant as Specified In Its Charter)

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

5508 Highway 290 West, Suite 120

Austin, Texas 78735

www.idealpower.com

April 26, 2024

To the Stockholders of Ideal Power Inc.:

It is my pleasure to invite you to attend Ideal Power Inc.’s 2024 Annual Meeting of Stockholders (the “Annual Meeting”), to be held on Thursday, June 20, 2024 at 10:00 a.m. Central Time. The Annual Meeting will be held entirely online via live audio webcast at https://www.viewproxy.com/IdealPower/2024/VM where you will be able to listen to the Annual Meeting live, submit questions and vote. We believe the virtual Annual Meeting offers the same participation opportunities as an in-person Annual Meeting.

Details regarding the business to be conducted at the Annual Meeting are more fully described in the accompanying Notice of Annual Meeting of Stockholders and proxy statement.

Your vote is important. Whether or not you expect to attend the Annual Meeting online, please date, sign and return your proxy card in the enclosed envelope or vote by using the Internet or by telephone according to the instructions in the proxy statement to assure that your shares will be represented and voted at the Annual Meeting. If you attend the Annual Meeting and follow the instructions in the proxy statement, you may vote your shares electronically during the Annual Meeting even though you have previously voted by proxy. If you hold your shares through an account with a brokerage firm, bank, trustee or other nominee, please follow the instructions you receive from your broker, bank, trustee or other nominee to vote your shares. Details about how to attend the Annual Meeting online and how to submit questions and cast your votes are posted at https://www.viewproxy.com/IdealPower/2024/VM and can be found in the proxy statement in the section entitled “Questions and Answers about this Proxy Material and Voting — How can I attend and vote at the Annual Meeting?”.

On behalf of your Board of Directors, thank you for your continued support and interest.

| Sincerely, | |

|

|

| R. DANIEL BRDAR | |

| President, Chief Executive Officer and Director |

5508 Highway 290 West, Suite 120

Austin, Texas 78735

(512) 264-1542

NOTICE OF 2024 ANNUAL MEETING OF

STOCKHOLDERS TO BE HELD JUNE 20, 2024

To the Stockholders of Ideal Power Inc.:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Ideal Power Inc., a Delaware corporation (the “Company”), on Thursday, June 20, 2024, at 10:00 a.m. Central Time. The Annual Meeting will be held entirely online via live audio webcast at https://www.viewproxy.com/IdealPower/2024/VM where you will be able to listen to the Annual Meeting live, submit questions, and vote. There will not be a physical location for the Annual Meeting. We believe the virtual Annual Meeting offers the same participation opportunities as an in-person Annual Meeting.

The Annual Meeting will be held for the following purposes:

|

1. |

To elect five directors to serve until the 2025 annual meeting of stockholders and until their respective successors are elected and qualified; |

|

2. |

To ratify the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; |

|

3. |

To approve, on a non-binding, advisory basis, the compensation of our named executive officers; and |

|

4. |

Any other business that may be properly brought before the Annual Meeting or any adjournment or postponement thereof. |

These proposals are more fully described in the proxy statement accompanying this notice.

Only stockholders of record of our common stock at the close of business on April 25, 2024 are entitled to notice of, and to vote, at the Annual Meeting or any adjournment or postponement thereof.

| By Order of the Board of Directors, | |

|

|

| TIMOTHY W. BURNS | |

| Chief Financial Officer and Corporate Secretary |

Austin, Texas

April 26, 2024

| You are cordially invited to attend the Annual Meeting online. Whether or not you expect to attend the Annual Meeting, please vote as soon as possible. We encourage you to vote via the Internet or by telephone. You may also vote your shares online and submit your questions during the Annual Meeting. Instructions on how to vote while participating at the Annual Meeting live via the Internet are posted at https://www.viewproxy.com/IdealPower/2024/VM and can be found in the proxy statement in the section entitled “Questions and Answers about This Proxy Material and Voting — How can I attend and vote at the Annual Meeting?”. |

5508 Highway 290 West, Suite 120

Austin, Texas 78735

(512) 264-1542

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these proxy materials?

You have received these proxy materials because the Board of Directors (the “Board”) of Ideal Power Inc. (the “Company”, “Ideal Power”, “we”, “us” or “our”) is soliciting your proxy to be voted at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company, which will be held on Thursday, June 20, 2024, at 10:00 a.m. Central Time, online at https://www.viewproxy.com/IdealPower/2024/VM. The Annual Meeting will be a completely virtual meeting, which will be conducted via live audio webcast.

This proxy statement is first being made available to stockholders on or about April 26, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 20, 2024. This proxy statement and our 2023 Annual Report on Form 10-K are available at www.idealpower.com.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on April 25, 2024 (the “record date”) are entitled to notice of, and to vote at, the Annual Meeting. The holders of common stock have the right to one vote for each share they held as of the record date. As of the close of business on the record date, there were 7,681,828 shares of our common stock outstanding.

To attend and participate in the Annual Meeting, you must register at https://www.viewproxy.com/IdealPower/2024/VM by 11:59 PM EDT on June 19, 2024, using the control number that was included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your broker, bank, trustee or other nominee to obtain a valid proxy if you plan on voting your shares during the Annual Meeting and your control number to register for the Annual Meeting, or otherwise vote through the broker, bank or other nominee. You will be able to attend the Annual Meeting online, vote and submit your questions during the Annual Meeting by visiting https://www.viewproxy.com/IdealPower/2024/VM and entering the event passcode you were provided after registration.

The Annual Meeting webcast will begin promptly at 10:00 a.m. Central Time. We encourage you to access the Annual Meeting prior to the start time. Online check-in will begin at 9:45 a.m. Central Time, and you should allow ample time for the check-in procedures.

In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available for examination for any purpose relevant to the Annual Meeting during the Annual Meeting through the Annual Meeting website for those stockholders who choose to attend. The list will also be available on the same basis for 10 days prior to the Annual Meeting through the Annual Meeting website.

What am I voting on?

At the Annual Meeting, our stockholders will consider and vote on the following matters:

|

1. |

To elect five directors to serve until the 2025 annual meeting of stockholders and until their respective successors are elected and qualified (Proposal 1); |

|

2. |

To ratify the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024 (Proposal 2); |

|

3. |

To approve, on a non-binding, advisory basis, the compensation of our named executive officers (Proposal 3); and |

|

4. |

Any other business that may be properly brought before the Annual Meeting or any adjournment or postponement thereof. |

As of the date of this proxy statement, we are not aware of any business to come before the Annual Meeting other than Proposals 1 through 3, noted above.

What is the difference between being a “stockholder of record” and being a beneficial owner of shares held in “street name?”

Stockholder of Record. If on the record date, your shares were registered directly in your name with our transfer agent, EQ Shareowner Services, then you are a “stockholder of record.” In this case, a set of proxy materials has been sent to you directly by us.

Beneficial Owners of Shares Held in Street Name. If your shares are held in a brokerage account or by a broker, bank, trustee or other nominee, then you are considered the beneficial owner of those shares, which are held in “street name.” In this case, a set of proxy materials has been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization as to how to vote the shares held in your account.

How do I vote?

Stockholder of Record. As a stockholder of record, you may vote your shares over the Internet, by telephone as described on the proxy card, or by mail by marking, signing, dating and mailing your proxy card in the postage-paid envelope provided. Your designation of a proxy is revocable by following the procedures outlined in this proxy statement. The method you use to vote will not limit your right to vote at the Annual Meeting if you decide to attend online. If you receive hard copy materials and sign and return your proxy card without specifying choices, your shares will be voted as recommended by our Board.

Stockholders of record may vote by using the Internet at www.proxypush.com/ipwr and following the instructions for Internet voting on the proxy card mailed to you. Internet and telephone voting are available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on June 19,2024. Stockholders of record may also vote by mail, by completing and mailing in the paper proxy card included with this proxy statement. Mailed proxy cards must be received prior to the start of the Annual Meeting in order to be counted at the Annual Meeting. If the Annual Meeting is adjourned or postponed, these deadlines may be extended.

Beneficial Owners of Shares Held in Street Name. If your shares are held through a broker, bank, trustee or other nominee in “street name”, you need to submit voting instructions to your broker, bank, trustee or other nominee in order to cast your vote. You may mark, sign, date and mail the accompanying voting instruction form in the postage-paid envelope provided. Most beneficial stockholders (“street name” holders) may vote by Internet by accessing the website specified on the voting instruction forms provided by their brokers, banks, trustees or other nominees. Most beneficial stockholders (“street name” holders) may vote via telephone by calling the number specified on the voting instruction forms provided by their brokers, banks, trustees or other nominees. Your vote is revocable by following the procedures outlined in this proxy statement. However, since you are not a stockholder of record, you may not vote your shares online at the Annual Meeting unless you have a valid proxy and a control number provided by your broker, bank, trustee or other nominee.

The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

All stockholders as of the close of business on the record date can also vote online at the Annual Meeting by following the instructions posted at https://www.viewproxy.com/IdealPower/2024/VM. Even if you plan to attend the Annual Meeting, we recommend that you also vote either by Internet, by telephone or by mail so that your vote will be counted if you later decide not to attend.

How can I attend and vote at the Annual Meeting?

This year’s Annual Meeting will be held entirely online via live audio webcast. In structuring our virtual Annual Meeting, our goal is to enhance stockholder participation. We have designed the virtual Annual Meeting to provide stockholders with substantially the same opportunities to participate as if the Annual Meeting were held in person and we believe the virtual Annual Meeting accomplishes this goal. We aim to provide a consistent experience to all stockholders regardless of their geographic location. Any stockholder can attend the Annual Meeting live online at https://www.viewproxy.com/IdealPower/2024/VM.

To attend and participate in the Annual Meeting, you must register at https://www.viewproxy.com/IdealPower/2024/VM by 11:59 PM EDT on June 19, 2024, using the control number that was included on your proxy card or on the instructions that accompanied your proxy materials. If your shares are held in “street name,” you should contact your broker, bank, trustee or other nominee to obtain a valid proxy if you plan on voting your shares during the Annual Meeting and your control number to register for the Annual Meeting, or otherwise vote through the broker, bank, trustee or other nominee. You will be able to attend the Annual Meeting online, vote and submit your questions during the Annual Meeting by visiting https://www.viewproxy.com/IdealPower/2024/VM and entering the event passcode you were provided after registration.

The Annual Meeting webcast will begin promptly at 10:00 a.m. Central Time. We encourage you to access the Annual Meeting prior to the start time. Online check-in will begin at 9:45 a.m. Central Time, and you should allow ample time for the check-in procedures.

The virtual Annual Meeting platform is fully supported across browsers (Internet Explorer, Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the Annual Meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at https://www.viewproxy.com/IdealPower/2024/VM. Assistance with questions regarding how to attend and participate via the Internet will be provided at https://www.viewproxy.com/IdealPower/2024/VM on the day of the Annual Meeting.

We have created and implemented the virtual format in order to facilitate stockholder attendance and participation by enabling stockholders to participate fully, and equally, from any location around the world, at no cost. However, you will bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. A virtual Annual Meeting makes it possible for more stockholders (regardless of size, resources or physical location) to have direct access to information more quickly, while saving the company and our stockholders time and money. We also believe that the online tools we have selected will increase stockholder communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Annual Meeting so they can ask questions of our Board or management. During the live Q&A session of the Annual Meeting, we may answer questions as they come in and address those asked in advance, to the extent relevant to the business of the Annual Meeting, as time permits.

Both stockholders of record and street name stockholders will be able to attend the Annual Meeting via live audio webcast, submit their questions during the meeting and vote their shares electronically at the Annual Meeting.

Questions pertinent to Annual Meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters, including those related to employment or suggestions for technology innovations or product introductions, are not pertinent to Annual Meeting matters and therefore will not be answered. We have designed the format of the virtual Annual Meeting to ensure that our stockholders are afforded the same rights and opportunities to participate as they would have at an in-person meeting. Any questions pertinent to Annual Meeting matters that cannot be answered during the Annual Meeting due to time constraints will be posted online and answered at the “Investors” section of our website at https://ir.idealpower.com/. The questions and answers will be available as soon as practical after the Annual Meeting and will remain available until one week after posting.

What if during the check-in time or during the Annual Meeting I have technical difficulties or trouble accessing the virtual Annual Meeting website?

There will be technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting live audio webcast. Please be sure to check in by 9:45 a.m. Central Time on June 20, 2024 (15 minutes prior to the start of the Annual Meeting is recommended), the day of the Annual Meeting, so that any technical difficulties may be addressed before the Annual Meeting live audio webcast begins. If you encounter any difficulties accessing the webcast during the check-in or Annual Meeting time, please email VirtualMeeting@viewproxy.com or call 866-612-8937.

What is the quorum requirement for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid Annual Meeting. Our bylaws provide that a quorum will be present if a majority in voting interest of the shares of common stock entitled to be voted at the Annual Meeting, present in person (including by remote communication) or by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement, but will have no effect on the outcome of any proposal. If a quorum is not present, the Annual Meeting may be adjourned until a quorum is obtained.

How many votes are needed to approve each proposal?

If a quorum is present at the Annual Meeting, the following vote is required for approval of each matter to be voted on:

|

• |

For Proposal 1 (Election of Directors), the five nominees receiving a plurality of the votes cast, meaning the most “FOR” votes (among votes properly cast in person, or by means of remote communication, or by proxy), will be elected. “WITHHOLD” votes and broker non-votes will have no effect on the outcome of this proposal. Cumulative voting is not permitted. |

|

• |

Proposal 2, to ratify the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, must receive a “FOR” vote from the majority of shares present in person, or by means of remote communication, or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the same effect as an “AGAINST” vote. Broker non-votes, if any, will have no effect on the outcome of this proposal. |

|

• |

Proposal 3, to approve, on a non-binding advisory basis, the compensation of our named executive officers, must receive a “FOR” vote from the majority of shares present in person, or by means of remote communication, or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions will have the same effect as an “AGAINST” vote. Broker non-votes will have no effect on the outcome of this proposal. |

What are “broker non-votes” and how do they affect the proposals?

A broker non-vote occurs when a broker, bank, trustee or other nominee holding shares for a beneficial owner in “street name” does not vote the shares on a proposal because the broker, bank, trustee or other nominee does not have discretionary voting power for a particular item and has not received instructions from the beneficial owner regarding voting. Brokers who hold shares for the accounts of their clients have discretionary authority to vote shares if specific instructions are not given with respect to “routine” items.

If your shares are held by a broker on your behalf and you do not instruct the broker as to how to vote your shares on Proposals 1 and 3, the broker may not exercise discretion to vote for or against those proposals because each of these proposals are considered “non-routine” under applicable rules. With respect to Proposal 2 (ratification of our independent registered public accounting firm), the broker may exercise its discretion to vote for or against the proposal in the absence of your instruction. Broker non-votes are not counted as votes in favor of, or against, any proposal.

What are the recommendations of the Board?

Our Board recommends that you vote:

|

• |

“FOR” the election of the five director nominees to serve until the 2025 annual meeting of stockholders and until their respective successors are elected and qualified; |

|

• |

“FOR” the ratification of the appointment of BPM LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

|

• |

“FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers. |

What if I return a proxy card but do not make specific choices?

Whether or not you are able to personally attend the Annual Meeting online, you are encouraged to vote your shares as instructed on the proxy card or voting instruction form. Shares represented by properly executed methods and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting as directed in the proxy. If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” each of Proposals 1, 2 and 3. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment. If you are a beneficial owner and you return your signed voting instruction form but do not indicate your voting preferences, your broker, bank, trustee or other nominee may not vote your uninstructed shares on any proposal other than Proposal 2.

If your shares are held in the name of a bank or brokerage firm, your bank or broker will send you a separate package describing the procedures and options for voting your shares. You should follow the instructions provided by your bank or brokerage firm. On routine matters, such as Proposal 2, your broker will vote your shares for you at his or her discretion if you do not instruct your broker how to vote. For non-routine matters, which include all other matters to be voted upon at the Annual Meeting, your broker may not vote your shares without specific voting instructions from you.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record. You can revoke your proxy at any time before the final vote at the Annual Meeting. You may revoke your proxy in any one of three ways:

|

• |

Submit another properly completed proxy with a later date by the applicable deadline either signed and returned by mail or transmitted using the telephone or Internet voting procedures described above; |

|

• |

Send a written notice that you are revoking your proxy to the Corporate Secretary of the Company at 5508 Highway 290 West, Suite 120, Austin, Texas 78735; or |

|

• |

Attend the Annual Meeting and vote online by following the instructions at https://www.viewproxy.com/IdealPower/2024/VM. |

Beneficial Owners of Shares Held in Street Name. If your shares are held in “street name,” you may submit new voting instructions by contacting your broker or other organization holding your account. You may also vote online at the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, as described above. If you hold your shares in “street name” through a bank or broker, you must provide a valid proxy from your bank or broker during registration and you will be assigned a control number in order to vote your shares during the Annual Meeting.

Whether you are a stockholder of record or a beneficial owner of shares held in street name, simply attending the Annual Meeting online will not, by itself, automatically revoke your proxy.

Who is paying for the cost of this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies in person, by telephone, or by other means of communication. They will not be paid any additional compensation for soliciting proxies. We may reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be available on a Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”) within four business days after the end of the Annual Meeting.

PROPOSAL 1 — ELECTION OF DIRECTORS

Nominees for Election

We currently have a Board consisting of five directors. At each annual meeting of stockholders, directors are elected for a term of one year to succeed those directors whose terms expire on the annual meeting date.

The term of each of the current directors, R. Daniel Brdar, Drue Freeman, Gregory Knight, Ted Lesster and Michael C. Turmelle, will expire on the date of the upcoming Annual Meeting. The Board’s nominees for election by the stockholders to the five positions are the current members of the Board. If elected, each nominee will serve as a director until our annual meeting of stockholders in 2025 and until their respective successors are elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate.

We believe that each of our directors has demonstrated business acumen, ethical integrity and an ability to exercise sound judgment as well as a commitment of service to us and our Board.

Nominees for Election as Directors

Biographical information for our director nominees who were nominated for re-election at the Annual Meeting is set forth below.

|

Name |

Position(s) with the Company |

Age |

Director Since |

|||

|

R. Daniel Brdar |

President, Chief Executive Officer and Director |

64 |

2014 |

|||

|

Drue Freeman |

Director |

61 |

2022 |

|||

|

Gregory Knight |

Director |

49 |

2022 |

|||

|

Ted Lesster |

Director |

86 |

2018 |

|||

|

Michael C. Turmelle |

Chairman of the Board |

65 |

2017 |

R. Daniel Brdar has served as our President and Chief Executive Officer since April 2020. Previously, Mr. Brdar served as our BTRAN Chief Commercial Officer from April 2018 until April 2020. Mr. Brdar originally joined the Company in January 2014, when he served as our Chief Executive Officer and President until April 2018 and served as Chairman of the Board until March 2017. He has over 30 years of experience in the power systems and energy industries and has held a variety of leadership positions during his career. Prior to joining the Company, Mr. Brdar was Chief Operating Officer of Petra Solar Inc. from March 2011 to May 2013. From January 2006 to February 2011, Mr. Brdar was Chief Executive Officer of FuelCell Energy, Inc. (Nasdaq: FCEL). Mr. Brdar also served as President of Fuel Cell Energy, Inc. from August 2005 to February 2011 and Chairman of the Board of Directors from January 2007 until April 2011. Prior to his employment with FuelCell Energy, Inc., which began in 2000, Mr. Brdar held management positions at General Electric Power Systems from 1997 to 2000 where he focused on new product introduction programs and was product manager for its gas turbine technology. Mr. Brdar was Associate Director, Office of Power Systems Product Management at the U.S. Department of Energy where he held a variety of positions from 1988 to 1997, including directing the research, development and demonstration of advanced power systems, including gas turbines, gasification systems and fuel cells.

Mr. Brdar received a B.S. in Engineering from the University of Pittsburgh in 1981. Mr. Brdar brings to our Board experience as an executive officer of a publicly traded company, knowledge of the renewable energy and power electronics markets, and experience and familiarity with our business as our Chief Executive Officer.

Drue Freeman has served on our Board since April 2022. He has over 30 years of semiconductor industry experience, sixteen of which focused on sales and marketing of semiconductors to the automotive industry. Mr. Freeman spent most of his career at NXP Semiconductors (“NXP”), a Dutch multinational manufacturer serving the automotive industry. In 1990, he joined VLSI Technology, an American company that designed and manufactured custom and semi-custom integrated circuits, which was bought by Philips Semiconductors, a division of Philips Electronics. Philips Semiconductors was subsequently spun-out from Philips to become NXP. At NXP, he served in various leadership positions in Japan, Germany, China and Silicon Valley. He launched and served on the Board of Directors for Datang-NXP Semiconductors, the first Chinese automotive semiconductor company, and ended his tenure at NXP as Senior Vice President of Global Automotive Sales & Marketing. While at NXP, Mr. Freeman built significant automotive semiconductor market share by developing long-term relationships with OEMs and locking in design wins at Tier-1 automotive customers. Since November 2016, he has served as an Advisor at Silicon Catalyst, an incubator focused exclusively on solutions in silicon, and, from March 2018 to April 2020, he served as Chief Executive Officer of the Association for Corporate Growth Silicon Valley, the premier organization for decision makers in Silicon Valley, providing business professionals with direct and referral access to key business leaders, transformational thought leadership and practical experience for professional growth and business development. Mr. Freeman provides strategic and advisory services, with recent clients including Savari (acquired by Harman) and DeepScale.ai (acquired by Tesla), and he has served on the Board of Directors of Sand Hill Angels, a group of Silicon Valley angel investors, since January 2018. He has a B.S. in Electrical Engineering from San Diego State University and an MBA in Business from Pepperdine Graziadio Business School. Mr. Freeman brings to our Board experience as a semiconductor executive and strategic advisor and investor and knowledge of, and relationships in, the semiconductor and automotive / electric vehicle (“EV”) industries.

Gregory Knight has served on our Board since April 2022. He has 20 years of experience in the photovoltaic (“PV”), silicon carbide, EV and power electronics markets in both leadership positions and as a strategic consultant. Since January 2023, Mr. Knight currently serves as President and Chief Executive Officer of Hardinge Inc, a leading international provider of advanced-cutting solutions for metals and other materials with a full spectrum of highly reliable computer numerical control, or CNC, turning, milling, grinding and honing machines. Prior to serving as President and Chief Executive Officer, Mr. Knight served as Vice President and Chief Operating Officer of Hardinge Inc. from January 2023 to July 2023. Previously, Mr. Knight served as President and Chief Executive Officer of GT Advanced Technologies, a producer of silicon carbide and sapphire crystal materials for expanding markets such as EVs and power electronics, from September 2016 to October 2021. His other leadership positions include: Co-Founder and Co-Chief Executive Officer of Exawatt, which provides strategic consulting for the solar PV, EV, power electronics, high-purity quartz and lithium-ion battery markets, from May 2015 to September 2016; President of PV Tech Group, a provider of a range of operations and strategic planning services to the PV industry, from July 2010 to September 2016; and Chief Technology Officer for Equity Solar, a provider of silicon surface chemistries intended to increase PV cell efficiency, from April 2010 to June 2015. Mr. Knight began his PV career as Manufacturing Director, Solar Cell Fabrication, at Schott Solar, a manufacturer of components for solar power systems. He currently serves on the Board of Directors of Hardinge Inc., a multi-national machine tool builder. Mr. Knight served five years in the U.S. Navy as Chemistry / Radiological Controls Officer and holds a B.A. in Chemistry from Cornell University and a formal nuclear engineering education from the Naval Nuclear Power School. Mr. Knight brings to our Board experience as an executive and knowledge of silicon carbide and PV, EV, energy storage and power electronics markets.

Ted Lesster has served on our Board since April 2018. Prior to 1985, Mr. Lesster worked first in the power conversion group at the Westinghouse R&D Center and subsequently at the Westinghouse ESSD Oceanic Division (“ESSD”). As an Advisory Engineer he was instrumental in developing power electronics for power conversion, active sonar and propulsion systems for deep submergence vehicle and surface ship applications. In 1985, he became manager of Electrical Engineering and, in 1992, he was appointed to assemble and lead the technical team that worked in conjunction with Chrysler to develop and take to initial production advanced power trains for the Chrysler EPIC minivan. Following the Northrop Grumman acquisition of ESSD he returned to the Oceanic Division as Engineering Director of the engineering department and then as Chief Scientist. In 1999, he joined SatCon as Engineering Director and later as General Manager. He resigned from his management position at SatCon in 2002 to lead the design and development of a novel 2-megawatt flywheel/doubly fed induction machine and diesel-based uninterruptible AC power source. With the transfer of that and similar power electronics-based technology to RCT Systems (“RCT”) in 2003, Mr. Lesster joined RTC in an advisory role and was active in hardware development of vehicle and shipboard pulse power and power management applications as well as both wave energy and tide power energy conversion projects until his retirement in 2014. Mr. Lesster has BA and MA degrees in Engineering from Oxford University and, in 1971, he received the Westinghouse B.G. Lamme Award for a year’s study scholarship. He used this to study at Imperial College of Science and Technology in London where his thesis for the Diploma of Imperial College certificate was on control techniques for reluctance machines. Mr. Lesster holds six patents and several pending in the field of power conversion. Mr. Lesster brings to our Board an extensive knowledge of power electronics and power conversion systems.

Michael C. Turmelle has served on our Board since December 2017 and as Chairman of the Board since December 2021. From January 2018 to January 2024, Mr. Turmelle served as the Managing Director of Hayward Tyler, which he joined in February 2015. Hayward Tyler designs, manufactures and services performance-critical electric motors and pumps to meet the most demanding of applications for the global energy industry, as both an original equipment manufacturer supplier and trusted partner. Previously, Mr. Turmelle ran his own consulting company working with start-ups and turn-arounds in the areas of renewable energy, medical and other advanced technologies. He has served on the Board of Directors of Quantum Computing Inc. (Nasdaq: QUBT) since January 2022. Mr. Turmelle has previously served on other Boards of Directors including the Board of Directors of Implant Sciences Corp., an explosive and narcotic trace detection company, where he served as Chairman of the Board from 2015 to 2017. He was Chief Financial Officer and Chief Operating Officer and a member of the Board of Directors of SatCon. Mr. Turmelle was also on the Board of Directors of Beacon Power, a SatCon spin-off company dealing in flywheel energy storage. He has a BA in Economics from Amherst College and is a graduate of General Electric’s Financial Management Program. Mr. Turmelle brings to our Board years of public company executive experience as well as extensive experience in finance and operations and in the field of electrical technology.

Vote Required and Board Recommendation

Nominees will be elected by a plurality of the votes of the shares of common stock present in person, or by means of remote communication, or represented by proxy and entitled to vote at the Annual Meeting. A “plurality” means, with regard to the election of directors that the nominees for director receiving the greatest number of “FOR” votes from the votes cast at the Annual Meeting will be elected. Abstentions and broker non-votes will have no effect on the outcome of this proposal. Proxies cannot be voted for a greater number of persons than five, the number of nominees named above. There is no cumulative voting in the election of directors.

|

THE BOARD RECOMMENDS VOTING “FOR” EACH OF THE NOMINEES FOR DIRECTOR |

CORPORATE GOVERNANCE AND BOARD MATTERS

We are committed to maintaining sound corporate governance practices. The Board has formalized several policies, procedures and standards of corporate governance, some of which are described below. We continue to monitor best practices and legal and regulatory developments with a view to further revising our governance policies and procedures, as appropriate.

Board Leadership Structure

The Chairman of the Board presides at all meetings of the Board. The Chairman is appointed on an annual basis by a majority vote of the remaining directors. Michael C. Turmelle is currently serving as the Chairman of the Board.

Our Board does not have a policy regarding separation of the roles of Chief Executive Officer and Chairman of the Board. The Board believes that it is currently in the best interests of the Company and its stockholders to make that determination based on circumstances from time to time.

While our Board does not have a person designated as a lead independent director, our Board believes that having, among other things, an independent director serving as Chairman of the Board, a majority of independent directors, a discrete and independent committee system and periodic meetings of non-employee directors in executive session permits the Board to maintain effective oversight of the Company’s management. The Board periodically reviews its leadership structure to ensure that it meets the Company’s needs.

Independence of the Board

Our Board has determined that each of our directors, with the exception of R. Daniel Brdar, our President and Chief Executive Officer, is an “independent director” as defined under the applicable rules of The Nasdaq Stock Market (“Nasdaq”) and SEC rules and regulations. In making such independence determination, the Board considered the relationships that each such director has with us and all other facts and circumstances that it deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each director.

Board Diversity

The following table below shows the diversity attributes of our Board as of April 26, 2024:

| Directors | ||

| Total Number of Directors | 5 | |

| Part I: Gender Identity | ||

| Male | 5 | |

| Part II: Demographic Background | ||

| White | 5 |

On August 6, 2021, the SEC approved Nasdaq Listing Rule 5605(f) regarding board diversity, which requires us to have, or explain why we do not have, at least one diverse director by December 31, 2023, and a company listed on the Nasdaq Capital Market, such as us, must have, or explain why it does not have, at least two diverse directors by December 31, 2026. However, under Nasdaq Listing Rule 5605(f)(2)(D), companies with smaller boards are required to have only one diverse board member by the compliance date. Under Nasdaq Listing Rule 5605(f), directors who self-identify as (i) female, (ii) an underrepresented minority or (iii) LGBTQ+ are defined as being diverse.

The composition of our Board does not currently include any individuals who are diverse under Nasdaq Listing Rule 5605(f), as presented in the above Board Diversity matrix. The Company believes that the current composition of the Board is well-balanced in skills and experience and it would not be in the best interest of the Company or its shareholders to replace any of the current directors for the purpose of adding a diverse director. The Company intends to add one or more diverse directors through natural Board attrition and/or at such time that the Company has grown and is able to reasonably and economically increase the size of the Board commensurate with such growth. In the future, the Company will recruit additional qualified directors within the above-indicated timeframes or explain why it does not have the prescribed number of diverse directors in order to comply with Nasdaq Listing Rule 5605(f).

Board Committees

The Board has three standing committees: Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Each of the committees of the Board operates pursuant to a written charter. Copies of the charters can be viewed on the corporate governance subsection of the investors section of our website at www.idealpower.com. The information contained, or accessible through, our website is not incorporated by reference into this proxy statement.

Evaluation of Board Performance

Through the Nominating and Corporate Governance Committee, the Board conducts an annual self-evaluation to assess its respective performance and consider potential areas of improvement. The assessment focuses on the effectiveness of the Board and each Board committee, assessed against their respective responsibilities, and the effectiveness of the Board’s and each Board committee’s processes. The full Board discusses all survey results, in order to determine if improvements can be made in Board or Board committee performance and procedures.

The following table is a summary of our committee structure and members on each of our committees as of the date of this proxy statement:

|

Director |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

|||

| Drue Freeman |

|

|

||||

|

Gregory Knight |

|

|

|

|||

|

Ted Lesster |

|

|

||||

|

Michael C. Turmelle |

|

|

||||

|

R. Daniel Brdar |

— |

— |

— |

|||

| Total Meetings in 2023 | 8 | 5 | 5 |

Chair Chair |

Member Member |

Financial Expert Financial Expert |

Audit Committee

The role of the Audit Committee is to:

|

• |

oversee management’s preparation of our financial statements and management’s conduct of the accounting and financial reporting processes; |

|

• |

oversee management’s maintenance of internal controls and procedures for financial reporting; |

|

• |

oversee our compliance with applicable legal and regulatory requirements, including without limitation, those requirements relating to financial controls and reporting; |

|

• |

oversee the independent auditor’s qualifications and independence; |

|

• |

oversee the performance of the independent auditors, including the annual independent audit of our financial statements; |

|

• |

prepare the report required by the rules of the SEC to be included in our proxy statement; |

|

• |

oversee the Company’s policies with respect to risk assessment and risk management, including cybersecurity risk; |

|

• |

discharge such duties and responsibilities as may be required of the Audit Committee by the provisions of applicable law, rule or regulation; and |

|

• |

review, at least annually, the adequacy of the Audit Committee charter. |

Our Board has determined that each of the directors serving on our Audit Committee is independent within the meaning of applicable Nasdaq rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Board has determined that all members of our Audit Committee meet the requirements for independence and financial literacy under the applicable rules and regulations of the SEC and Nasdaq. In addition, our Board has determined that Mr. Turmelle qualifies as an “audit committee financial expert” within the meaning of SEC regulations and applicable Nasdaq rules. In making this determination, our Board has considered the formal education and nature and scope of his previous experience.

Compensation Committee

The role of the Compensation Committee is to:

|

• |

develop and recommend to the Board the annual compensation (base salary, bonus, stock options and other benefits) for our Chief Executive Officer; |

|

• |

review, approve and recommend to the Board the annual compensation (base salary, bonus and other benefits) for all of our executives and for members of the Board; |

|

• |

review, approve and, when appropriate, recommend to the Board for approval, incentive compensation plans and equity-based plans and administer such plans; |

|

• |

review, approve and, when appropriate, recommend to the Board for approval, any employment agreements and any severance arrangements or plans, including any benefits to be provided in connection with a change in control, for the Chief Executive Officer and other executive officers; |

|

• |

review our incentive compensation arrangements to determine whether they encourage excessive risk-taking; |

|

• |

develop and recommend to the Board for approval a Chief Executive Officer succession plan; and |

|

• |

review, at least annually, the adequacy of the Compensation Committee charter. |

Under our 2013 Equity Incentive Plan (as amended and restated to date, the “2013 Plan”), the Compensation Committee may delegate to any officers of the Company the duties, power and authority of the Compensation Committee under the 2013 Plan to persons who are not then subject to Section 16 of the Exchange Act.

The Compensation Committee reviews and considers our Chief Executive Officer’s recommendations with respect to compensation decisions for our named executive officers, other than himself. The Compensation Committee believes it is valuable to consider the recommendations of our Chief Executive Officer with respect to these matters because, given his knowledge of our operations, our industry and the day-to-day responsibilities of our named executive officers, he is in a unique position to provide the Compensation Committee perspective into the performance of our named executive officers in light of our business at a given point in time. The Compensation Committee (without the participation of our Chief Executive Officer) makes all compensation decisions with regard to our Chief Executive Officer.

Our Board has determined that each of the directors serving on our Compensation Committee is independent within the meaning of applicable Nasdaq rules and SEC rules and regulations for purposes of membership on the Compensation Committee.

Nominating and Corporate Governance Committee

The role of the Nominating and Corporate Governance Committee is to:

|

• |

evaluate from time to time the appropriate size (number of members) of the Board and recommend any increase or decrease; |

|

• |

determine the desired skills and attributes of members of the Board, taking into account the needs of the business and listing standards; |

|

• |

establish criteria for prospective members, conduct candidate searches, interview prospective candidates, and oversee programs to introduce the candidate to us, our management, and operations; |

|

• |

review planning for succession to the position of Chairman of the Board and Chief Executive Officer and other senior management positions; |

|

• |

annually recommend to the Board persons to be nominated for election as directors; |

|

• |

recommend to the Board the members of all standing Committees; |

|

• |

adopt or develop for Board consideration corporate governance principles and policies; |

|

• |

review stockholder nominations for candidacy to the Board, if any, and any stockholder proposals affecting corporate governance, and make recommendations to the Board accordingly; |

|

• |

periodically review and report to the Board on the effectiveness of corporate governance procedures and the Board as a governing body, including conducting an annual self-assessment of the Board and its standing committees; and |

|

• |

review, at least annually, the adequacy of the Nominating and Corporate Governance Committee charter. |

Our Board has determined that each of the directors serving on our Nominating and Corporate Governance Committee is independent within the meaning of applicable Nasdaq rules and SEC rules and regulations.

Board and Committee Meetings Attendance

The Board met nine times during 2023. In 2023, one director did not attend one meeting of the Board. Otherwise, each of our directors attended 100% of the aggregate of (i) the total number of meetings of the Board and (ii) the total number of meetings held by all committees of the Board on which such person served.

Director Attendance at Annual Meeting of Stockholders

We do not have a policy with regard to attendance by members of the Board at our annual meetings of stockholders. All of the members of our Board at the time attended the 2023 annual meeting of stockholders.

Policy with Regard to Stockholder Proposals and Director Recommendations

Our Nominating and Corporate Governance Committee (the “Governance Committee”) believes that the minimum qualifications and skills that candidates for director should possess include the highest professional and personal ethics and values, experience at the policy-making level in business, government, education, technology or public interest, a commitment to enhancing stockholder value and sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. The Governance Committee also considers the following factors, in no particular order of importance: (i) various and relevant career experience, (ii) relevant skills, such as an understanding of the Company’s business, (ii) financial expertise, (iv) diversity and (v) local and community ties. However, the Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of our Board, our operating requirements and the long-term interests of our stockholders. While we do not have a formal policy on diversity, our Governance Committee considers diversity of experience as well as diversity in gender and whether an individual represents an underrepresented minority or class, as factors it considers in conducting its assessment of director nominees, along with such other factors as it deems appropriate given the then current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors, our Governance Committee reviews such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence.

In the case of new director candidates, the Governance Committee will also determine whether the nominee is independent. In conducting a search for director candidates, the Governance Committee may use its network of contacts to compile a list of potential candidates, but it may also engage, if it deems appropriate, a professional search firm. The Governance Committee will conduct any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. Thereafter, the Governance Committee will meet to discuss and consider such candidates’ qualifications and select a nominee for recommendation to the Board.

We do not have a separate policy regarding director candidates recommended by stockholders, but the Governance Committee will consider director candidates recommended by stockholders and evaluate them using the same criteria as candidates identified by the Board or the Governance Committee for consideration. If a stockholder of the Company wishes to recommend a director candidate for consideration by the Governance Committee, the stockholder recommendation should be delivered to the Corporate Secretary of the Company at 5508 Highway 290 West, Suite 120, Austin, Texas 78735, and must include information regarding the candidate and the stockholder making the recommendation, in accordance with Article 12 of our amended and restated certificate of incorporation and our bylaws. Stockholders also have the right under our governing documents to nominate director candidates directly, without any action or recommendation on the part of the Governance Committee or the Board, by following the procedures set forth under the heading “Stockholder Proposals and Director Nominations.”

Risk Oversight Management

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including those described under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in other filings that we periodically make with the SEC. Our Board is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full Board, which has responsibility for general oversight of risks. Our Board provides risk oversight for the Company by regularly receiving and reviewing management presentations, including risk assessments, and discussing these assessments with management. In addition, our Board oversees our cybersecurity program and risks. The Board’s overall risk oversight is supplemented by the Board’s various committees. The Audit Committee discusses with management and our independent registered public accounting firm our risk management guidelines and policies, our major financial risk exposures and the steps taken to monitor and control such exposures. Our Compensation Committee oversees risks related to our compensation programs, discusses with management its annual assessment of our employee compensation policies and programs and oversees CEO succession planning. The Compensation Committee also has reviewed our compensation policies and practices for employees generally and has concluded that these policies and practices do not create risks that are reasonably likely to have a material adverse effect on us. Our Governance Committee oversees risk management activities relating to Board composition and succession planning. In addition, members of our executive management team attend our quarterly Board meetings and are available to address any questions or concerns raised by the Board on risk-management and any other matters. Our Board believes that full and open communication between management and the Board is essential for effective risk management and oversight.

Anti-Hedging and Anti-Pledging Policy

Our Insider Trading Policy prohibits all of our employees, officers and directors from engaging in hedging transactions designed to offset decreases in the market value of our securities, including certain forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts. Our Insider Trading Policy also prohibits all of our employees, officers and directors from holding our stock in a margin account or pledging our securities as collateral to secure loans or other obligations.

Code of Business Conduct and Ethics

The Board has adopted a code of business conduct and ethics (the “Code of Conduct”) designed to deter wrongdoing and to promote honest and ethical conduct. The Code of Conduct applies to all of our directors, executive officers and employees. The Code of Conduct may be found on the corporate governance subsection of the investors section of our website at www.idealpower.com. If we make any substantive amendments to, or grant certain waivers from, the Code of Conduct that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, we will disclose the nature of such amendment or waiver on our website or in a Current Report on Form 8-K.

Communications with the Board

Stockholders wishing to communicate with the Board may send a written communication addressed to the Corporate Secretary of Ideal Power Inc. at 5508 Highway 290 West, Suite 120, Austin, Texas 78735. The Corporate Secretary will screen all communications for product complaints, product inquiries, new product suggestions, resumes, job inquiries, surveys, business solicitations and advertisements, as well as unduly hostile, threatening, illegal, unsuitable, frivolous, patently offensive or otherwise inappropriate material before forwarding to the Board.

Non-Employee Director Compensation Policy

Our Board compensation policy provides for the following compensation to our non-employee directors:

|

• |

Annual Cash Retainer. Each non-employee director, other than the Chairman of the Board, receives an annual cash retainer of $60,000. The Chairman of the Board receives an annual cash retainer of $70,000. |

|

• |

Annual Equity Grant. Each non-employee director, other than the Chairman of the Board, receives an annual equity grant having a grant date fair value of $60,000. The Chairman of the Board receives an annual equity grant having a grant date fair value of $120,000. Annual equity grants vest in equal quarterly installments over the fiscal year. |

All non-employee directors are also reimbursed for ordinary and reasonable expenses incurred in exercising their responsibilities. We do not compensate Mr. Brdar, our President and Chief Executive Officer, for his service on the Board.

2023 Director Compensation

The following table describes the compensation earned by non-employee members of our Board during the year ended December 31, 2023:

|

Name |

Fees Earned or Paid in Cash ($) |

Option Awards ($)(1) |

Total ($) |

|||||||||

|

Drue Freeman |

$ | 60,000 | $ | 60,000 | $ | 120,000 | ||||||

|

Gregory Knight |

$ | 60,000 | $ | 60,000 | $ | 120,000 | ||||||

|

Ted Lesster |

$ | 60,000 | $ | 60,000 | $ | 120,000 | ||||||

|

Michael C. Turmelle |

$ | 70,000 | $ | 120,000 | $ | 190,000 | ||||||

|

(1) |

The amounts included in this column are the aggregate grant date fair value of restricted stock unit awards, determined in accordance with Financial Standards Accounting Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718. These amounts do not necessarily reflect the actual value that may be recognized by the individual upon restricted stock unit vesting. |

The aggregate number of stock option awards outstanding for each of our non-employee directors as of December 31, 2023, was as follows:

|

Name |

Number of Vested Stock Options |

Number of Unvested Stock Options |

||||||

|

Drue Freeman |

8,983 | — | ||||||

|

Gregory Knight |

8,983 | — | ||||||

|

Ted Lesster |

34,821 | — | ||||||

|

Michael C. Turmelle |

45,731 | — | ||||||

The following sets forth certain information with respect to the executive officers of the Company as of April 26, 2024.

|

Name |

Age |

Position(s) with the Company |

||

|

R. Daniel Brdar |

64 |

President, Chief Executive Officer and Director |

||

|

Timothy W. Burns, CPA |

49 |

Chief Financial Officer, Secretary and Treasurer |

Please see “Proposal 1 — Election of Directors — Nominees for Election as Director” for information regarding Mr. Brdar.

Timothy W. Burns, CPA, Chief Financial Officer, Secretary and Treasurer

In October 2013, Timothy W. Burns joined Ideal Power as our Chief Financial Officer and Treasurer and in November 2013 he was appointed as our Secretary. Prior to joining the Company, Mr. Burns was employed by Rainmaker Systems, Inc. (Nasdaq: RMKR), then a publicly traded company, from November 2010 until February 2013, first as the company’s Controller and, beginning in April 2011, as its Chief Financial Officer. Mr. Burns also served as Interim President and Chief Executive Officer of Rainmaker Systems, Inc. from October 2012 to December 2012. Prior to his employment with Rainmaker Systems, Inc., Mr. Burns was employed by Dean Foods Company (NYSE: DF), then a publicly traded company, from 2001 until November 2010 where he held various positions in finance and accounting including Director of Corporate Accounting from 2008 to November 2010. From 1998 to 2001, Mr. Burns was employed by Deloitte & Touche, LLP as an auditor. Mr. Burns has a master’s degree in professional accounting from the University of Texas and a bachelor’s degree in accounting from the University of Southern California. He is a public accountant certified in Texas.

Family Relationships

There are no family relationships between any of our executive officers or directors.

The following table summarizes compensation earned during the years ended December 31, 2023 and 2022 by our named executive officers (“NEOs”).

Summary Compensation Table

|

Name and Principal Position |

Year |

Salary ($) |

Bonus ($)(1) |

Stock Awards ($)(2) |

All Other Compensation ($)(3) |

Total ($) |

||||||||||||||||

|

R. Daniel Brdar |

2023 |

354,200 | 247,940 | — | 25,559 | 627,699 | ||||||||||||||||

|

President and Chief Executive Officer |

2022 |

354,200 | 247,940 | 909,841 | 24,128 | 1,536,109 | ||||||||||||||||

|

Timothy Burns |

2023 |

282,576 | 98,902 | — | 18,856 | 400,334 | ||||||||||||||||

|

Chief Financial Officer and Secretary |

2022 |

252,300 | 88,305 | 520,866 | 14,131 | 875,602 | ||||||||||||||||

|

(1) |

Bonus represents performance bonus earned during the year. See “Employment Agreements” below for further discussion of NEO target bonuses. |

|

(2) |

The amounts included in this column are the aggregate grant date fair value of restricted stock units and performance stock units, determined in accordance with FASB ASC Topic 718, excluding the effect of estimated forfeitures. Assumptions used to determine the aggregate grant date fair value of the performance stock unit awards are set forth in Note 10 to our audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024. |

|

(3) |

Other compensation includes Company-paid benefits. |

Current and Future Compensation Practices

Currently, compensation for our NEOs consists of base salary, a cash bonus and equity awards. The current practice is for the Company to provide annual equity awards in the form of performance stock units and restricted stock units to NEOs. In 2023, the Compensation Committee elected not to provide NEOs with annual equity awards. The Company has not established a policy or practice for determining the number of NEOs’ equity awards and, as such, the number of awards granted to NEOs are at the discretion of the Compensation Committee of our Board. We may establish such a policy or practice in the future.

In setting the compensation for our NEOs, we look primarily at the person’s responsibilities and level of performance, at the person’s experience and education, at our ability to replace the individual and competitive benchmarking data. In 2022, the Compensation Committee engaged a firm that specializes in executive and Board compensation to conduct a compensation benchmarking study. This firm obtained market benchmarking data for public companies with similar characteristics to us and compared this data to actual executive compensation at the Company. The firm’s analyses determined that base salary for the CEO was well positioned to the 25th percentile of the peer group while the annual incentive target for the CEO registered below the 25th percentile and below the range of competitive practice. As a result, the Compensation Committee approved an increase in the annual incentive target for the CEO from 75% to 100% of CEO base salary. The firm’s analyses also determined that the total estimated direct compensation, defined in the study as the sum of base salary, annual incentive target and long-term incentive, of the CFO registered below the 25th percentile of the peer group and below the range of competitive practice and that the most recent (2021) long-term incentives for the CEO and CFO at the time registered below the range of competitive practice. The Compensation Committee considered this information in determining 2022 annual equity grants for NEOs and in setting 2023 NEO base salaries.

We expect the base salaries of our NEOs to remain relatively constant but may adjust an NEO’s base salary if the person’s responsibilities are materially changed or due to other economic or market considerations. We also may pay bonuses to reward exceptional performance or the achievement by the Company or an individual of targets to be agreed upon. The performance bonus target for each NEO who is currently an employee of the Company is established by his employment agreement, subject to adjustment by the Compensation Committee, which is discussed in detail below. In 2023 and 2022, the actual bonuses paid to NEOs, equal to 70% of the performance bonus target for each NEO, were based on the level of achievement by the Company of targets approved by the Board.

In September 2023, the Company adopted an Incentive Compensation Recovery Policy, commonly referred to as a “Clawback Policy.” The Company’s Clawback Policy is intended to comply with, and to be administered and interpreted consistent with, Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 promulgated under the Exchange Act (“Rule 10D-1”), and Listing Rule 5608 adopted by the Nasdaq Stock Market LLC (“Nasdaq”) (the “Listing Standards”). The Company’s Clawback Policy was filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024.

Employment Agreements

Mr. Brdar

In connection with his appointment as President and Chief Executive Officer, the Company and Mr. Brdar entered into a Second Revised and Restated Employment Agreement effective April 8, 2020. The agreement provided for an initial annual salary, subject to a cost of living adjustment and adjustment no less frequently than annually at the discretion of the Board or Compensation Committee. Mr. Brdar is also entitled to a target bonus based on performance objectives and targets (the “Performance Goals”) established by Mr. Brdar and the Compensation Committee. If the Performance Goals are satisfactorily achieved during the period or periods designated, as determined by the Compensation Committee, Mr. Brdar is eligible to receive a performance bonus with a target amount of up to 100% of his annual salary.

Pursuant to his employment agreement, if Mr. Brdar’s services are terminated without cause at the election of the Company or as a result of a change in control, he will be entitled to receive (i) his accrued but unpaid annual salary and the value of unused paid time off through the effective date of the termination; (ii) business expenses incurred prior to the effective date of termination; (iii) any unpaid bonus to the extent he met some or all of the Performance Goals prior to termination; and (iv) severance (the “Brdar Severance Payment”). The Brdar Severance Payment is equal to twelve months of Mr. Brdar’s base salary and shall be paid in equal installments over the severance period with the first payment made on the 30th day following termination of Mr. Brdar’s employment and subsequent payments made on Company paydays during the severance period. Mr. Brdar will be entitled to continue to participate in employee benefit plans, at the Company’s sole expense, during the severance period. In addition, if Mr. Brdar’s services are terminated as a result of a change in control, any of his equity awards that were scheduled to vest following the termination of his employment will vest immediately.

Mr. Brdar is also entitled to receive the same benefits and opportunities to participate in any of the Company’s employee benefit plans which may now or hereafter be in effect on a general basis for executive officers or employees. During his employment, the Company will provide, at the Company’s sole expense, health insurance benefits for Mr. Brdar and his spouse under the same policy or policies generally available to other executive officers of the Company.

Mr. Burns

On September 16, 2014, Timothy Burns entered into an employment agreement with us. The agreement provided for an initial annual salary, subject to a cost of living adjustment and adjustment annually at the discretion of the Board or Compensation Committee. Mr. Burns is also eligible for an annual bonus with a target performance bonus equal to 50% of his annual salary. The actual performance bonus percentage for a given year is based on actual performance relative to the Performance Goals, which are to be mutually agreed upon by the Compensation Committee, the Chief Executive Officer and Mr. Burns.

The employment agreement will be terminated if Mr. Burns is disabled or voluntarily resigns from his employment. The Company may terminate Mr. Burns’ employment for cause or without cause on 30 days’ written notice. If his employment is terminated by the Company without cause, Mr. Burns will receive his accrued but unpaid salary and the value of unused paid time off through the effective date of the termination, any accrued but unpaid bonus, business expenses incurred prior to the effective date of the termination, and severance (the “Burns Severance Payment”) consisting of six months’ salary. The Company may elect, in its sole discretion, whether to pay the Burns Severance Payment in one lump sum or on regular pay days for the six months following termination of Mr. Burns’ employment. Mr. Burns will also be entitled to continue to participate in employee benefit plans, at the Company’s sole expense, for six months following the termination of his employment. In addition, if Mr. Burns’ employment is terminated as a result of a change in control, any of his equity awards that were scheduled to vest following the termination of his employment will vest immediately.

Under the terms of his employment agreement, Mr. Burns is entitled to participate in any of our employee benefit plans that may now be, or in the future will be, in effect on a general basis for our executive officers or employees. Additionally, we provide, at the Company’s sole expense, healthcare benefits for Mr. Burns and his children.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information concerning outstanding equity awards for our NEOs at December 31, 2023. No stock options were exercised by our NEOs during 2023 or 2022.

| Option Awards | Stock Awards | |||||||||||||||||||||||

| Name |

Number of securities underlying unexercised options (#) Exercisable |

Number of securities underlying unexercised options (#) Unexercisable |

Option exercise price ($) |

Option expiration date |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(1) |

||||||||||||||||||

| R. Daniel Brdar | — | — | $ | — | — | 70,000 | (2) | $ | 543,900 | |||||||||||||||

| — | — | $ | — | — | 20,000 | (3) | $ | 155,400 | ||||||||||||||||

| — | — | $ | — | — | 25,000 | (4) | $ | 194,250 | ||||||||||||||||

| 50,000 | — | $ | 7.59 |

12/10/2030 |

— | $ | — | |||||||||||||||||

| 25,000 | — | $ | 7.19 |

08/06/2030 |

— | $ | — | |||||||||||||||||

| 38,000 | — | $ | 1.99 |

03/25/2030 |

— | $ | — | |||||||||||||||||

| 21,000 | — | $ | 2.85 |

10/28/2029 |

— | $ | — | |||||||||||||||||

| Timothy Burns | — | — | $ | — | — | 27,500 | (2) | $ | 213,675 | |||||||||||||||

| — | — | $ | — | — | 18,333 | (3) | $ | 142,447 | ||||||||||||||||

| — | — | $ | — | — | 8,332 | (4) | $ | 64,740 | ||||||||||||||||

| 25,000 | — | $ | 7.59 |

12/10/2030 |

— | $ | — | |||||||||||||||||

| 5,700 | — | $ | 7.19 |

08/06/2030 |

— | $ | — | |||||||||||||||||

| 9,500 | — | $ | 1.99 |

03/25/2030 |

— | $ | — | |||||||||||||||||

| 9,721 | — | $ | 2.85 |

10/28/2029 |

— | $ | — | |||||||||||||||||

|

(1) |

Value calculated as the number of unearned units multiplied by the closing price of the Company’s common stock on the Nasdaq Capital Market at December 31, 2023 of $7.77 per share. |

|

(2) |

Performance stock units, with a grant date of December 15, 2022, vest in three equal tranches at such time or times prior to December 15, 2025 that certain common stock price appreciation metrics are achieved, provided that the NEO remains in continuous service with us through each vesting date. |

|

(3) |

Restricted stock units, with a grant date of December 15, 2022, vest one-third annually over a three-year vesting period, provided that the NEO remains in continuous service with us through each vesting date. |

|

(4) |

Restricted stock units, with a grant date of December 17, 2021, vest one-third annually over a three-year vesting period, provided that the NEO remains in continuous service with us through each vesting date. |

Compensation Risk Assessment

The Compensation Committee has reviewed our compensation policies and practices for all employees, including our NEOs, and has concluded that these policies and practices do not create risks that are reasonably likely to have a material adverse effect on us.

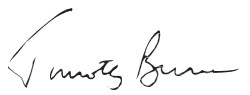

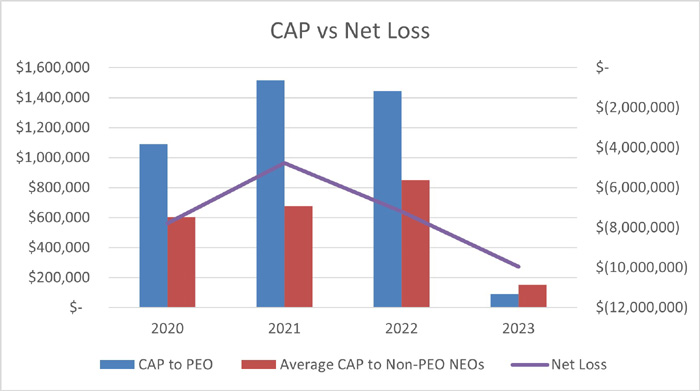

In accordance with rules adopted by the Securities and Exchange Commission pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following information regarding the relationship between executive compensation actually paid (“CAP”) for our principal executive officer (“PEO”) and Non-PEO NEOs, and Company performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown. The CAP amounts shown in the table below do not reflect the actual amount of compensation earned by or paid to our NEOs during the applicable year.

| Year |

Summary Compensation Table Total for PEO(1) |

Compensation Actually Paid to PEO(2) |

Average Summary Compensation Table Total for Non-PEO NEOs(1) |

Average Compensation Actually Paid to Non-PEO NEOs(3) |