UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________

FORM 10-K

________________________________________________________________

(Mark One)

| |

ý | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2016 |

OR

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-36216

________________________________________________________________

IDEAL POWER INC.

(Exact name of registrant as specified in its charter)

________________________________________________________________

|

| | |

DELAWARE | | 14-1999058 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

4120 Freidrich Lane, Suite 100

Austin, Texas 78744

(Address of principal executive offices)

(512) 264-1542

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which each is registered |

Common Stock, par value $0.001 | | NASDAQ Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. |

| | |

Large accelerated filer o | | Accelerated filer o |

Non-accelerated filer o | | Smaller reporting company ý |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the issuer is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of June 30, 2016, the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the last sale price of the common equity was $35,944,832. As of March 20, 2017 the issuer has 13,996,782 shares of common stock, par value $0.001, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the Proxy Statement relating to the registrant’s 2017 annual meeting of stockholders, which shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

TABLE OF CONTENTS

|

| |

| |

PART I. | |

| |

| |

| |

| |

| |

| |

PART II. | |

| |

| |

| |

| |

| |

| |

| |

| |

PART III. | |

| |

| |

| |

| |

| |

PART IV. | |

| |

Signatures | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND

OTHER INFORMATION CONTAINED IN THIS REPORT

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by looking for words such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "would," "should," "could," "may" or other similar expressions in this report. In particular, these include statements relating to future actions, prospective products, applications, customers, technologies, future performance or results of anticipated products, expenses, and financial results. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience and our present expectations or projections. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| |

• | our ability to achieve profitability; |

| |

• | our limited operating history; |

| |

• | our ability to successfully market and sell our products; |

| |

• | the size and growth of markets for our current and future products; |

| |

• | our expectations regarding the growth and expansion of our customer base; |

| |

• | regulatory developments that may affect our business; |

| |

• | our ability to successfully develop new technologies, including our bi-directional bipolar junction transistor, or B-TRAN™; |

| |

• | our expectations regarding the completion of testing of new products under development and the timing of the introduction of those new products; |

| |

• | the expected performance of new products incorporating our B-TRAN™; |

| |

• | the performance of third-party manufacturers who supply and manufacture our products; |

| |

• | our ability to cost effectively manage product life cycles, inclusive of product launches and end of product life situations; |

| |

• | the rate and degree of market acceptance for our current and future products; |

| |

• | our ability to successfully obtain certification for our products, including in new markets, and the timing of the receipt of any necessary certifications; |

| |

• | our ability to successfully license our technology; |

| |

• | our ability to obtain, maintain, defend and enforce intellectual property rights protecting our current and future products; |

| |

• | our expectations regarding the decline in prices of battery energy storage systems; |

| |

• | general economic conditions and events and the impact they may have on us and our potential customers; |

| |

• | our ability to obtain adequate financing in the future, as and when we need it; |

| |

• | our success at managing the risks involved in the foregoing items; and |

| |

• | other factors discussed in this report. |

The forward-looking statements are based upon management’s beliefs and assumptions and are made as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statements included in this report. You should not place undue reliance on these forward-looking statements.

PART I

ITEM 1: BUSINESS

Our Company

Ideal Power Inc. was formed in Texas on May 17, 2007 and converted to a Delaware corporation on July 15, 2013. Unless otherwise stated or the context otherwise requires, the terms "Ideal Power," "we," "us," "our" and the "Company" refer to Ideal Power Inc.

We design, market and sell electrical power conversion products using our proprietary technology called Power Packet Switching Architecture™, or PPSA™. PPSA™ is a power conversion technology that improves upon existing power conversion technologies in key product metrics, such as size and weight while providing built-in isolation and bi-directional and multi-port capabilities. PPSA™ utilizes standardized hardware with application specific embedded software. Our advanced technology is important to our business and we make significant investments in research and development and protection of our intellectual property. At December 31, 2016, we have been granted 32 US patents and six foreign patents related to PPSA™.

We sell our products primarily to systems integrators for inclusion in larger turn-key systems which enable end users to manage their electricity consumption by reducing demand charges or fossil fuel consumption, integrating renewable energy sources and forming their own microgrid. Our products are made by contract manufacturers to our specifications, enabling us to scale production to meet demand on a cost-effective basis without requiring significant expenditures on manufacturing facilities and equipment. As our products establish a foothold in key power conversion markets, we may begin to focus on licensing our proprietary PPSA™-based product designs to OEMs to reach more markets and customers. We may seek to build a portfolio of relationships that generate license fees and royalties from OEMs for sales of their products which integrate PPSA™.

Industry Background

Utility power grids are built using alternating current, or AC, generation, transmission, and distribution resources. This method of power transmission and distribution has been proven over time to be reliable and safe. The outlets in a typical home or business are AC but many electrical devices, such as computers, televisions, and other appliances operate on direct current, or DC, power. Batteries and photovoltaic, or PV, solar panels produce DC power as well. In order to connect DC devices to an AC power grid, a power conversion device is necessary.

We believe that significant changes in the supply of and demand for electrical power are driving demand for new energy infrastructure products and supporting technologies. In a traditional utility model, electrical power is generated from central stations and transmitted over long distance high-voltage transmission lines to substations where the voltage is reduced for distribution to consumers. Utility power grids are built to manage the flow of power in one direction, from generation to use, where sophisticated tools have been developed to match the amount of power being generated with the amount being consumed. Utilities ramp power plants up or down to closely match generation with load.

The rapid growth in worldwide renewable energy generation, such as wind and solar power, has added a new level of complexity to the task of matching power generation with consumption. These intermittent resources cannot be dispatched at will or relied upon to meet the peak power demands of the grid. Renewable energy sources tend to ramp up and down quickly. For example, a single cloud over a PV farm can cause electrical output to change dramatically in a matter of seconds. These new challenges make it increasingly difficult for utilities to accurately forecast and meet peak power demands.

Increased peak demand for power also has exposed weaknesses in the existing power grid. In high-cost, high-demand states, such as California, public utilities have instituted peak demand charges as a way to ration power during periods of peak demand and to incentivize customers to shift their power consumption to off-peak times. At the same time, both the Federal and certain state governments have created incentive programs to encourage the development and implementation of alternative energy sources, such as solar and wind power, which has the adverse consequence of making peak demand more difficult to forecast and satisfy. Strains on the electric grid have resulted in significant brown-outs and black-outs that have heightened awareness of the vulnerabilities of the existing system. As a result, power consumers are turning to new technologies to manage their energy consumption, lower costs and assure a reliable source of supply. We believe that distributed generation with advanced power conversion systems, such as our PPSA™ products, is becoming an increasingly important element of this new infrastructure.

In response to these changes in the market for electrical power, a number of technologies have been developed to enable users to more effectively manage their consumption and, one of these technologies, energy storage systems, has emerged as the best way to mitigate the instabilities and market inefficiencies caused by these emerging power grid realities. For example, a commercial business can shift energy usage from peak to non-peak times by installing a battery energy storage system, or BESS. The commercial business can use electricity generated during off-peak hours to charge the BESS and then use the stored power to satisfy all or part of its demand during peak hours. Similarly, a commercial business can install a solar power system to generate power for use either immediately upon generation or for storage in a BESS for later use.

Battery energy storage systems and many alternative energy sources provide power on a DC basis. However, the electric power grid and most electrical equipment operates on an AC basis. Consequently, power conversion systems are required to convert power from DC to AC or from AC or DC as necessary to make the various components of the system function together. In addition to converting power, power conversion systems enable customers to regulate current, voltage and frequency while optimizing system resources such as batteries, PV and the utility power grid to reduce energy costs. Systems incorporating advanced power converters may also manage distributed grid energy storage and be used to create stand-alone microgrids to bring power to a business or residence if the main electrical grid, if one is present, is unavailable.

Our Technology

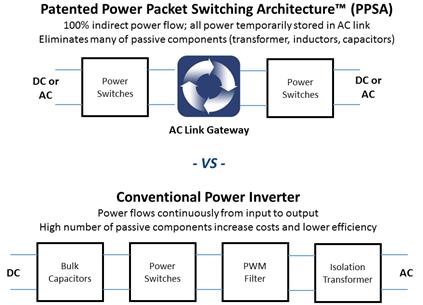

PPSA™ uses indirect power flow in which power flows through input switches and is temporarily stored in our proprietary AC link inductor. Our proprietary fast switching algorithms enable the transfer of quantum packets of power between ports in our system. As the AC link becomes charged, it disconnects from its input switches, resonates without being connected to either the input or output switches, and then reconnects to its output switches when it reaches the correct voltage and frequency for the application.

Figure 1: Schematic of PPSA™ Process

Traditional power conversion systems use continuous power flow that relies on relatively heavy and expensive magnetic components and bulk capacitors. Many of these traditional systems have custom hardware for specific applications and are not readily adaptable or customizable. Because they are relatively inefficient, these systems generate excess heat that causes electrical and thermal stresses resulting in drive component failures and losses. By contrast, our conversion technology eliminates the majority of the passive components of traditional power conversion systems, including the separate isolation transformer and most of the inductors and bulk capacitors.

We believe PPSA™ offers several key advantages over traditional technologies, such as:

| |

• | Bi-directional: PPSA™ is inherently bi-directional enabling power flow in both directions. For example, one PPSA™-based power converter could be used to both charge and discharge batteries. |

| |

• | Built-in Isolation: PPSA™-based power converters have built-in isolation and thus do not require an isolation transformer which adds cost, size and weight and reduces the efficiency of battery energy storage systems. |

| |

• | Multi-Port Capabilities: PPSA™ architecture enables multiple AC and/or DC sources and uses to be connected together in one power converter, minimizing total system cost for tying together, for example, DC solar PV and DC batteries to the AC grid. |

| |

• | Scalability/Flexibility: PPSA™ is made from standard industry components, is battery agnostic and software driven, thus providing more scalability that enables rapid development cycles for new products and new applications. This same functionality provides ultimate flexibility for customers globally as it is capable of power conversion in both 50Hz and 60Hz AC environments. |

| |

• | Size and Weight: PPSA™ reduces size and weight by eliminating passive components such as isolation transformers, inductors and bulk capacitors. Reduced sized and weight result in lower transportation and installation costs. Our newest, fully isolated 30kW power conversion system weighs less than 150 pounds. By contrast, similar transformer-based 30kW power conversion systems typically weigh over 600 pounds. |

Products

We have developed products commercializing PPSA™ and make these products available for sale both directly to customers and through distributors. We currently sell several power conversion systems, or PCS, utilizing our patented PPSA™ technology. These products are described as follows:

| |

• | The 30kW SunDial™ and the 30kW SunDial Plus™, which are UL-1741 certified and are intended to be used for the commercial and industrial grid-tied solar and solar plus storage market. The SunDial™ is a PV string inverter which is field upgradable through the addition of a drop-in second DC port to connect batteries to a solar PV array. The SunDial Plus™ includes the PV inverter and the second DC battery port in one package. These products both include a built-in 6 string PV combiner and DC disconnects and are grid-tied, AC export only. |

| |

• | The 30kW Stabiliti™ series has two product offerings, two-port (AC-DC) and multi-port (AC-DC-DC) models, which are both UL-1741 certified. These products are intended to be used in the stand-alone storage and microgrid markets. They are bi-directional and operate in both grid-tied and grid-forming modes with near seamless transfer between operating modes. Grid-forming mode provides customers the ability to form and manage a microgrid. The products operate in both 50Hz and 60Hz environments and will be introduced in markets other than North America in 2017. |

| |

• | 125kW Grid-Resilient AC-DC PCS, which is certified for UL1741 conformance, has over four times the power of the 30kW product and is also able to convert in both 50Hz and 60Hz AC environments and form and manage a microgrid. This product is intended for use in higher power stand-alone storage and microgrid applications. |

Future Innovations

Bi-Directional Switches

Our existing products incorporate multiple insulated gate bipolar transistors (“IGBTs”), which are power switches used in the process to convert power from one current form to another. IGBTs switch power in only one direction (DC to AC or AC to DC) and require the use of a blocking diode to prevent power from flowing back through the system. To enable our existing products to perform bi-directional power conversion, for each IGBT and diode used in our products, we must include a second IGBT and diode. These additional components have slight voltage drops that affect the electrical efficiency of our products and generate excess heat that must be dissipated. We have patented and are developing a new, highly efficient silicon switch called a bi-directional bipolar transistor, or B-TRAN™, that we believe will allow us to substitute one B-TRAN™ for two pairs of IGBTs and diodes used in our current products and is also a potential replacement for conventional power switches in the broader power semiconductor market.

Based on third party device software simulations, we believe that the B-TRANs™ can significantly improve electrical efficiency in our power converters. The higher efficiency would substantially reduce the heat generated by the operation of our products. As a result, products incorporating B-TRANs™ will require less space for heat dissipation which would allow us to increase power density, or power per pound, and reduce material costs.

In April 2016, we announced one of our semiconductor fabricators successfully tested B-TRAN™ silicon dies and the results were consistent with third party simulations that predict significant performance and efficiency improvements over conventional power switches such as SCRs, IGBTs and MOSFETs. In October 2016, we announced one of our semiconductor fabricators successfully completed the fabrication of prototype B-TRAN™ devices. The next major milestone towards commercializing the B-TRAN™ will be to begin testing a fully-packaged device in the first half of 2017.

We plan to first utilize the B-TRAN™ in our own power conversion products and then introduce it into the rapidly growing power semiconductor market, estimated to be $19 billion in 2017 according to research firm IHS Technology, or IHS, utilizing a licensing model. We believe our new B-TRAN™ technology can potentially address a significant portion of the power semiconductor market that currently relies on power semiconductor devices such as technologies such as IGBTs. Potential addressable markets for B-TRAN™-based products include very low loss solid-state DC and AC contactors, electric vehicle drivetrains, variable frequency drives, solar PV inverters, bi-directional energy storage and microgrid power conversion systems, matrix converters and other power conversion products. At December 31, 2016, we have 18 US and five foreign issued patents covering the operation, control and manufacturing of the B-TRAN™ device.

EV Fast Chargers

Electric vehicles, or EVs, are emerging as a fast growth area of the overall automotive sector in the US and abroad. As EVs become a more significant section of the automotive market, the infrastructure to support them will need to be developed. Our PPSA™ technology is a natural power conversion choice for system integrators looking for a highly efficient and compact system for an DC EV fast charger. In 2017, we expect to begin the development of products based on our existing product family to directly target this fast-growing market segment.

Business Strategy

Our business strategy is to promote and expand the uses of PPSA™ initially through product development and product sales. To bring our products to market, we will seek out best-in-class partners who will distribute, white-label or integrate our innovative products into higher value systems resulting in multiple strategic sales channels for our PPSA™-based products and product designs. Although our primary market is the United States, we will increasingly target markets outside the United States. As our products gain broader acceptance in the power conversion market, we intend to license our proprietary PPSA™-based product designs to OEMs within our target markets, as well as license our technologies for other markets which we do not plan to enter directly. The basis for this approach is the belief that OEMs may achieve higher product margins and gain more market share by providing PPSA™-based products, which are differentiated from the traditional product offerings in the industry, to their customers. We believe such strategic relationships with key OEM licensees would enable us to reap the benefits of PPSA™ and gain market share more quickly than by strictly manufacturing and distributing our products.

Target Markets

Currently, our primary markets are stand-alone storage, which represented a majority of our sales in the year ended December 31, 2016, and PV + storage.

Stand-Alone Storage Market

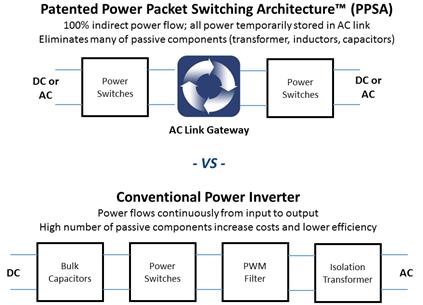

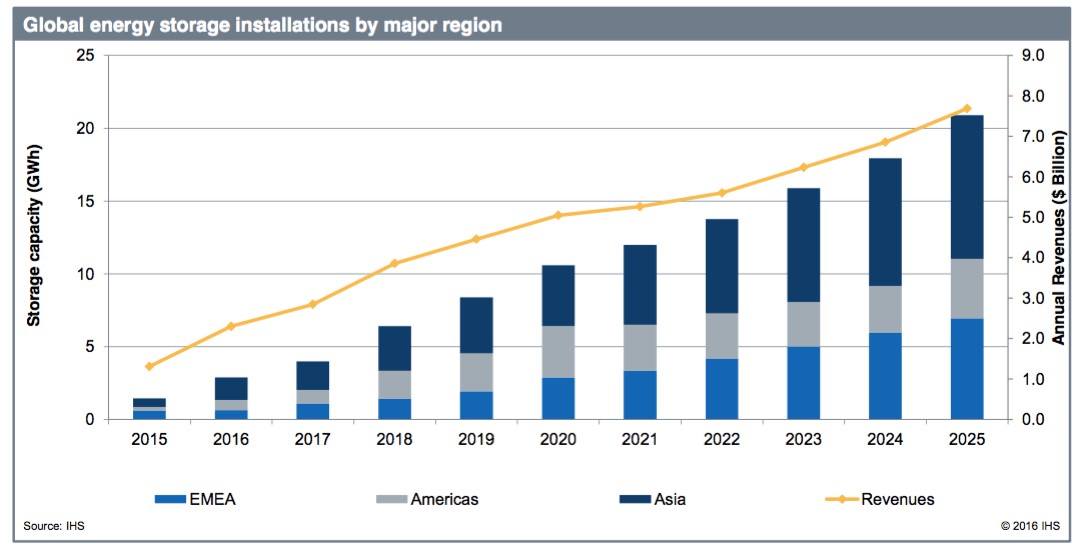

Based on market studies and forecasts by IHS, as shown in Figure 2, the global stand-alone storage market is forecasted to grow to $13 billion cumulatively from 2017 through 2020. Based on our estimate that power conversion systems represent approximately 10% to 15% of the system cost, power conversion systems, such as ours, would account for approximately $2 billion of this market.

Figure 2: Stand-Alone Storage Market Forecast

The stand-alone storage market is served by BESS. BESS are racks of batteries coupled with a system controller and a power conversion system, such as those manufactured by us, to enable electric power to be captured, stored, and used in conjunction with electric power grids. These systems can be large, megawatt-scale systems operated by utilities to better manage their system resources, or smaller kilowatt-scale systems used by businesses and designed to enable these businesses to manage their power use and mitigate utility imposed "peak demand charges", which are charges utilities levy on their business customers for delivery of power at peak usage times of the day, such as mid-afternoons in the summer. The growth of peak demand charges has been substantial over the past decade and now can make up 50% or more of a commercial utility bill in certain markets. This is a trend that is likely to continue as more intermittent resources are added to the utility power grid causing grid instability. Utilities and aggregators of distributed generation resources are also expected to adopt BESS due to the proliferation of renewables and to take advantage of additional value streams such as energy arbitrage, frequency regulation and ancillary services, infrastructure upgrade deferral and locational capacity.

There are strong economic incentives available to commercial and industrial consumers in major US markets such as California and New York in the form of reduced demand charges for installing a BESS and reducing peak consumption. There is also strong regulatory support for such systems. For example, California has issued a mandate for over 1,000 megawatts of new energy storage to be installed by 2020. Our 30kW and 125kW power conversion systems enable these BESS to connect to the utility power grid and, when paired with batteries, offer these customers a substantial cost saving opportunity on their monthly electric bill. This market is still in its early years, but we have established a strong brand and position in this market with our customers having many systems installed and operating today. We believe this market offers a compelling value proposition today for our products.

We believe, as early as the second half of 2017, this market will begin to grow beyond pilot installations to higher volume installations driven by the underlying economics of BESS to commercial and industrial customers. A good indicator of this is the availability of third party financing for BESS. Several of our customers have signed, announced or are in negotiation for financing deals for their BESS products.

We expect the cost of commercial and industrial BESS to continue to decline due primarily to lower battery costs and, as a result, expect significant expansion in the addressable market for these systems. We also believe the combination of lower BESS costs, third-party financing, increases in utility demand charges, and the continued entrance of large, established companies to the BESS space will all contribute to accelerating market growth for stand-alone storage.

PV + Storage Market

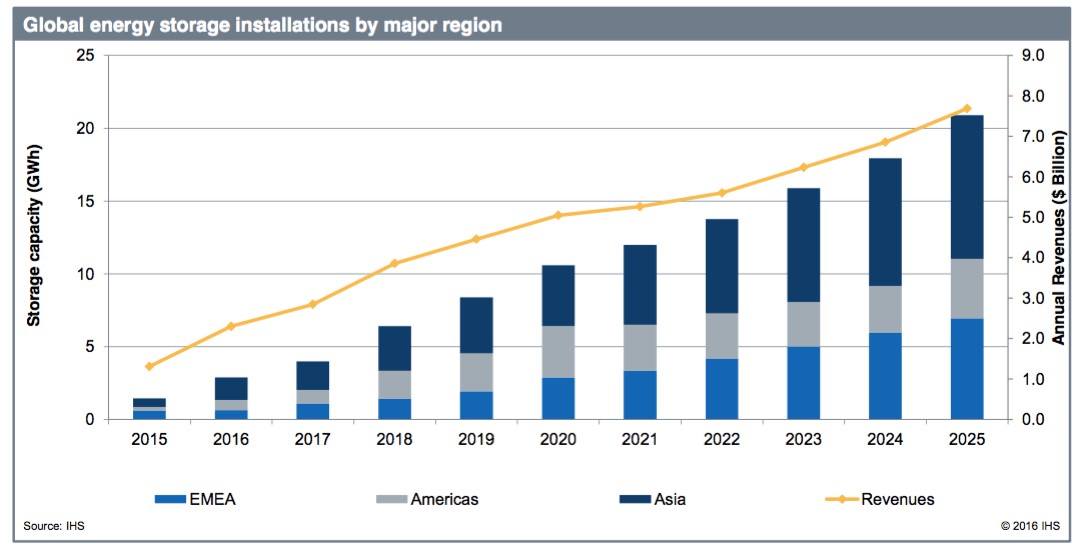

The global solar PV + storage market is forecast by IHS to grow to over 4,000 mega-watts of PV, or MWPV, annually by 2020. Utilizing our estimate of $0.18 per watt, this translates to approximately $2 billion Solar PV + Storage power conversion market over the next four years. See Figure 3 below.

Figure 3: PV + Storage Market Forecast

PV has one of the lowest levelized costs of energy for new electrical generation capacity and this is expected to remain true in the near term. We expect distributed PV to continue to be a high growth business as system costs have fallen dramatically over the past several years. As such, the economics of generating PV for local consumption is expected to remain strong for several more years, especially given the investment tax credit, or ITC, extension passed by Congress and signed into law in 2015 for solar energy production. Our new Sundial™ products were launched in 2016 to directly address this market.

One shortcoming of distributed, behind-the-meter PV systems is that they require connection to the utility power grid in order to operate. For example, a business with PV on its roof will not, in most cases, benefit from the ability to generate power should the utility power grid go down. Another shortcoming of distributed PV systems is the instability they cause on the local power lines. Utility power grids were not designed to manage power inflow from the end of the lines. As such, distributed generation sources can lead to wide swings in line voltages when clouds pass and power output falls off, requiring the utility to ramp up its central power stations to make up for the shortfall in solar. We believe the proliferation of PV, its intermittency and the elimination of net metering in many states will drive significant growth in the PV + storage market.

Our power conversion products help resolve these shortcomings. For example, when a distributed PV system is connected to a BESS that includes one of our Stabiliti™ multi-port PCS, the business will benefit from the ability to form and manage a local microgrid powered by the PV system and BESS even when the utility power grid is down. This capability is attractive to electricity consumers who need to power critical loads even in a blackout. Our Stabiliti™ PCS are also equipped to meet evolving utility requirements for low voltage ride-through and other key operating parameters, enabling the PV and BESS it connects to the grid to help stabilize the utility power grid when voltage or frequency fluctuates due to imbalances in load and supply.

Commercial and industrial BESS are able to generate value far beyond peak demand reduction. We believe our products will become increasingly attractive to co-locate BESS with distributed PV. IHS, which has strong renewable industry focus,

forecasts that global installations of grid-tied commercial BESS coupled with PV will grow to over 1,500 MW of commercial PV + storage systems being installed annually by 2020.

According to their research, IHS believes that systems will be deployed in two principal configurations. The present configuration is to have separate BESS and PV systems tied together through the AC wiring, which is supported by all of our current products. A second, emerging configuration will be to place the BESS and the PV system behind a single PCS with two DC inputs. This configuration is forecast to improve efficiency, reduce costs, and allow PV harvesting when operating without a utility power grid present in microgrid mode. Our Sundial Plus™ was designed specifically to enable this lower cost and more efficient second configuration.

Also according to IHS, the global commercial PV industry is projected to grow to over 33GW annually by 2020. IHS further forecasts that these commercial systems will have a 2% storage attachment rate by 2020, providing for a nearly 700MW annual commercial PV + storage market. These new PV + storage markets include providing backup power during blackouts, improving grid stability in high penetration PV areas and reducing fossil fuel consumption in remote and off-grid microgrids.

Other Markets

Although our technology may be suitable for other vertical markets within the global power conversion market landscape, we do not currently offer products for sale directly to other power conversion markets such as the VFD, uninterruptible power supply, rail, wind or EV traction drive markets.

In addition to the markets discussed above, we also have opportunities for market expansion into fast electric vehicle chargers in certain applications where our products’ compact size and multi-port capabilities can unlock value for the system integrator particularly in locations where battery storage is coupled with the charging system to eliminate demand charges or expand the charging systems response capabilities. We have provided PCS to multiple EV charging system integrators who have deployed initial projects using our products coupled with batteries at EV charging stations to prove out these concepts. As these initial installations begin to operate, the value propositions of these new opportunities will become clearer.

We plan to continue to monitor all power conversion markets for opportunities to create solutions for customers and unlock the broader value of our patented technology.

Intellectual Property

We rely on a combination of patents, laws that protect intellectual property, confidentiality procedures, and contractual restrictions with our employees and others, to establish and protect our intellectual property rights. In addition, the software that is shipped with our products is encrypted. As of December 31, 2016, we have 50 US and 11 foreign issued patents. We also had approximately 100 additional pending U.S. and international patent applications. We expect to continue to build our patent estate for both our core power conversion technology, our bi-directional switch technology and other technological developments that broaden the scope of our technology platform.

Customers

Although we are expanding our customer base and channels to market, we have historically been reliant on a small number of customers. For the year ended December 31, 2016, Sonnen Inc. and Gexpro accounted for 44% of net revenues. For the year ended December 31, 2015, Sharp Corporation, Gexpro, Green Charge Networks, LLC, and Coda Energy LLC, accounted for 66% of net revenues.

Sales and Marketing

We sell our products primarily to systems integrators for installation as part of a larger turn-key system providing end users with a complete solution for managing their energy consumption. Our products are also sold through distribution channel partners. Before a system integrator agrees to specify our products in their systems, the integrator engages in a lengthy and time-consuming process of testing and evaluating our equipment for use, which typically takes from a few months to as long as a year.

For certain geographic markets and applications, we may seek to enter into licensing agreements that would enable licensees to build our products for sale in local markets or we may license product designs to global brands for specific applications. In 2016, we entered into our first licensing agreement for our Sundial™ with Flex Ltd. (Nasdaq: Flex).

NEXTracker Inc., a Flex company, will sell the Sundial™ as part of its newly launched NX Fusion Plus solar plus storage tracker.

Manufacturing and Supply

We use contract manufacturers to manufacture our products to our specifications. We have an agreement with one of our contract manufacturers pursuant to which we provide it with a rolling forecast of our expected demand. Finished products are produced based on upon our forecast, and we have the ability to delay shipments for up to 18 months from the date of the purchase order. The initial three-year term of the agreement expires in October 2017 and renews annually thereafter unless terminated. We intend to finalize an agreement with a second contract manufacturer in the first quarter of 2017. We believe there are many contract manufacturers that are qualified to manufacture our products to our specifications.

Typically, our contract manufacturers are responsible for the sourcing of components and materials. We qualify sources for our components and materials. Our strategy is to have multiple suppliers for all of our components and materials. Currently, we have multiple sources for most of our components. A very limited number of components are single-sourced and the process of identifying and qualifying alternative sources for these components is underway.

Backlog

Our backlog was approximately $5.5 million at December 31, 2016 compared to $5.2 million at December 31, 2015. The Company defines backlog as consisting of accepted orders from customers for which a product delivery schedule has been specified. The purchased orders comprising backlog are not cancelable in most cases and such orders do not typically provide price protection. Nevertheless, deliveries against received purchase orders may be rescheduled within negotiated parameters and our backlog may therefore not be indicative of the level of future sales.

Competition

We will compete against well-established incumbent power conversion technology providers as these competitors enter the commercial and industrial markets. For our target markets, we believe that PPSA™ may provide significant competitive advantages compared to the traditional power conversion solutions sold by well-established power conversion technology providers.

Traditional Power Conversion: Traditional power conversion systems are the conservative choice, as they are proven and have been commercially available longer than any other type of power conversion system. They provide isolation, but are big, heavy, and relatively inefficient. There have been improvements in the efficiency of transformer-based power conversion systems over the years, but we believe further improvements are limited due to the physical characteristics of transformers themselves. Major suppliers in this market include ABB, Eaton and Schneider Electric.

Transformerless PV Inverters: Transformerless PV solar inverters are a special class of power conversion system applicable only to PV arrays. They have become a popular choice in the market for PV applications, as they are lighter and more efficient than transformer based inverters. These transformerless inverters are one-way (DC to AC) inverters, and provide no electrical isolation. PV systems are not required to be electrically isolated in most electrical code jurisdictions. These PV inverters have no applicability to markets that require electrical isolation. Key providers of transformerless PV inverters include companies such as SMA and SolarEdge.

Research and Development Costs

Research and development costs are presented as a line item under operating expenses and are expensed as incurred. Total research and development costs incurred during the years ended December 31, 2016 and 2015 amounted to $5,224,992 and $5,521,390, respectively.

Employees

As of February 28, 2017, we have 30 employees, all of whom are full-time employees. None of these employees are covered by a collective bargaining agreement, and we believe our relationship with our employees is good.

Industry Certifications

Industry certifications are generally required for our products. The main certification requirement is conformance to UL1741, which specifies standards for grid and product safety for grid-connected generation equipment, including the power conversion systems made by us. A National Recognized Testing Laboratory, or NRTL, must certify our products for conformance to UL1741 before our customers may install and use our products in grid-tied applications in the United States. We utilize both Underwriters Laboratories, or UL, and Intertek, or ETL, for our certification requirements.

The European Union, or EU, Japan and other major jurisdictions have different certification test procedures, but generally test for similar safety and performance capabilities. Local certifications are likely to be required to sell our products outside of the United States for many applications. To date, we have not received any international certifications on our products but have deployed products in a few instances in foreign countries as demonstrations, test projects in laboratories or microgrid applications which may be exempt from the certification requirements. We expect to start the certification process in one or more international markets in 2017.

Government Regulation

Government approval is not required for us to sell our products. However, government support for renewable energy, grid storage, electric vehicle charging infrastructure and improved grid resiliency, including incentives and mandates, may impact the size and growth rate of our target markets. Utility regulations and support may also impact these end markets. In the near term, government and utility support for many of these markets is generally required for these markets to grow and therefore changes in policy by governments or utilities may limit the near-term market opportunities for our products.

Available Information

Our Internet address is www.idealpower.com and our investor relations website is located at ir.idealpower.com. We make available free of charge on our investor relations website under the heading “SEC Filings” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports as soon as reasonably practicable after such materials are electronically filed with (or furnished to) the SEC. We also make available on our website, our corporate governance documents, including our code of conduct and ethics. Information contained on our website is not incorporated by reference into this Annual Report on Form 10-K. In addition, the public may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site, www.sec.gov, that includes filings of and information about issuers that file electronically with the SEC.

ITEM 1A: RISK FACTORS

We are subject to various risks that may materially harm our business, prospects, financial condition and results of operations. An investment in our common stock is speculative and involves a high degree of risk. In evaluating an investment in shares of our common stock, you should carefully consider the risks described below, together with the other information included in this report.

The risks described below are not the only risks we face. If any of the events described in the following risk factors actually occurs, or if additional risks and uncertainties later materialize, that are not currently known to us or that we currently deem immaterial, then our business, prospects, results of operations and financial condition could be materially adversely affected. In that event, the trading price of our common stock could decline, and you may lose all or part of your investment in our shares. The risks discussed below include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risks Related to the Company

We lack an established operating history on which to evaluate our business and determine if we will be able to execute our business plan. We have also incurred losses in prior periods, expect to incur losses in the future and we can give no assurance that our operations will result in profits.

We were formed in Texas on May 17, 2007 and converted to a Delaware corporation on July 15, 2013. We have a limited operating history that makes it difficult to evaluate our business. Historical sales of our products have been in low volume, and we cannot say with certainty when we will begin to achieve profitability, if ever.

Since inception, we have sustained approximately $45 million in net losses and we had a net loss for the year ended December 31, 2016 of approximately $11 million. We expect to have operating losses at least until such time as we have developed a substantial and stable revenue base. We cannot assure you that we can develop a substantial and stable revenue base or achieve or sustain profitability on a quarterly or annual basis in the future.

As sales of our products have generated limited operating revenues, we have been funding operations primarily through the sale of common stock and, prior to our initial public offering, the issuance of convertible debt. If we are unable to execute our business plan, generate sustainable revenue and achieve profitable operations with our existing capital we would need to raise funds through equity or debt offerings and there can be no assurance that we will be able to do so.

Our future success is difficult to predict because we operate in emerging and evolving markets, and the industries in which we compete are subject to volatile and unpredictable cycles.

The stand-alone storage, solar combined with storage, microgrid and related industries are emerging and evolving markets which may make it difficult to evaluate our future prospects and which may lead to period to period variability in our operating results. Our products are based on unique technology which we believe offers significant advantages to our customers, but the markets we serve are in a relatively early stage of development and it is uncertain how rapidly they will develop. It is also uncertain whether our products will achieve high levels of demand and acceptance as these markets grow. If companies in the industries we serve do not perceive or value the benefits of our technologies and products, or if they are unwilling to adopt our products as alternatives to traditional power conversion solutions, the market for our products may not develop or may develop more slowly than we expect, which could significantly and adversely impact our operating results.

We may also be subject to business cycles. The timing, length, and volatility of these business cycles may be difficult to predict. These markets may be cyclical because of sudden changes in customers’ manufacturing capacity requirements and spending, which depend in part on capacity utilization, demand for customers’ products, the availability and amount of government incentive programs, inventory levels relative to demand, and access to affordable capital. These changes may affect the timing and amounts of customers’ purchases and investments in technology, and materially affect our orders, net sales, operating expenses, and net income. For example, during 2016, we experienced a significant decline in revenues compared to 2015 as a result of delays in awards under California’s Self-Generation Incentive Program, or SGIP, which provides economic incentives for energy storage projects. The California Public Utility Commission, or CPUC, delayed announcing the 2016 awards as it examined and ultimately revised the award solicitation process and other aspects of the SGIP. The revised SGIP was not finalized until July 1, 2016, which delayed the determination of project winners and the processing of the related awards. These delays caused a temporary disruption in the market that impacted 2016 and likely, at least, part of 2017 as awarded projects may not be commissioned and installed until many months after the award is granted. If delays occur in the future under the SGIP or other governmental incentives, our revenues may be reduced.

To meet rapidly changing demand in each of the markets we serve, we must effectively manage our resources and production capacity. During periods of decreasing demand for our products, we must be able to appropriately align our cost structure with prevailing market conditions, effectively manage our supply chain, and motivate and retain key employees. During periods of increasing demand, we must have sufficient manufacturing capacity and inventory to fulfill customer orders, effectively manage our supply chain, and attract, retain, and motivate a sufficient number of qualified individuals. If we are not able to timely and appropriately adapt to changes in our business environment or to accurately assess where we are positioned within a business cycle, our business, financial condition, or results of operations may be materially and adversely affected.

Obsolete inventory as a result of changes in demand for our products, changes in life cycle of our products or regulatory changes could adversely affect our business, operating results and financial condition.

The life cycles of our products depend upon the rapidly evolving industries for which our products are designed. Products with short life cycles require us to closely manage our production and inventory levels. Inventory may also become obsolete because of adverse changes in market demand. We may in the future be adversely affected by obsolete or excess inventories, which may result from unanticipated changes in the estimated total demand for our products or shorter than anticipated product life cycles due to changes in product designs necessitated by market factors or changes to regulatory standards and/or requirements. In addition, certain customers in early markets may change their strategy, exit our target markets and/or go out of business; therefore, some of our product inventory may become obsolete and, thus, adversely affect our business, operating results and financial condition. As an example, in 2016, we recorded a charge of $334,889 for excess and obsolete inventory in connection with the end-of-life, or EOL, of our IBC-30 battery converter. In 2017, we intend to EOL our second generation 30kW and first generation 125kW products. Challenges in managing EOL situations or lower than expected sales prior to the EOL of our products could result in material charges related to excess and obsolete inventory and our business, financial condition, or results of operations may be materially and adversely affected.

To date we have had a limited number of customers. We cannot assure you that our customer base will increase.

We had revenue from two customers that accounted for 44% of net revenue for the year ended December 31, 2016. The Company had an accounts receivable balance from two customers that accounted for 78% of trade receivables at December 31, 2016. As we sell our products to a limited number of customers, we cannot assure you that our customer base will expand or that any decline in net revenue attributable to customer losses will be replaced in a timely manner.

Product development is an inherently uncertain process, and we may encounter unanticipated development challenges and may not be able to meet our product development and commercialization milestones.

Product development and testing may be subject to unanticipated and significant delays, expenses and technical or other problems. We cannot guarantee that we will successfully achieve our milestones within our planned timeframe or ever. We commonly develop prototypes of planned products prior to the full commercialization of these products. We cannot predict whether prototypes of future products will achieve results consistent with our expectations. A prototype could cost significantly more than expected or the prototype design and construction process could uncover problems that are not consistent with our expectations. Prototypes of emerging products are a material part of our business plan, and if they are not proven to be successful, our business and prospects could be harmed.

More generally, the commercialization of our products may also be adversely affected by many factors not within our control, including:

| |

• | the willingness of market participants to try new products and the perceptions of these market participants of the safety, reliability, functionality and cost effectiveness of our products; |

| |

• | policy changes and the availability of governmental incentives at both the state and federal level for our target markets; |

| |

• | the emergence of newer, possibly more effective technologies; |

| |

• | the future cost and availability of the raw materials and components needed to manufacture and use our products; and |

| |

• | the adoption of new regulatory or industry standards that may adversely affect the use or cost of our products. |

Accordingly, we cannot predict that our products will be accepted on a scale sufficient to support development of mass markets for them.

We must achieve design wins to retain our existing customers and to obtain new customers, although design wins achieved do not necessarily result in substantial sales.

Our products are typically integrated into systems by our customers. We must work with these manufacturers early in their design cycles to modify our equipment or design new equipment to meet the requirements of their systems. Manufacturers typically choose one or two vendors to provide the components for use in their systems. Selection as one of these vendors is called a design win. It is critical that we achieve these design wins in order to retain existing customers and to obtain new customers.

We believe that equipment manufacturers often select their suppliers based on factors including long-term relationships and end user demand. Accordingly, we may have difficulty achieving design wins from equipment manufacturers who are not currently our customers. In addition, we must compete for design wins for new systems and products of our existing customers, including those with whom we have had long-term relationships. Our efforts to achieve design wins are time consuming and expensive and may not be successful. If we are not successful in achieving design wins, or if we do achieve design wins but our customers’ systems that utilize our products are not successful, our business, financial condition, and results of operations could be materially and adversely impacted.

Once a manufacturer chooses a component for use in a particular system, it is likely to retain that component for the life of that system. Our sales and growth could experience material and prolonged adverse effects if we fail to achieve design wins. However, design wins do not always result in substantial sales, as sales of our products are dependent upon our customers’ sales of their products.

We will be subject to applicable third-party certification to ensure compliance with applicable codes and standards of the countries in which we sell products, which are costly and may prevent or delay us from marketing our products in those countries.

In addition to third-party certification to ensure compliance with applicable codes and standards in the United States, we are subject to the third-party certification of our products to ensure compliance with applicable codes and standards for each foreign country to which we export our products. For example, in the EU, third-party certification requires compliance with Conformité Européene, or CE, standards and is evidenced by a CE mark. The CE mark is the manufacturer’s declaration that the product complies with the essential requirements of the relevant European health, safety and environmental protection legislation. Additionally, to sell a product in any specific country in the EU, the product must meet the International Electrotechnical Commission, or IEC, codes specified for products in the specific country. The applicable codes vary from country to country. It generally takes several months to obtain the relevant CE and IEC certifications. Any changes in codes and standards and related third-party compliance testing and listing may cause us to incur additional costs. We may not be able to obtain US or foreign third-party certification on a timely basis, if at all, and any failure to do so may cause us to incur additional costs or prevent us from marketing or selling our products in US or foreign countries, which may have a material adverse effect on our business, financial condition and results of operations.

We have received grant funds from the United States for the development of a bi-directional switch. In certain instances, the United States may obtain title to inventions related to this effort. If we were to lose title to those inventions, we may have to pay to license them from the United States in order to manufacture the inventions. If we were unable to license those inventions from the United States, it could slow down our product development.

In conjunction with the Advanced Research Projects Agency-Energy, or ARPA-E, grant we received from the Department of Energy, we granted to the United States a non-exclusive, nontransferable, irrevocable, paid-up license to practice or have practiced for or on behalf of the United States inventions related to the bi-directional switch and made within the scope of the grant. If we fail to disclose to the Department of Energy an invention made with grant funds that we disclose to patent counsel or for publication, or if we elect not to retain title to the invention, the United States may request that title to the subject invention be transferred to it.

We also granted “march-in-rights” to the United States in connection with any bi-directional switch inventions in which we choose not to retain title, if those inventions are made under the ARPA-E grant. Pursuant to the march-in-rights, the United States has the right to require us, any person to whom we have assigned our rights, or any exclusive licensee to grant a non-exclusive, partially exclusive, or exclusive license in any field of use to a responsible applicant upon terms that are reasonable. If the license is not granted as requested, the United States has the right to grant the license if it determines that we have not achieved practical application of the invention in the field of use, the action is necessary to alleviate health or safety needs, the action is necessary to meet requirements for public use specified by Federal regulations and such requirements have not been

satisfied, or the action is necessary because an agreement to manufacture the invention in the United States has not been obtained or waived or because any such agreement has been breached.

If we lost title to the United States as a result of any of these events, we would have to pay to license the inventions, if needed, to manufacture the bi-directional switch from the United States. If we were unable to license those inventions from the United States, it could slow down our product development.

As we continue to grow and to develop our intellectual property, we could attract threats from patent monetization firms or competitors alleging infringement. We may incur substantial costs as a result of litigation or other proceedings relating to patent and other intellectual property rights.

As we continue to grow and to develop our intellectual property, we could attract threats from patent monetization firms or competitors alleging infringement of intellectual property rights.

In addition, some of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources. If we do not prevail in this type of litigation, we may be required to: pay monetary damages; stop commercial activities relating to our product; obtain one or more licenses in order to secure the rights to continue manufacturing or marketing certain products; or attempt to compete in the market with substantially similar products. Uncertainties resulting from the initiation and continuation of any litigation could limit our ability to continue some of our operations.

We expect to license our technology in the future; however the terms of these agreements may not prove to be advantageous to us. If the license agreements we enter into do not prove to be advantageous to us, our business and results of operations will be adversely affected.

During 2016, we entered into our first licensing agreement and we expect to license the manufacture of our product designs for certain markets as well as license our technology for certain potential applications which we choose not to pursue directly through the sale of products in the future. However, we may not be able to secure license agreements with customers on terms that are advantageous to us. Furthermore, the timing and volume of revenue earned from license agreements is and will be outside of our control. If the license agreements we have, or enter into in the future, do not prove to be advantageous to us, our business and results of operations will be adversely affected.

Until recently, we have not devoted significant resources towards the marketing and sale of our products and we continue to rely on the marketing and sales efforts of third parties whom we do not control.

We expect that the marketing and sale of our products to end user customers will continue to be conducted primarily by a combination of system integrators, third-party strategic partners, distributors, and original equipment manufacturers, or OEMs. Consequently, commercial success of our products will depend, to a great extent, on the efforts of others. We may not be able to identify, maintain or establish additional and/or appropriate relationships in the future. We can give no assurance that these third parties will focus adequate resources on selling our products or will be successful in selling them. In addition, these third-parties have or may require us to provide volume price discounts and other allowances, customize our products or provide other concessions that could reduce the potential profitability of these relationships. Failure to develop sufficient customer, distribution and marketing relationships in our target markets will adversely affect our commercialization schedule and to the extent we have entered or enter into such relationships, the failure of our distributors and other third parties to assist us with the marketing and distribution of our products, or to meet their monetary obligations to us, may adversely affect our financial condition and results of operations.

A material part of our success depends on our ability to manage our suppliers and contract manufacturers. Our failure to manage our suppliers and contract manufacturers could materially and adversely affect our results of operations and relations with our customers.

We rely upon suppliers to provide the components necessary to build our products and on contract manufacturers to procure components and assemble our products. There can be no assurance that key suppliers and contract manufacturers will provide components or products in a timely and cost efficient manner, provide quality components or manufacturing and assembly services or otherwise meet our needs and expectations. Our ability to manage such relationships and timely replace suppliers and contract manufacturers, if necessary, is critical to our success. Our failure to timely replace our contract manufacturers and suppliers, should that become necessary, could materially and adversely affect our results of operations and relations with our customers.

We may need additional financing to execute our business plan and fund operations, which additional financing may not be available on commercially reasonable terms or not at all.

We believe that our current cash and working capital resources, together with the estimated net proceeds of approximately $13.6 million from our March 2017 private placement, will be sufficient to fund our operations for at least the next twelve months. If we are unable to generate sufficient cash flow from our operations to fund our future working capital needs, we will be required to obtain additional financing to continue our operations and execute our business plan. We may not be able to obtain such financing on commercially reasonable terms or at all. If we are unable to obtain such financing when needed, our business could fail.

The macro-economic environment in the United States and abroad has adversely affected, and may in the future adversely affect, our ability to raise capital, which may potentially impact our ability to continue our operations.

As a company with limited revenues to date, we have relied on raising funds from investors to support our future research and development activities and our operations. Macro-economic conditions in the United States and abroad may result in a tightening of the credit markets and/or less capital available for small public companies, which may make it more difficult to raise capital. If we are unable to raise funds as and when we need them, we may be forced to curtail our operations or even cease operating altogether.

We are subject to credit risks.

Some of our customers may experience financial difficulties and/or may fail to meet their financial obligations to us. As a result, we may incur charges for bad debt provisions related to some trade receivables. In addition, in connection with the growth of the renewable energy market and other markets for our products, we are gaining new customers, some of which have relatively short histories of operations, are located outside the United States or are newly formed companies. As a result, it is difficult to ascertain financial information in order to appropriately extend credit to these customers. Further, the volatility in the renewable energy market may put additional pressure on our customers’ financial positions, as they may be required to respond to large swings in revenue. The renewable energy industry has also, from time to time, seen an increasing amount of bankruptcies and reorganizations as the availability of financing has diminished. In 2016, one of our customers, SunEdison Inc., filed for bankruptcy.

If customers fail to meet their financial obligations to us, or if the assumptions underlying our recorded bad debt provisions with respect to receivables obligations do not accurately reflect our customers’ financial condition and payment levels, we could incur write-offs of receivables in excess of our provisions, which could have a material adverse effect on our cash flow and operating results.

If our products have component malfunctions or design defects, we may be exposed to lawsuits and/or other claims and we may not be able to control our warranty exposure, which could increase our expenses, harm our reputation and prevent us from growing our business.

We currently offer, and expect to continue to offer, a warranty with respect to our products and a design warranty with respect to licensing agreements. Due to our limited long-term history of operating data, our warranty reserve is estimated based on engineering judgment and third party assessments of our product reliability. If our products have component malfunctions or design defects, the accumulated cost of warranty claims could be significant. If the cost of warranty claims exceeds any reserves we may establish for such claims, our results of operations and financial condition could be adversely affected. In 2016, we recorded incremental charges of $116,448 to increase our reserves for warranty claims and may have other potentially material incremental charges in the future.

In addition, potential customers may rely on our products for critical needs and a malfunction of our products could result in warranty claims or other product liability. A well-publicized actual or perceived problem could adversely affect the market’s perception of our products. This could result in a decline in demand for our products, which would reduce revenue and harm our business. Further, since our products are used in systems that are made by other manufacturers, we may be subject to product liability claims or negative market perception of our products even if our products do not malfunction.

We are highly dependent on the services of R. Daniel Brdar and William Alexander, as well as other key members of our executive management team. Our inability to retain these individuals could impede our business plan and growth strategies, which could have a negative impact on our business and the value of your investment.

Our ability to implement our business plan depends, to a critical extent, on the continued efforts and services of R. Daniel Brdar, our Chief Executive Officer and President, William Alexander, our founder and Chief Technology Officer, and other members of our executive management team. If we lose the services of any of these persons during this important time in our development, the loss may result in a delay in the implementation of our business plan and plan of operations. We can give no assurance that we could find satisfactory replacements for these individuals on terms that would not be unduly expensive or burdensome to us. We do not currently carry a key-man life insurance policy that would assist us in recouping our costs in the event of the death or disability of any of these persons.

Any failure by management to properly manage our expected rapid growth could have a material adverse effect on our business, operating results and financial condition.

If our business develops as expected, we anticipate that we will grow rapidly in the near future. Our failure to manage properly our expected rapid growth could have a material adverse effect on our ability to retain key personnel. Our expansion could also place significant demands on our management, operations, systems, accounting, internal controls and financial resources. If we experience difficulties in any of these areas, we may not be able to expand our business successfully or effectively manage our growth. Any failure by management to manage growth and to respond to changes in our business could have a material adverse effect on our business, financial condition and results of operations.

Backlog may not result in revenue.

Our backlog was approximately $5.5 million at December 31, 2016. We define backlog as consisting of accepted orders from customers for which an expected product delivery schedule has been specified. The purchase orders comprising backlog are not cancelable in most cases and such orders generally do not provide price protection. Nevertheless, deliveries against received purchase orders may be rescheduled within negotiated parameters or canceled in certain limited instances and our backlog may, therefore, not be indicative of revenues in any given period. Our backlog is highly concentrated with a limited number of customers. If any of these customers change their strategy, exit our target markets and/or go out of business, our backlog would be materially adversely impacted.

Risks Relating to the Industry

The electric power conversion industry is competitive, has a number of well-financed incumbents and may see a significant number of new market entrants. We cannot guarantee that we can compete successfully.

We may compete against providers of PCS that are well established and have substantially greater assets, including manufacturing, marketing, and financial assets. These incumbents also have strong market share and name brand recognition in the industry. Potential competitors include ABB, Ltd., Eaton Corporation plc, Huawei Technologies Co., Ltd., SMA Solar Technology AG, and Schneider Electric SE. Pricing and servicing, as well as the general quality, efficiency and reliability of products, are significant competitive criteria in this industry. New market entrants may offer competitive new technologies and products, and will contribute to significant price competition.

Our ability to successfully compete on each of these criteria is material to the acceptance of our products and their future profitability. In addition, the industry may resist new technology and products from suppliers that are not well capitalized with long track records of performance. Our competitors use their balance sheet and brand recognition to their competitive advantage. Should our products become commercially successful, competitors may seek to drive their own innovation and adopt or copy ideas, designs and features to regain their competitive positions. Incumbent or new competitors may develop or offer technologies and products that may be more effective or popular than our products and these competitors may be more successful in marketing their products than we are in marketing our products.

Our ability to achieve our cost reduction goals now and in the future and maintain pricing at or near the level of our competitors is critical to our long-term success and the viability of our business as, over the long-term, price is likely the key competitive criteria in the power electronics industry. Additionally, price competition may result in lower than expected margins for our products which would adversely affect our business prospects, financial condition and operating results.

We expect to compete on the basis of our products’ technological innovation, flexibility, features and smaller footprint at a market competitive price. Unrelated technological advances in alternative energy products or other power conversion

technologies may negatively impact the development of our products or make our products uncompetitive or obsolete at any time. We cannot guarantee that we will be able to compete successfully in the electric power conversion industry.

Our business is and we expect will continue to be substantially dependent on utility rate structures and government incentive programs that encourage the use of alternative energy sources. The reduction or elimination of government subsidies and economic incentives for energy-related technologies would harm our business.

The current market for, and we believe that near-term growth of energy-related technologies, including power conversion technology, relies and will continue to rely on the availability and size of government and economic incentives and grants (including, but not limited to, the U.S. ITC and various state and local incentive programs). These incentive programs could be challenged by utility companies, or for other reasons found to be unconstitutional, and/or could be reduced or discontinued for other reasons. The reduction, elimination, or expiration of government subsidies and economic incentives would harm our business.

A combination of utility rate structures and government subsidies that encourage the use of alternative energy sources is a primary driver of demand for our products. For example, public utilities are often allowed to collect demand charges on commercial and industrial customers in addition to traditional usage charges. In addition, the federal government and many states encourage the use of alternative energy sources through a combination of direct subsidies and tariff incentives such as net metering for users that use alternative energy sources such as solar power. California also encourages alternative energy technology through its SGIP which offers rebates for businesses and consumers who adopt certain new technologies. As a result of these incentives, we believe that a substantial portion of the products we have sold have been for use by end customers in California. Other states have similar incentives and mandates which encourage the adoption of alternative energy sources. Notwithstanding the adoption of other incentive programs, we expect that California will be the most significant market for the sale of our products in the near term for stand-alone storage applications. Should California or another state in which we derive a substantial portion of our product revenues in the future change its utility rate structure or delay, eliminate or significantly reduce its incentive programs, demand for our products could be substantially affected, which would adversely affect our business prospects, financial condition and operating results.

For example, in 2016, we experienced a material decline in revenues compared to 2015 as a result of delays in awards under California’s SGIP, which provides economic incentives for energy storage projects. Awards under the SGIP were delayed as the California Public Utility Commission, or CPUC, examined and ultimately revised the award solicitation process and other aspects of the SGIP. The revised SGIP was not finalized until July 2016, which delayed the determination of project winners and the processing of the related awards. Political changes, disruptions or gridlock, or reviews or revisions of previously announced incentive programs or procedures for making awards or administering such programs could have a material adverse impact on our financial results and future prospects.

Changes to the National Electrical Codes could adversely affect our technology and products.

Our products are installed by system integrators that must meet the National Electrical Codes, or NEC, standards, including using equipment that meets industry standards such as UL1741. The NEC standards address the safety of these systems. The NEC standards, along with the UL1741 and IEEE1547 requirements, continue to evolve and are subject to change. If we respond to these changing standards and requirements more slowly than our competitors, or if we are unable to meet new standards and requirements, our products will be less competitive.

Some of the components of energy storage products pose potential safety risks which could create negative public perception regarding the energy storage markets.

Many energy storage products make use of lithium-ion batteries, which have been observed in certain applications, such as automotive applications, to catch fire or vent smoke and flame. Such events have raised concerns, and future events may lead to additional concerns, about the safety of lithium-ion batteries. Negative public perceptions regarding the suitability of lithium-ion batteries for energy storage applications or any future incident involving lithium-ion batteries, even if such incident does not involve our power conversion systems or relates to an application other than energy storage, could negatively impact the continued adoption of energy storage products and have a material adverse impact on our sales and our business.

Growth in our target markets largely depends on the continued decline in battery prices